New sources of information like mobile devices, social media, customer reviews and in-store POS are making it extremely difficult for retailers to gather, process and pull useful insights from an ever-expanding amount of data that’s growing in real time.

We partnered with Bluecore to poll over 100 digital marketing and ecommerce retailers across 13 different product categories to explore how the sheer volume of data makes it challenging to analyze and implement data-driven strategies effectively, ultimately hindering potential sales and profit growth.

In our latest report, Seize The Data! The 2023 Retail Data Collection & Satisfaction Survey, you’ll learn:

- How retailers rate their data proficiency. We asked retailers to share their approaches toward marketing data collection and analysis and how they feel those efforts affect their bottom line.

- How to confront challenges blocking the path to profitability. An exploration of current analytic methods and tools and how to score and evaluate performance.

- How to get the most out of data investment. The key challenges and obstacles that retailers believe they must address to gain the full benefit from their data and analytic efforts.

- How privacy compliance is driving up the cost of customer acquisition

As you’ll see in this report, if understanding and effectively using customer data remains a significant challenge, you’re not alone!

Download the free report to learn more.

How Retailers Rate Their Data Proficiency

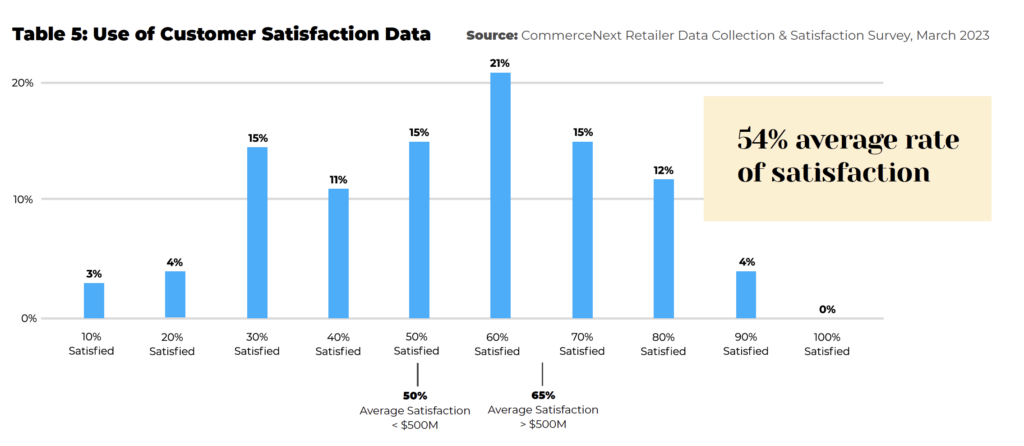

One of our major findings showed that there is a 54% average rate of satisfaction among retailers’ customer data (see table 5). Of course, larger retailers have an advantage because they have a larger marketing budget to dedicate to data collection, along with having larger customer databases.

Many retailers have noticed that their personalized campaigns are not resonating the same way that they did pre-pandemic (or even two years ago), and they are switching gears to improve data collection and use. The report shares specific examples from brands like Burberry and Nike.

Challenges to Profitability

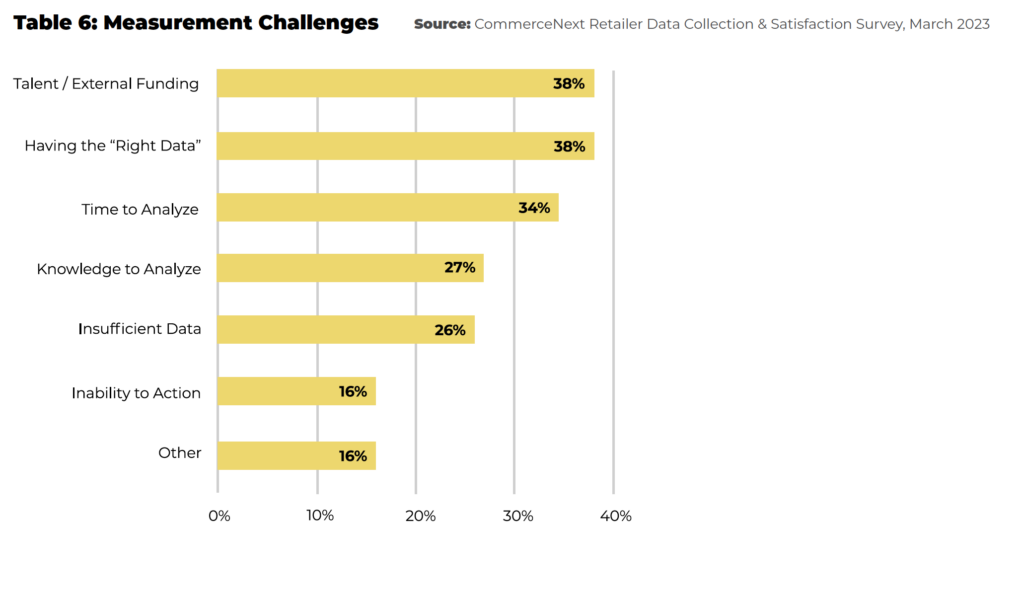

There are a number of challenges that retailers face in managing data analysis and marketing in today’s market—the top organizational struggles are talent/external funding at 38% and having the “right data” (38%) (see table 6). Customer acquisition is also more expensive, as retailers know, which means that the data collected at acquisition and retention is more crucial than ever. Retailers are continuing to use content like historical purchases to measure a customers’ value.

Getting the Most out of Data Investment

With all these challenges, it may seem daunting to get the most out of your data, but there are ways to improve! The first step is to utilize your existing data—do not miss out on this opportunity to help your top-and-bottom line growth.

Other recommendations include driving acquisition and return on ad spend (ROAS), strengthening your analysis and optimizing spend. Read the full report for more in-depth example on these recommendations and more, including examples from retailers and a case study with NOBULL. Download for free here.

If you’re looking for more in-depth conversations from retailers about data, acquisition, or organizational challenges, make sure to register for the Ecommerce Growth Show, where you’ll hear from 120+ leading industry experts on 50+ marketing and ecommerce sessions.

Related Posts

-

Ecommerce Growth Show Spotlight: Anthropologie CMO Talks Brand Loyalty

We are less than ten weeks away from The Ecommerce…

-

2023 Ecommerce Growth Show Speaker Spotlight

Get ready to learn from the brightest minds in the…

-

Elevate Your Ecommerce Business: The Ultimate Guide to the 2023 CommerceNext Ecommerce Conference

Ecommerce businesses are facing an ever-changing landscape and it's essential…

-

New Digital Trends and Investment Priorities Research

Our latest research focuses on the strategies for growth and…

-

New Personalization Research

Our newest research report focuses on better understanding the relationship…

-

Turn Facebook Uncertainty into Advertising Profitability with First-Party Data

We are in a particularly turbulent time for growth marketing,…