Our latest research focuses on the strategies for growth and investment priorities to consider in 2023.

We partnered with The Commerce Experience Collective (CommX) to poll over 100 digital and marketing executives from every retail vertical about:

- How the past year measured up to forecasts made in 2021, and what the growth targets are for 2023.

- What the biggest obstacles to growth will be in 2023.

- What the plan is for 2023, to both overcome those obstacles and maximize investments.

In this benchmark report, the major takeaways you’ll learn about are:

- How 2022’s disappointing sales led to tempered expectations for 2023.

- The ways retailers are weighing investments in customer experiences versus new technologies.

- The balance between retention and acquisition to drive growth in 2023.

- How brands are responding to declining KPIs on social.

Below, you’ll find information on some crucial findings in our research. Download the free report here to learn more.

Lack of Optimism for Sales Forecasts

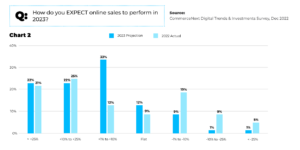

One of our major findings showed that despite high optimism heading in 2022, 85% of those polled last year expected double-digit growth last year—instead, only 58% of our respondents hit those double-digit targets (see chart 1).

Now, retailers and brands are altering their forecasts for 2023. Nearly half of respondents projected single or flat-line growth in the new year, and growth expectations are in line with 2022’s performance (see chart 2).

Pulling Back from Social

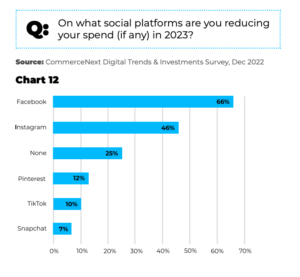

Meta’s declining place in ad budgets has led to social losing its stature as the top acquisition investment.

Out of the 68% respondents who reported declining KPI performance, 66% are pulling back spending on Facebook and 46% pulling back on Instagram (see chart 12).

Read the full report now to understand all our industry trends for 2023 and get some optimal strategies for investment and growth this year.

Related Posts

-

Top 2023 Valentine's Day Marketing Tips for a Love-Filled Holiday

As we approach Valentine's Day 2023, it's crucial for retailers…

-

Marketing Tips to Kick Off 2023

The new year is here, which means it is time…

-

3 Reasons Why You Should Attend the 2023 Ecommerce Growth Show

CommerceNext is the leading community, event series and conference for…

-

New CommX Research Report: 2022 Digital Trends and Investment Priorities

For their premier research report of 2022, CommerceNext partnered with…

-

New CommerceNext Research: Understanding Today’s Digital Commerce Team

CommerceNext’s newest qualitative research report focuses on helping the ecommerce…

-

New Personalization Research

Our newest research report focuses on better understanding the relationship…