As the economy and stores slowly start to re-open, CommerceNext is continuing to monitor the effects of the COVID-19 pandemic on retail and ecommerce.

Last week, we collected our fourth set of survey responses from digital marketing leaders tracking the impact of COVID-19 from April 12th-April 26th. In this survey, we added questions to gauge retailers’ plans for reopening and predictions on recovery, in addition to our regular questions benchmarking sales and ecommerce traffic results against pre-COVID February (you can refer back to our first, second and third surveys for additional information).

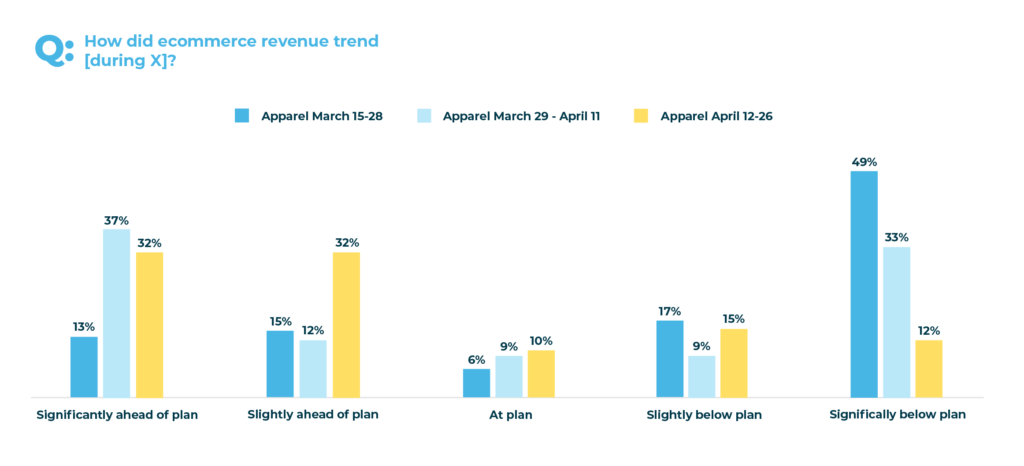

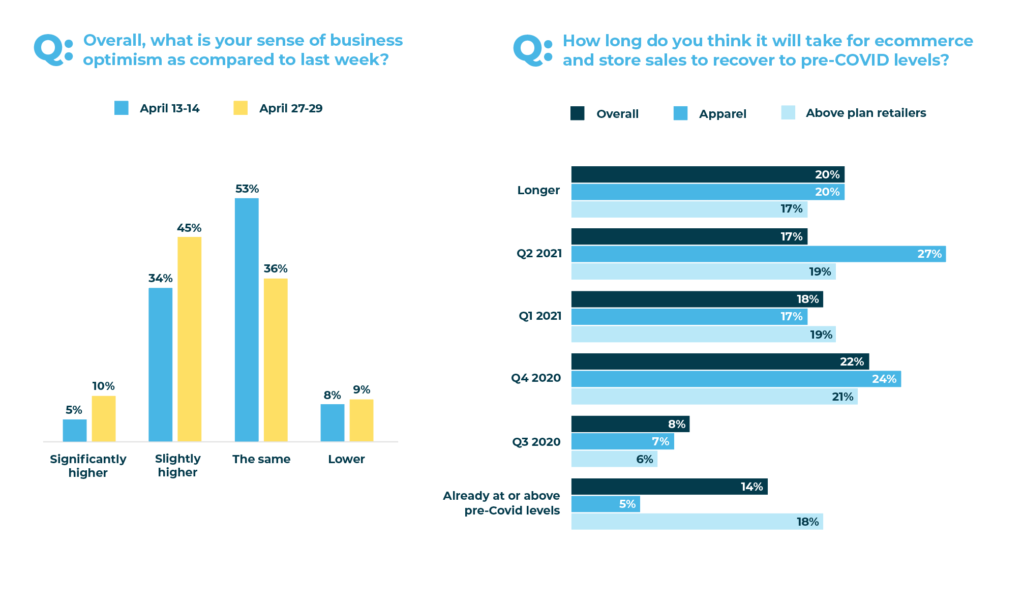

The good news is we’re continuing to see revenues and optimism grow across all verticals, although apparel still lags slightly behind in several recovery benchmarks. Retailers believe that growth in ecommerce will continue even as stores start to re-open. Most merchants are prepping protocols to reopen and have plans in place to accommodate those customers who want to return to in-store shopping. Even with the plans to re-open, the recovery timeline is long and most retailers do not believe their sales across stores and ecommerce will recover before Q4 of this year.

Thank you to the 80+ respondents who took the survey and, again, to Sucharita Kondali, VP and Principal Analyst at Forrester Research, for her analysis of CommerceNext’s survey results.

Below is an overview of the analysis:

Methodology and demographics

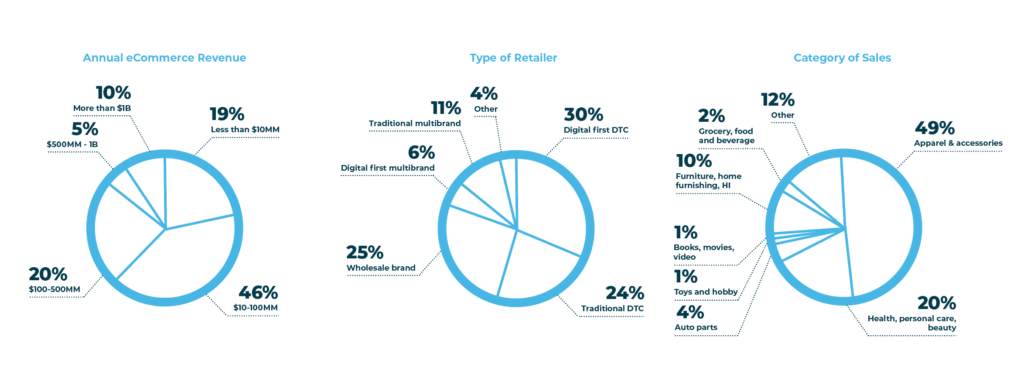

Survey answers were collected on April 27th-29th, 2020 from 84 respondents who span the retail and ecommerce landscape. As all CommerceNext surveys previously reported on, this data was collected confidentially and aggregated here in our analysis.

Summary of findings

Kodali’s analysis revealed the following key takeaways:

- Retailers have remained surprisingly resilient and optimistic throughout April.

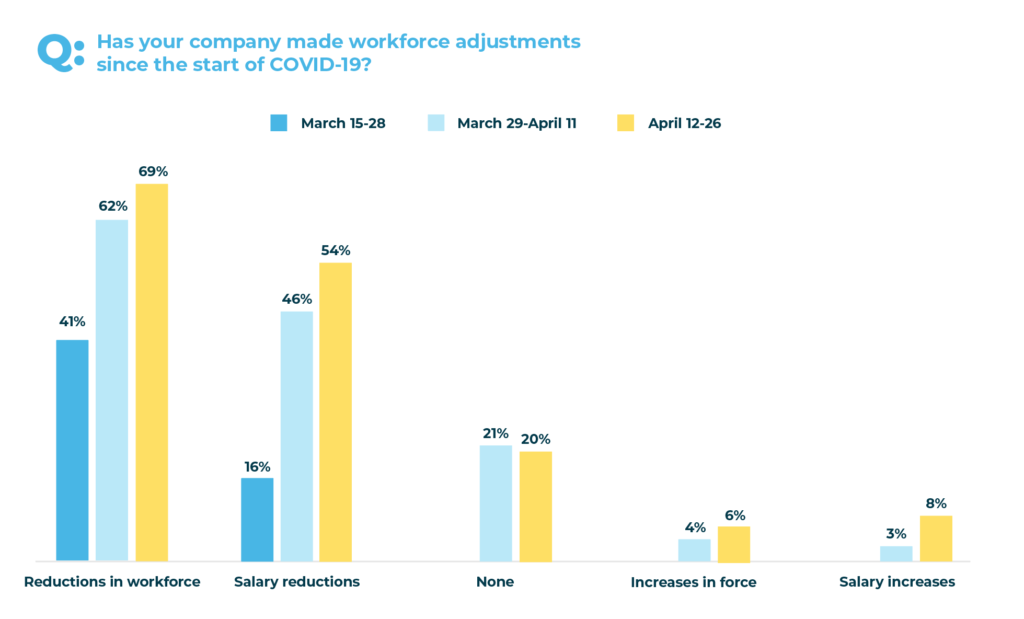

- The majority of retailers have reduced headcount or cut salaries, and the numbers continue to increase with every CommerceNext survey. However, 55% of retailers also say their business optimism is higher than in the prior week.

- Retailers continue to transition customers from stores to the web, leading to improved traffic, which in turn justifies larger marketing spend.

- Even as stores reopen, ecommerce executives believe that most new shoppers will stay in the online channel.

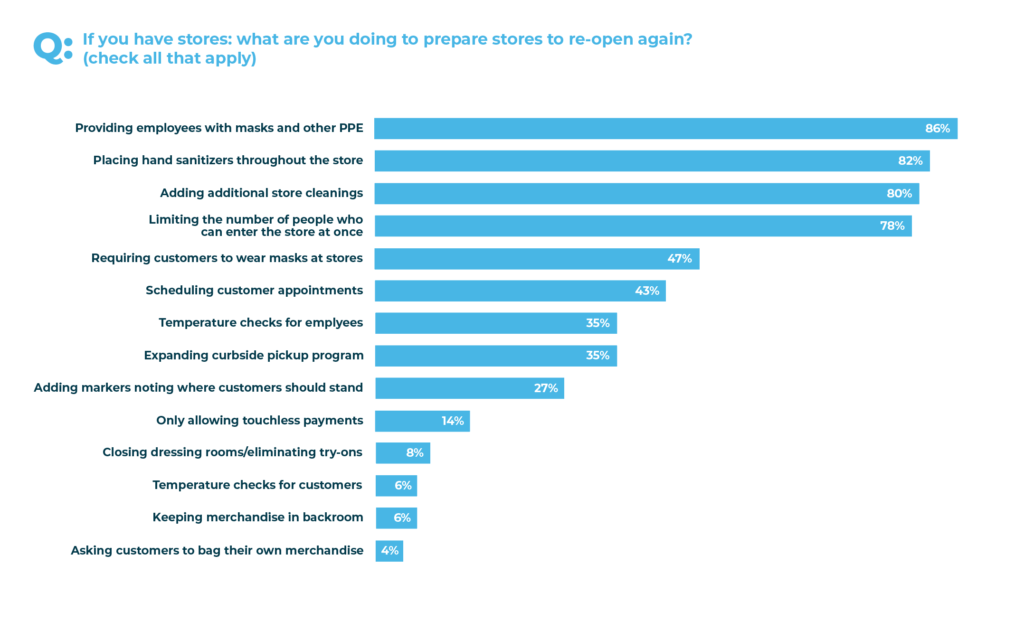

- The four things that most retailers plan to do for stores include: providing PPE for employees, sanitizing spaces, adding hand sanitizer and limiting the number of people in stores.

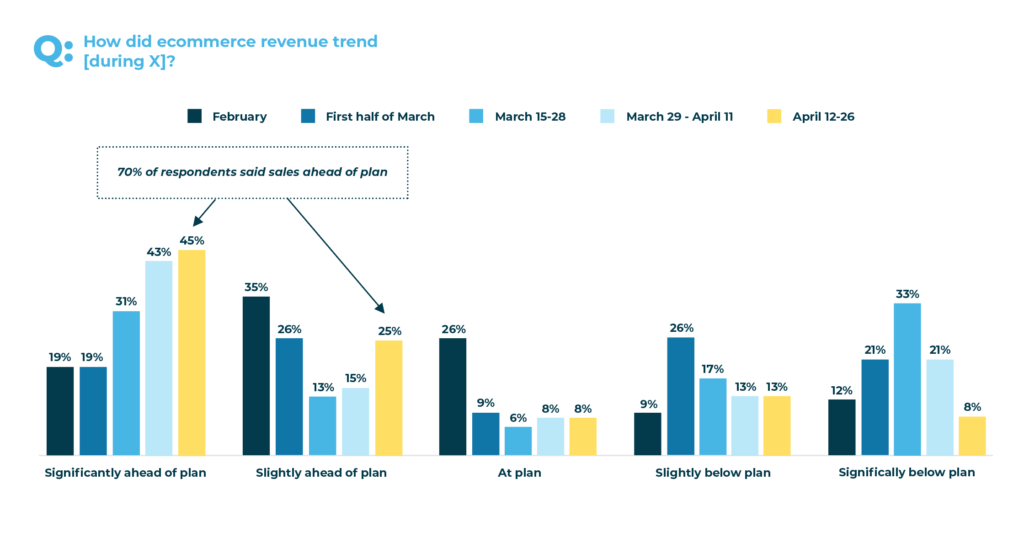

Question: How did ecommerce revenue trend?

Continuing the upward trend seen in our previous survey, 70% of retailers now report their late April ecommerce revenues above plan, though apparel continues to lag.

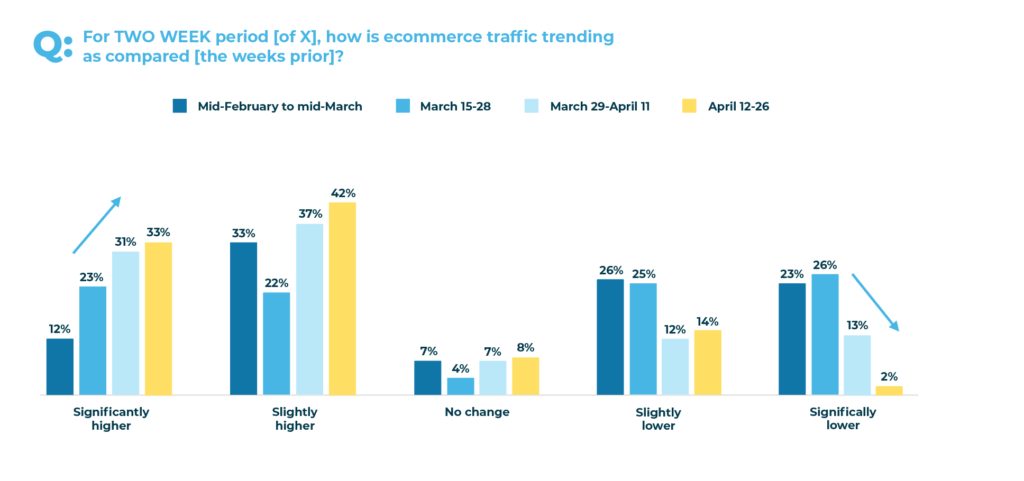

Question: How did ecommerce traffic trend?

In our third survey, we saw traffic rising. That rise continued throughout April, demonstrating the declines in online traffic have finally stabilized.

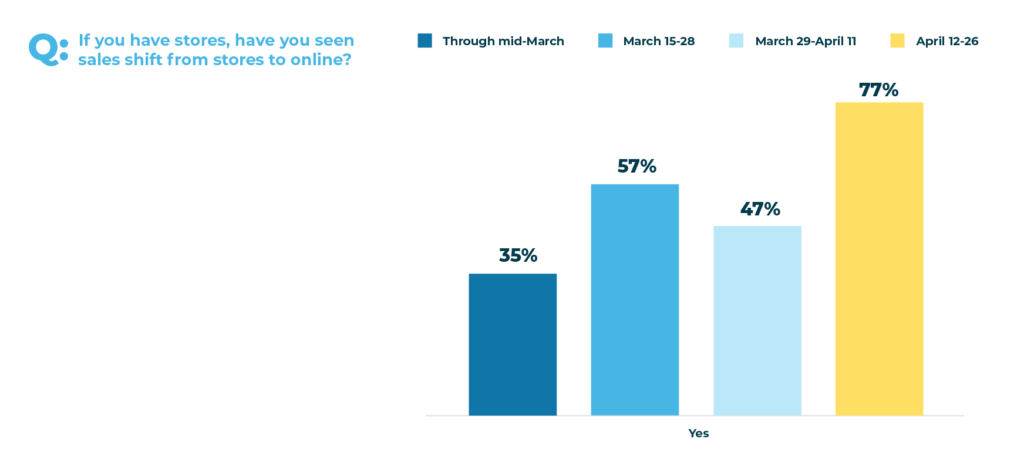

Question: [For those with brick and mortar stores] Have you seen sales shift from stores to online during the last two weeks?

In this last survey cycle, the majority of merchants (77%) reported a pick-up in online shopping, although this still can’t make up for the overall loss in sales across verticals.

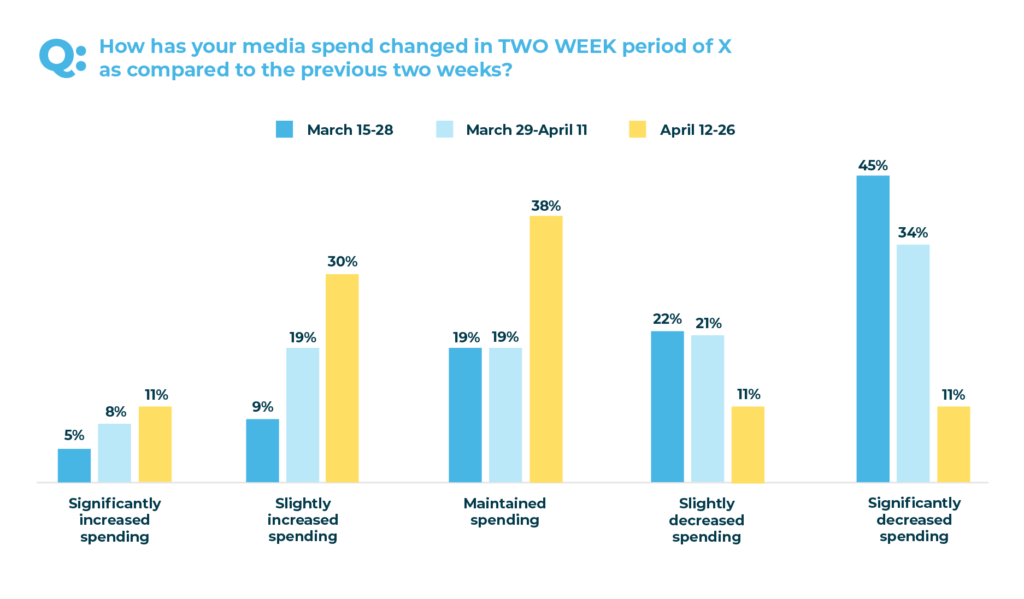

Question: How has your media spending changed in the last two weeks?

We’re also finally seeing a bounceback in media spend with 41% of respondents now actively increasing their budgets. This has been fueled by the general growth in ecommerce and by the fact that consumer demand increased as stimulus checks were received.

Question: Once stores reopen, do you believe new ecommerce shoppers will continue using the channel or move back to shopping in-store?

The majority of retailer respondents (70%) believe that at least 40% of shoppers who moved from in-store to online will stay online. COVID-19 has driven a rapid shift in spending to the ecommerce channel which seems to have accelerated ecommerce adoption permanently.

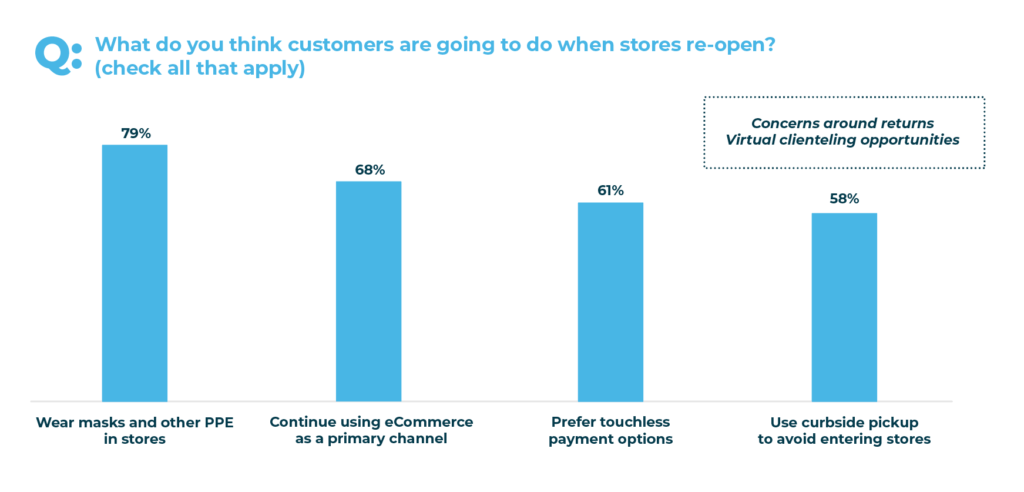

Question: What do you think customers are going to do when stores re-open?

As customers venture back into stores, things will look very different. Seventy-nine percent of retailers expect consumers to wear masks and 68% expect them to continue using ecommerce as their primary channel, even if more adopt curbside pick-up and virtual clienteling. Retailers are also considering various options for in-store returns, but still have concerns about the process.

Question: [For those with brick and mortar stores] What are you doing to prepare stores to reopen again?

Most retailers will initiate various protocols to keep both their employees and customers safe while shopping, including requiring employees to wear PPE and metering the amount of customers allowed in-store.

Question: Has your company made workforce adjustments since the start of COVID-19?

Unfortunately, because the positives still can’t offset the negative COVID impacts enough, reductions in workforce and salaries continue to climb.

Question: Overall, what is your sense of business optimism as compared to last week, and how long do you think it will take for ecommerce and store sales to recover to pre-COVID levels?

We’re still seeing increasing optimism across verticals, especially as compared to March when new social distancing measures and mandated store closures were rolling out in waves across the country. While some merchants have already reached or surpassed pre-COVID revenue levels, the majority of merchants, particularly those in apparel (64%), anticipate a long recovery period that rolls into 2021.

Get more details on this COVID research

We’re going to deep dive into these results live with the retailers surveyed in the upcoming CommerceNext Webinar sponsored by Acquia on Wednesday, May 6th at 2pm ET / 11am PT.

Panelists include:

Sucharita Kodali, VP and Principal Analyst, Forrester Research

Liesel Walsh, VP CRM, Party City

Kent Zimmerman, Vice President of Ecommerce and Consumer Technology, Shoe Carnival

Omer Artun, Chief Science Officer, Acquia

Catch up on all our COVID research and content

You can find replays of past webinars, CommerceNext original research summaries, data from numerous sources and COVID-19 blog posts on our COVID Resource Center.

As our community faces both immediate and long term impacts from COVID-19, we’ll keep gathering data to help you better understand how the industry is doing. And, once this is behind us, we’re here to help you share knowledge on how to rebuild.

Related Posts

-

Ecommerce Executives Express Cautious Optimism in Third COVID-19 Survey

For the past six weeks, CommerceNext has tracked the effects…

-

4 Tips for Brand Communications During COVID-19

There is no doubt that right now, we’re all navigating…

-

The Era Of COVID-19 Ecommerce: Which Categories Are Thriving?

While the coronavirus doesn’t discriminate, we’ve definitely seen some categories…