While our community and country cope with the uncertainty caused by the COVID-19 pandemic, we realize that the need for information is more pronounced than ever. Earlier this week, CommerceNext surveyed nearly 100 digital retail leaders to get a quick read on how COVID-19 is impacting brick and mortar and ecommerce business. We also surveyed what initial adjustments they’re making to both revenue targets and their marketing playbooks.

Given the urgency, we’re sharing high-level results below with minimal analysis.

A webinar is scheduled for next week on Wednesday, March 25th at 2 pm ET (11 am PT) to review the research results in more detail and hear reactions from retail executives Chris Hardisty, SVP of E-Commerce at Clarks, Barkha Saxena, Chief Data Officer Poshmark, and Angela Triano, Director of CRM at Altar’d State as well as Sucharita Kodali, VP and Principal Analyst at Forrester Research.

We want to thank the digital retail leaders who completed the survey. Below is a high-level overview of the results.

Methodology and Demographics

The data in the research was collected earlier this week on Monday, March 16, and Tuesday, March 17, from 90 respondents. Below is a breakdown of the company size and product category of the respondents.

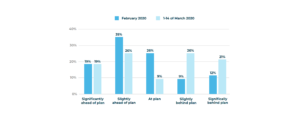

Question: How did ecommerce revenue trend for February? How did ecommerce revenue trend for the two week period of March 1st to 14th?

February 2020 was a strong month for ecommerce revenue with more than half of merchants being ahead of plan and about 20% being behind plan. This is probably because the US market was largely unaffected by COVID-19 at that time. The first two weeks of March show a significant downward shift in ecommerce revenue in which over 45% of merchants are reporting sales as below plan.

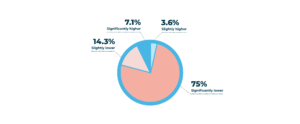

Question: [For respondents with brick and mortar locations] Since the COVID-19 crisis began in mid-February, how is store traffic trending?

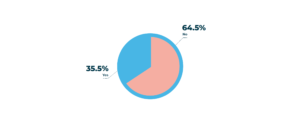

Question: [For respondents with brick and mortar locations] Have you seen sales shift from stores to online during the COVID-19 crisis?

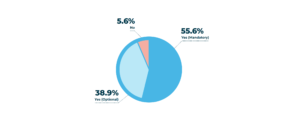

Question: Have you updated your forecast for Q2?

With the COVID-19 crisis still very new with unpredictable consequences, more than half of the merchants surveyed already lowered their Q2 forecasts. Many merchants maintained their forecasts for Q2, however, we expect that some of this group have yet to revisit them.

Question: What kind of marketing adjustments are you making if any due to COVID-19? [Respondents were directed to check all that apply.]

Most respondents are: shifting marketing channels, decreasing paid media and shifting marketing tactics from acquisition-focused to retention-focused. In our March 25th webinar, CommerceNext hopes to shed some light on exactly what kind of marketing channel shifts are happening.

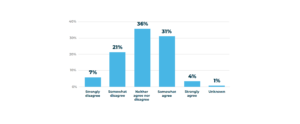

Question: [Respondents were asked whether they agree or disagree with the following statement.] The likely decline in demand from travel and entertainment due to COVID-19 will lead to lower paid media costs and improved marketing KPIs (RoAS, CAC, CPC, etc.).

Respondents have mixed points of view on whether media costs will go down due to decreased demand from the industries most affected by COVID-19, such as travel and live events (sports, concerts, etc.). We plan to learn more on this topic in the webinar.

Question: Has your company implemented a work from home option related to the crisis?

Nearly 95% of all respondents’ companies have initiated a work from home policy.

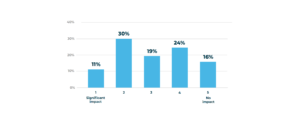

Question: To what degree are supply chain disruptions impacting your ability to fulfill demand for products? [Respondents asked to rate the impact based on a 1-5 scale: 1 = Significant Impact; 5 = No Impact.]

One a scale of 1 to 5, with 5 having the least impact and 1 having the most impact, the average was 2.9, indicating that the impact is split among respondents.

Question: What else retailers and brands are thinking about?

With circumstances changing by the hour—from store closures to shelter-in-place orders—below are a sample of open-ended comments from respondents.

- Cost reductions in all possible areas

- Creative ways to continue generating sales and meeting top-line revenue targets

- Solving for hourly employees whose hours have been reduced despite the same demand

- Limiting store hours/pushing BOPIS

- Being more sensitive in messaging/communication which is affecting our content stories

- Biggest concern is not being able to operate stores and distribution centers that require employees to be at work.

- Creating new digital products to accommodate target consumers

- Increasing efficiencies by taking advantage of reduced advertising costs and decreased competition in bid-based channels

Get more details on this research

We’re going to deep dive into these results live with the retailers surveyed in a CommerceNext Community Webinar sponsored by Exponea on Wednesday, March 25th at 2pm EST / 11am PST.

Panelists include:

- Sucharita Kodali, VP and Principal Analyst, Forrester Research

- Chris Hardisty, SVP of E-Commerce, Clarks

- Barkha Saxena, Chief Data Officer, Poshmark

- Angela Triano, Director of CRM, Altar’d State

Get help from fellow retailers and brands

Need even more community support, or tips on forming your crisis marketing playbook? We created a virtual (only for brands and retailers and without, solution providers) for collaboration and networking. Powered by Givitas, this tool connects easily to your inbox and facilitates asking for and offering help, advice, connections and introductions.

Join our CommerceNext Givitas Community and start getting crisis-proof ideas right away.

As our community faces both immediate and long term impacts from COVID-19, we’ll keep gathering data to help you better understand how the industry is doing. And, once this is behind us, we’re here to help you share knowledge on how to rebuild.

CommerceNext would like to thank Exponea for sponsoring this important webinar.

Related Posts

-

Balancing Brand and Performance Marketing At Scale

It seems that these days, every marketing team’s goal is…

-

Personalizing Your Full-Funnel Customer Acquisition Strategy

We all love a brand that makes us feel special.…

-

How Retailers Are Investing In Digital Customer Experience

Time is the most precious resource. Within our twenty-four hour…