With the holiday season quickly approaching, CommerceNext partnered with BizRate Insights to conduct an in-depth survey capturing holiday shopping insights from over 1,000 consumers. This article delves into essential data and emerging trends to inform and enhance your strategies for a successful 2023 holiday season.

Key Takeaways:

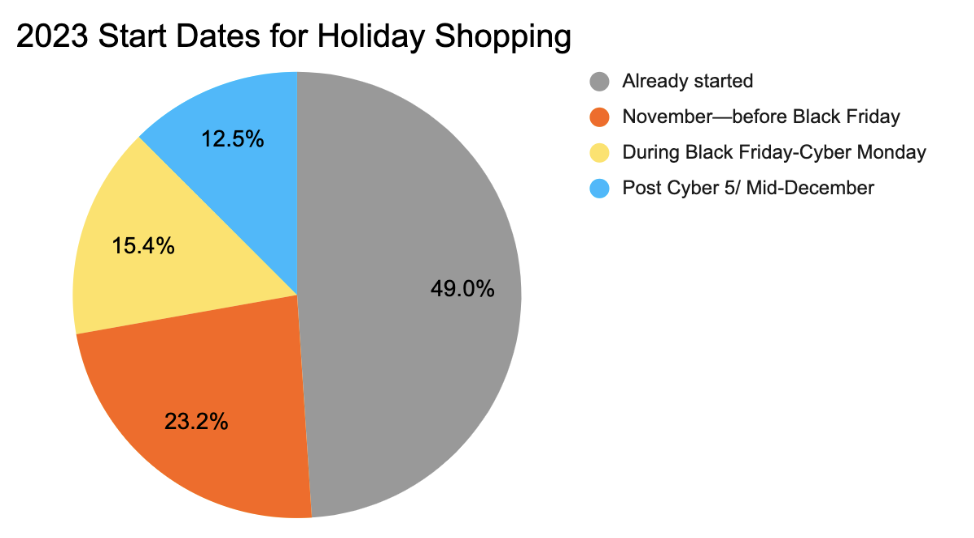

- Early planning is evident, as 72% of respondents kickstart their holiday shopping before Black Friday.

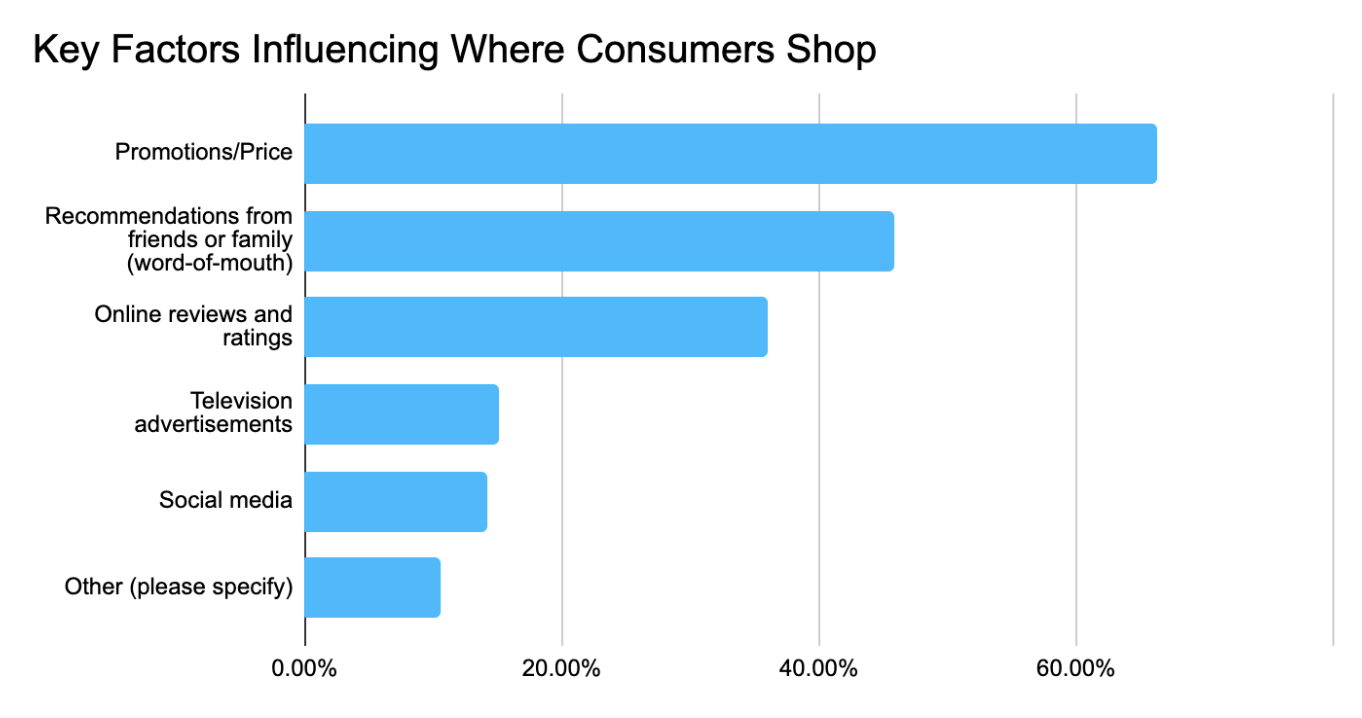

- Purchase decisions are heavily influenced by promotions, closely followed by recommendations from friends and family and online reviews.

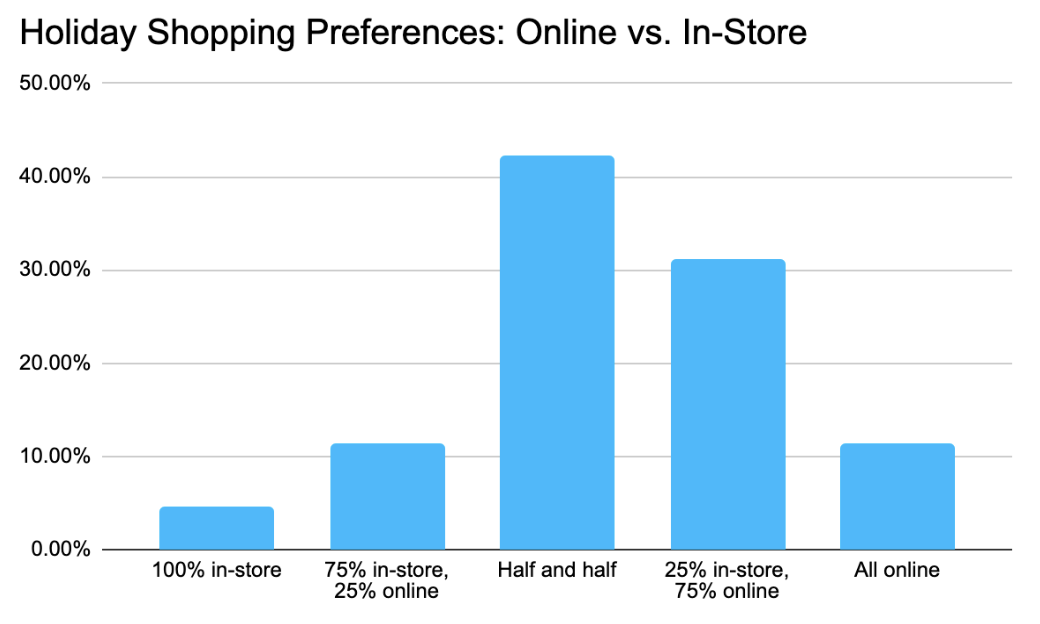

- A combination of online and in-store shopping remains essential.

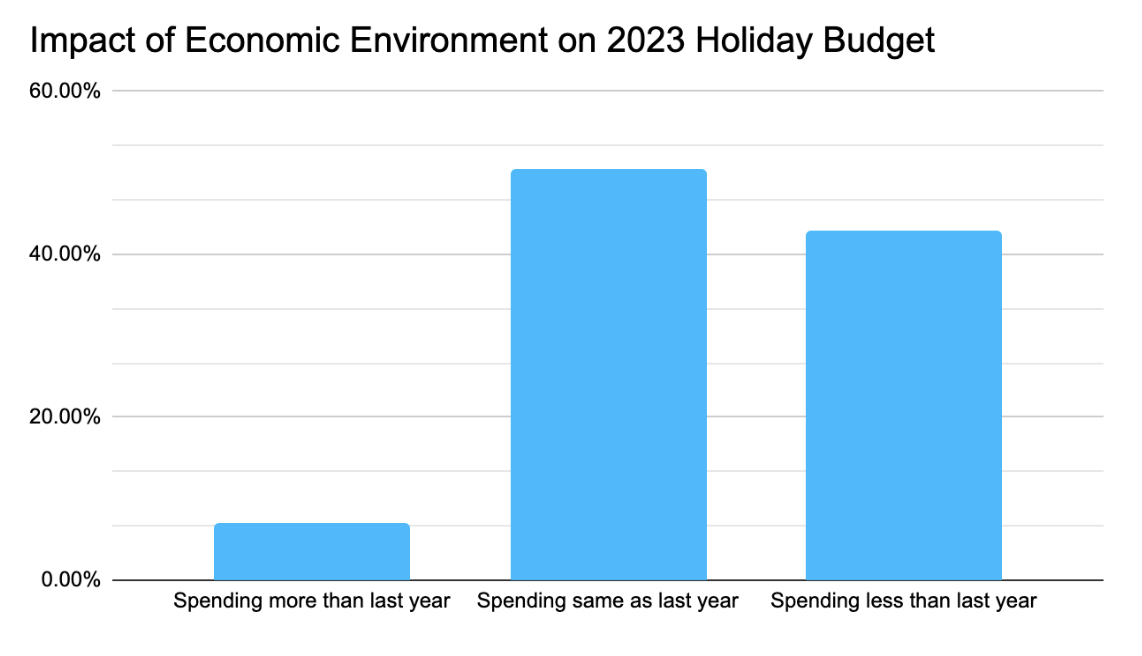

- Given the current economic climate, 42% of respondents plan to cut back on holiday spending.

- Discounts and promotions are still pivotal to attracting customers.

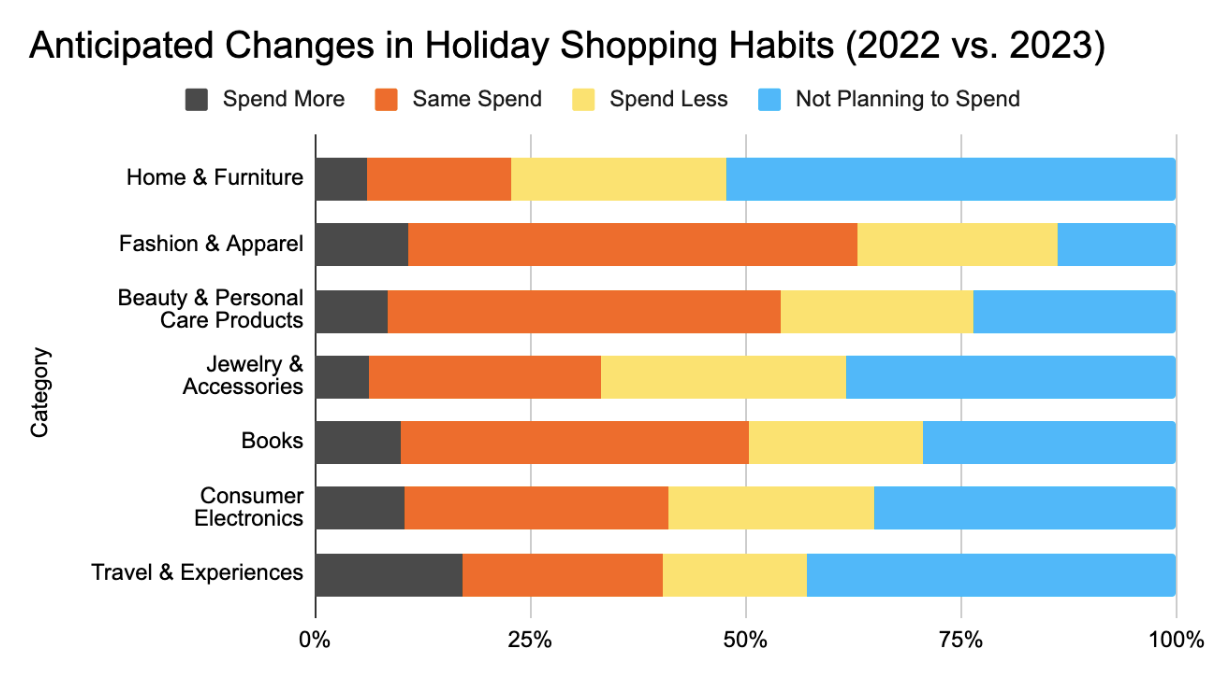

- Consumers are planning to decrease spending for high-priced items such as home furnishings and jewelry, while travel and experiences show some growth. Fashion and beauty categories remain stable.

Shopping Commences Pre-Black Friday for 72% of Consumers

Almost half of shoppers (49%) have already started shopping by October, suggesting a desire to spread out purchases and take advantage of early promotions. An additional 23% plan to start holiday gift shopping before Black Friday, reflecting the trend of early preparation we’ve seen YoY. In 2022, Forrester found that 25% of online shoppers had begun holiday shopping by October. This indicates an opportunity for retailers to engage early-bird shoppers with strategic promotions and targeted marketing efforts.

Promotions Are The Most Influential Factor For Holiday Purchases

Promotions have the highest influence on holiday purchase decisions, likely because consumers hope to make their dollars go further in the current economic state (more on that below). Recommendations from friends or family also play a pivotal role, emphasizing the power of trust, social connections and word of mouth. Online reviews and ratings hold substantial influence, underscoring the significance of a positive online reputation and feedback on consumer choices. If you don’t already have a referral program in place for your brand, consider capitalizing on word of mouth and reward your customers with discounts or loyalty points for getting their family and friends to shop with you. It will help you build your customer base and have an impact on your business beyond the holiday season.

Omnichannel Experience Preferred by 84% of Consumers

The enduring significance of digital channels is reinforced as almost all respondents (95%) plan to incorporate online shopping to some extent. However, the preference for a “half in-store and half online” approach among respondents underscores the necessity for brands to adopt a unified omnichannel strategy. In 2022, Thanksgiving weekend foot traffic had a notable 17% YoY increase, emphasizing the urgency for retailers to seamlessly blend online and offline experiences. Services like Buy Online, Pickup in Store (BOPIS) and others play a pivotal role in bridging this gap.

Budgeting in the Current Economic Climate

In an economically cautious climate, 50% of respondents plan to maintain last year’s spending levels, while 43% are preparing to tighten their budgets. Retailers must pivot towards value-driven propositions and cost-effective offerings to capture the attention of budget-conscious consumers. Tailoring promotions and discounts to align with these sentiments will be a cornerstone of success during the holiday season and beyond. If you aren’t able to implement extra promotions due to margins, consider rewarding your most loyal customers with personalized discounts, free shipping or other tactics to help them take their dollars further.

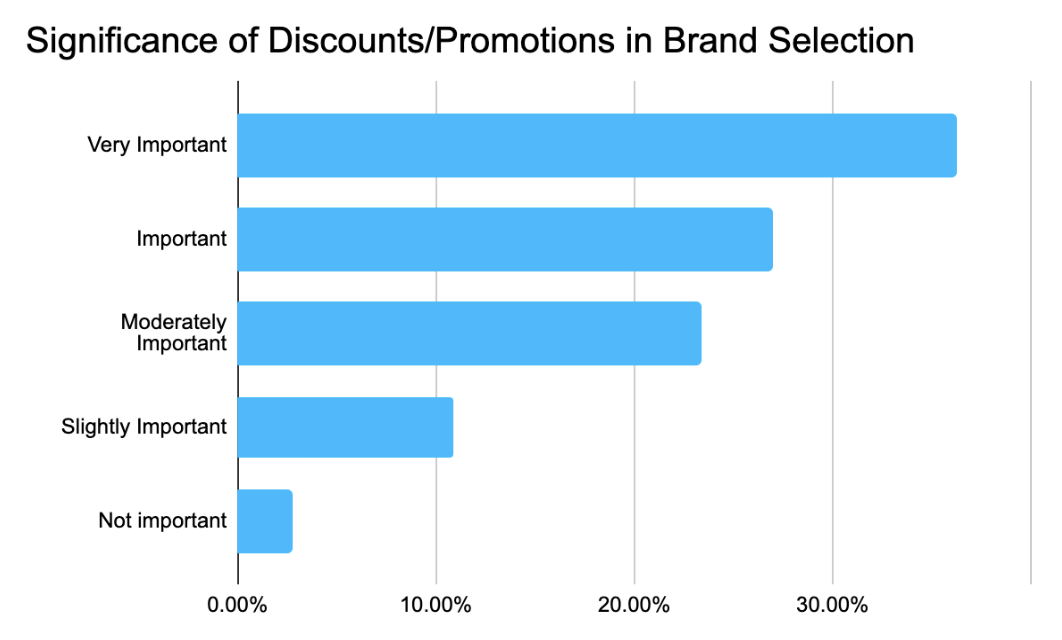

The Unwavering Power of Discounts: A Universal Need

An overwhelming 97% of shoppers consider discounts/promotions to be important. The significance of promotions remains consistent across age and gender, offering retailers valuable insights into their customer base. This highlights the universal appeal of cost-saving incentives and the need for retailers to deploy promotions to engage a wide demographic strategically. If your brand is hesitant to increase discounts or promotions, come up with creative ways to help customers save money or provide additional value (i.e. discounts for referring friends to shop or loyalty rewards).

Anticipated Category Shifts for the 2023 Holiday Shopping Season

High-price, high-consideration purchases like home and furniture, as well as jewelry, are experiencing decreased spending. Travel and experiences show modest growth, while additional spending across categories remains relatively low. Fashion and beauty categories demonstrate the most stability in anticipated spending patterns. These shifts in spending priorities offer valuable guidance for retailers in curating their product offerings and marketing to align with evolving consumer preferences.

As we enter the 2023 holiday shopping season, early planning, a seamless omnichannel experience and strategic discounting are critical for retailers and brands. Consider crafting personalized promotions and leveraging trusted customer recommendations to boost holiday sales. To delve deeper into the latest industry trends and strategies like these, join us at the CommerceNext 2024 Ecommerce Growth Show and gain valuable insights like this from 150+ industry experts and leaders!

Related Posts

-

NEW Retailer Data Collection Research

New sources of information like mobile devices, social media, customer…

-

Join The CommerceNext Ecommerce Growth Show in June 2023

It’s time—registration for our Ecommerce Growth Show is open now! …

-

New Digital Trends and Investment Priorities Research

Our latest research focuses on the strategies for growth and…