While no one knows what the full impact of the COVID-19 pandemic will be, social distancing and economic shutdowns will have a lasting impact on consumer behaviors and the way people engage with digital media. As the crisis continues, 95% of Americans are currently under stay-at-home orders and new social distancing lifestyles and behaviors are changing the way consumers interact with content across platforms. In recent weeks, internet usage is reported to have increased by 50-70%. Social platform usage, messaging and video communication are all on the rise, along with short-form video, streaming OTT and podcast engagement.

This increase in time spent with media during the pandemic crisis will also likely influence post-coronavirus habits. All brands today face a new reality that requires them to pivot and adapt their creative and media strategy to meet current consumer needs. The need to move faster and operate with authenticity across digital channels has never been more critical for brands.

This set of analyses outlines the performance trends of over 3,200 campaigns for CPG, retail, entertainment and QSR clients looking to adapt their strategies to the new COVID-19 environment.

This blog post addresses:

- The current landscape for digital advertisers

- Social platforms trends during COVID-19

- Recommendations for advertisers

Methodology

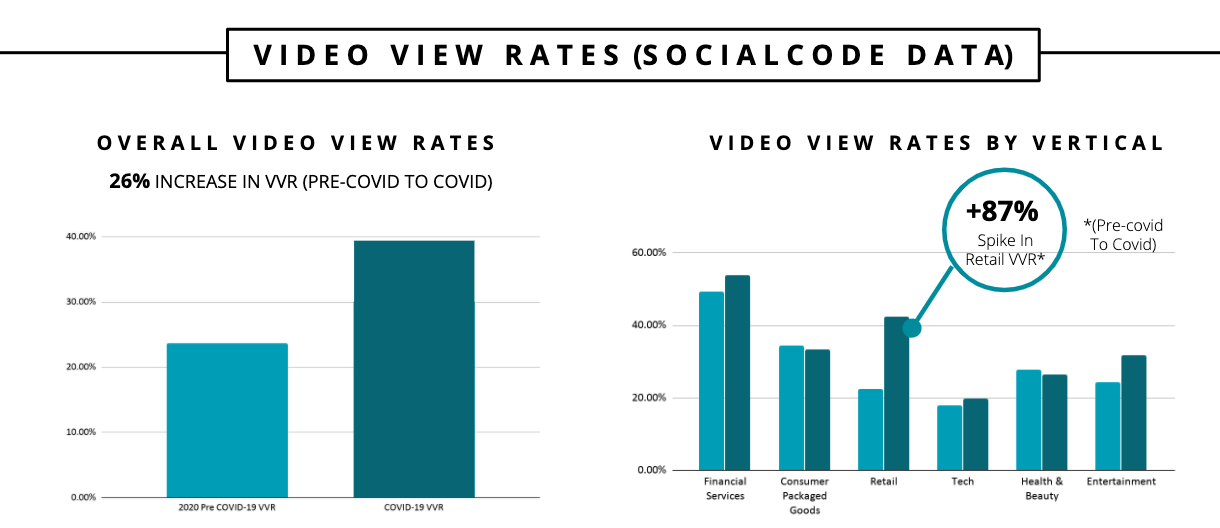

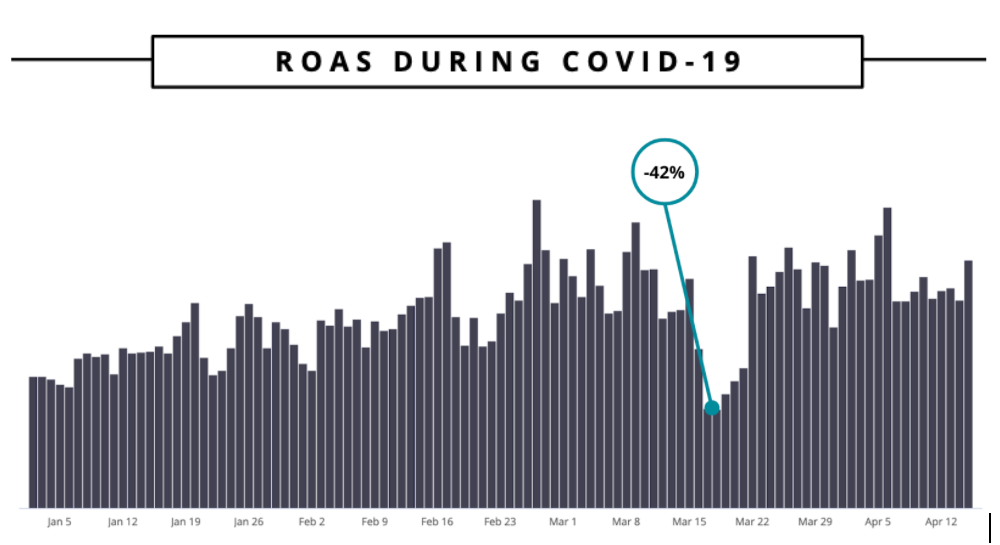

Data was collected from the period from January 1, 2020 to April 15, 2020. ‘Pre-COVID-19’ data is defined as January 1-March 11, prior to the official pandemic declaration by the World Health Organization and ‘COVID-19 data’ defines the period from March 12 – April 15, 2020.

Consumers are buying & brands are adapting

Consumer behaviors have shifted daily and the performance data illuminates the trends that can help advertisers adapt their strategies and maximize return on their marketing investments.

Here are the top three ways consumers and brands are shifting behavior since the start of the COVID-19 crisis.

1. Consumers want to connect—they’re leaned back and highly engaged

In the current environment, consumers are particularly interested in engaging with brands across digital channels, especially with videos.

Facebook has seen increases of 53% and time spent on Instagram usage has also increased by 32% (Kantar). Americans are also increasing their time spent with both free video streaming and subscription video, with 58% of U.S. adults spending more time streaming free online videos and 51% streaming more subscription video services (eMarketer).

There’s been a clear trend of increased video view rates across most verticals since the start of the COVID-19 pandemic.

2. E-commerce: consumers are not just browsing, they’re buying

Initial news around COVID-19 slowed sales across all verticals—with the exception of CPG—as consumers adjusted to the new normal. Recently, however, RoAS across most verticals has increased, as consumers turn to e-commerce for goods they would have historically purchased in-store.

For SocialCode clients, we have seen an overall increase in e-commerce investment as brands pivot to meet new consumer demands. Across all verticals with e-commerce capabilities, we’ve seen an overall increased investment of 102%. For CPG, that number is even more significant, with an increase of 112% in e-commerce investments.

3. RoAs begins to rebound in late March

After an initial dip in the first weeks of March, new data shows that we’re holding a steady RoAS that is ~22% higher than pre-COVID aggregate RoAS.

1/1 – 3/14: RoAS: 10.8 – RoAS consistent with historical norms through the first part of the quarter.

3/15 – 3/21: RoAS: 6.3 – Significant decline (-42%) in RoAS as COVID-19 impacts day-to-day lives of consumers (as people are asked to WFH and major sporting events are cancelled).

3/22 – 4/12: RoAS: 9.3 – Current data shows that we’re holding a steady RoAS in the post-COVID dip that is ~22% higher than pre-COVID aggregate RoAS.

Marketers are adjusting spend by platform & channel

Advertisers are turning to channels that have been proven to drive performance and shifting traditional marketing budgets to digital. Macro spend in mid-March was down, leading to more inventory and a decrease in CPMs. Continued investment from advertisers in recent weeks has reversed that however, resulting in an uptick in CPMs in the U.S.

Heavier investments on social

To reach these users where they’re most active, retailers and brands have increased their overall social investments, which varies by platform:

1. Increased investment on Facebook, Instagram and Google, the platforms that have historically proven to be the most effective at driving full-funnel return.

2. Increased investment on Pinterest to capitalize on increased search volume especially around DIY activities, new recipes and self-care activities.

3. Decreased investment in Twitter as brands real time event activations are limited due to COVID-19 guidelines.

Recommendations for advertisers

In the current climate of social distancing, many brands are uniquely positioned to provide solutions that can help consumers be more comfortable, more educated, more entertained and more prepared. As we head into May, remember the following:

- Consumers are still reachable and they are still shopping.

- Your customers are still looking for ways to engage and consume content, in many cases now more than ever.

- Brands who can pivot and be there for consumers now have an opportunity to build loyal and lasting customer relationships for a post-coronavirus environment.

On average, those who follow the below recommendations see a 2x lift in engagement metrics and are able to scale investment 2 – 3x in e-commerce initiatives while maintaining return.

- Adapt Your Message

- Acknowledge the shift / changing mindset

- Focus on essentials / basics

- Practice self-care messaging

- Incorporate text overlays that speak to at-home use occasions

- Show Support

- Offer free shipping / delivery

- Create contests / games within ads

- Maintain dialogue with your customers

- Does not have to be solely paid advertising

- Be Where Your Customers Are

- TV to OTT (Streaming +24% YOY, ComScore)

- Radio to Podcast (Podcast listening up 8%, InsideRadio)

- Print & OOH to Digital

- Track, Iterate, Repeat

- Set up new mechanisms to review data and track performance

- Update media budgets to reflect sales data—what products are moving, what inventory is in demand

In closing: The new normal for advertisers

Advertisers will need to to stay agile and nimble throughout this unpredictable period, and continue to track the return on your investments.

While this is a challenging time for businesses across every vertical, it is also a time to think about investments today that can position your business for success in the long term. Consumers are engaging more with lean-back content like videos and podcasts. They are looking for brands to trust. They are browsing and buying.

Related Posts

-

How Will COVID-19 Change Shopping Habits?

As new COVID-19 infection rates, deaths and other daily measures…

-

4 Tips for Brand Communications During COVID-19

There is no doubt that right now, we’re all navigating…

-

How To Engage The Right Consumer Tribe For Your Brand

The coronavirus has had devastating effects on people and businesses…

-

4 Tips for Brand Communications During COVID-19

There is no doubt that right now, we’re all navigating…

-

Impact Of COVID-19 On Retail And Ecommerce: Survey Results

While our community and country cope with the uncertainty caused…

-

Ecommerce Executives Express Cautious Optimism in Third COVID-19 Survey

For the past six weeks, CommerceNext has tracked the effects…