WITHIN tracks daily revenue, media spend and conversion rates across major verticals

Recognizing the importance of sharing valuable resources with the CommerceNext community to help them understand the impact of COVID-19 on digital retail, we worked with WITHIN to make their COVID-19 Retail Pulse available. Leveraging first-party ecommerce data from its roster of 75 clients, WITHIN’s index tracks trends in ecommerce revenue, digital media ad spend, and conversion rate relative to the pre-COVID benchmark period.

WITHIN is seeing many retailers and ecommerce brands altering forecasts to match demand, evaluating acquisition versus retention strategies, and experimenting with various online media and marketing tactics to meet customers where they are online.

Here are WITHIN’s ecommerce industry learnings as of March 22, 2020.

Profile and definitions of companies sampled.

- 75 companies contributing to the data set: a mix of fast-growing VC-backed startups and Fortune 100 companies

- Total yearly digital marketing spend across the indexed companies: $500 million

- Total U.S. ecommerce revenue for the indexed companies: $5 billion

- The Omnichannel category represents brands selling products in-store and online, whether it is wholesale or with owned bricks and mortar stores

- The Pure-Play Ecommerce category represents brands selling only online

- Pure-Play Ecommerce and Omnichannel are mutually exclusive, but a company may also fall into one of the three verticals: Fashion, Essentials, or Luxury

High-level trend takeaways.

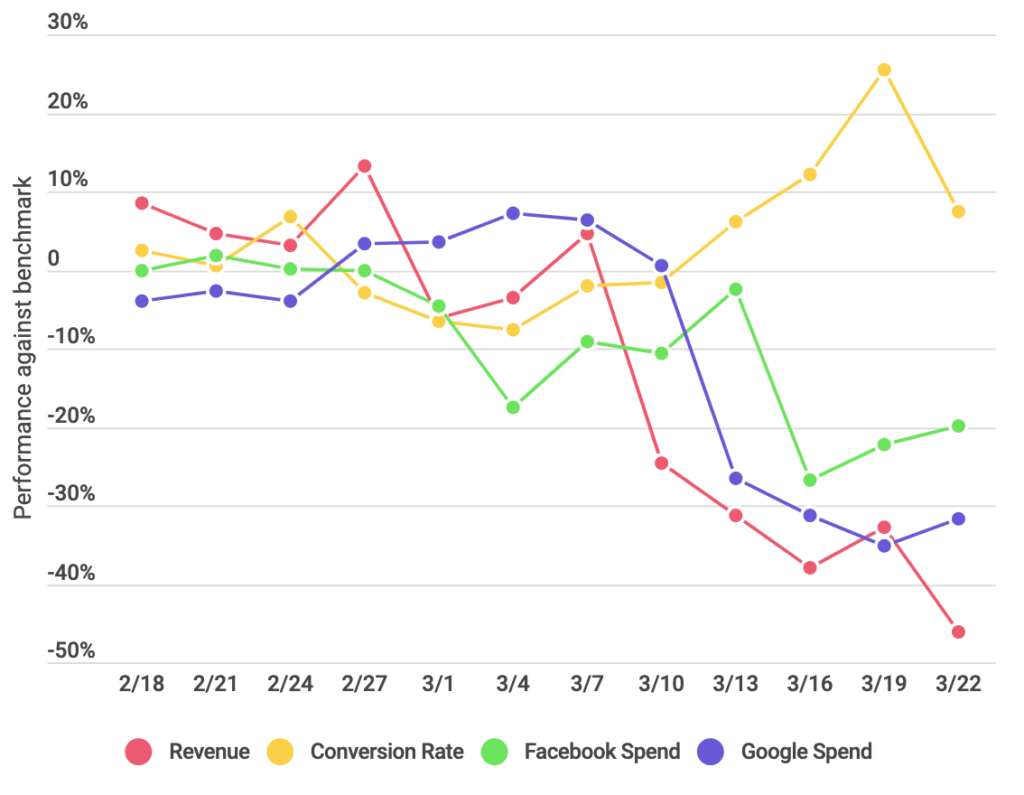

Fashion and luxury are leaning into loyal customers.

Fashion and Luxury brands are incurring sharp revenue blows since their products are considered non-essential during this time. These types of brands have seen a decline in revenue and are now pushing harder into customer retention campaigns via email. They are using their marketing to (a) build brand loyalty by promoting what they are doing to help those in need during this crisis and (b) promote discounts and sales.

Digital media: essential products prioritize search and non-essentials focus on social.

Customers are mostly focused on searching for and buying any and all essentials. While this is a sweet spot for some — like Subscription and At-Home Convenience brands — this is devastating to others, necessitating a sharp turn in strategy.

Brands selling non-essential products have largely decreased spend on Google search during this time, but some have turned to social media channels where they’re executing powerful brand marketing at reduced digital media pricing (due to the recent pullout of travel and hospitality ad buys). Instead of relying on search traffic, brands are using social, which is better suited to communicate important messages about the impact of COVID-19 on their community of employees and customers.

Other verticals—like Subscription and At-Home Convenience and brands selling essentials with cheaper shipping—are on the other side of the customer acquisition coin. They’re focused on connecting with the high volume of customers searching for essential buys.

Trend breakdown by vertical.

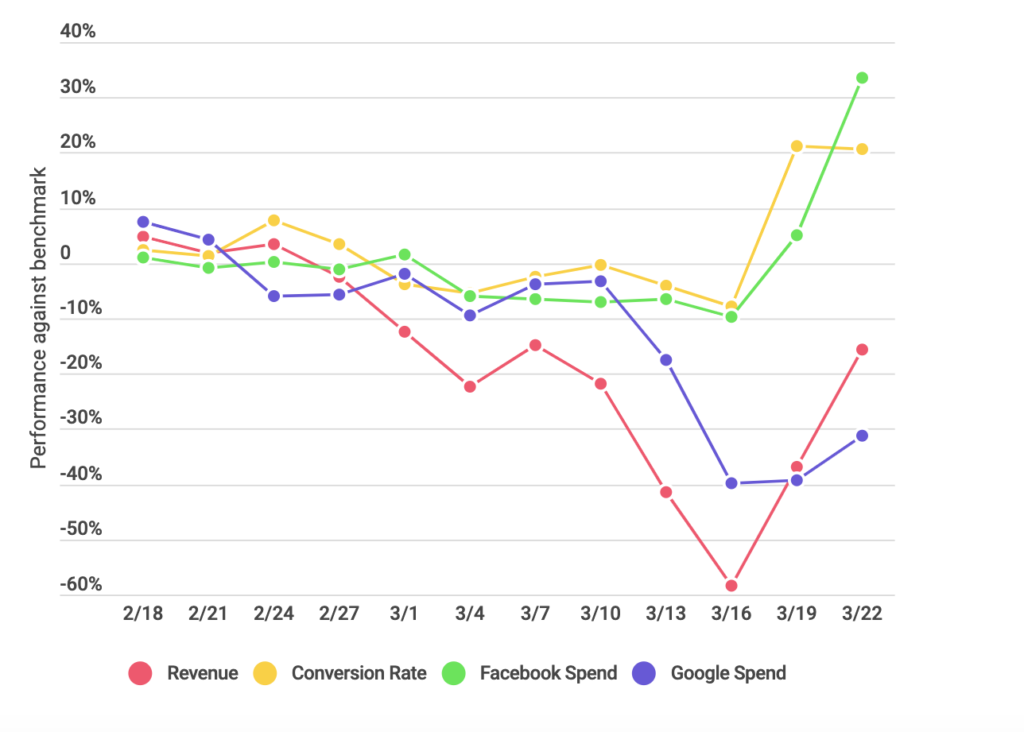

Omnichannel

Toward the end of last week, Omnichannel companies began to rally back from a steep revenue decline by leaning heavily on promotions and increasing digital media spend on Facebook. These companies are trying to make up the loss from in-store sales by sending customers to ecommerce via discounts and sales.

Pure-Play Ecommerce

After sharply cutting ad spend over the past two weeks, these pure-play ecommerce brands watched revenue hold relatively steady until this past weekend. Now, after keeping ad spend low, revenue is declining quickly and consistently, dropping to its lowest yet on Sunday.

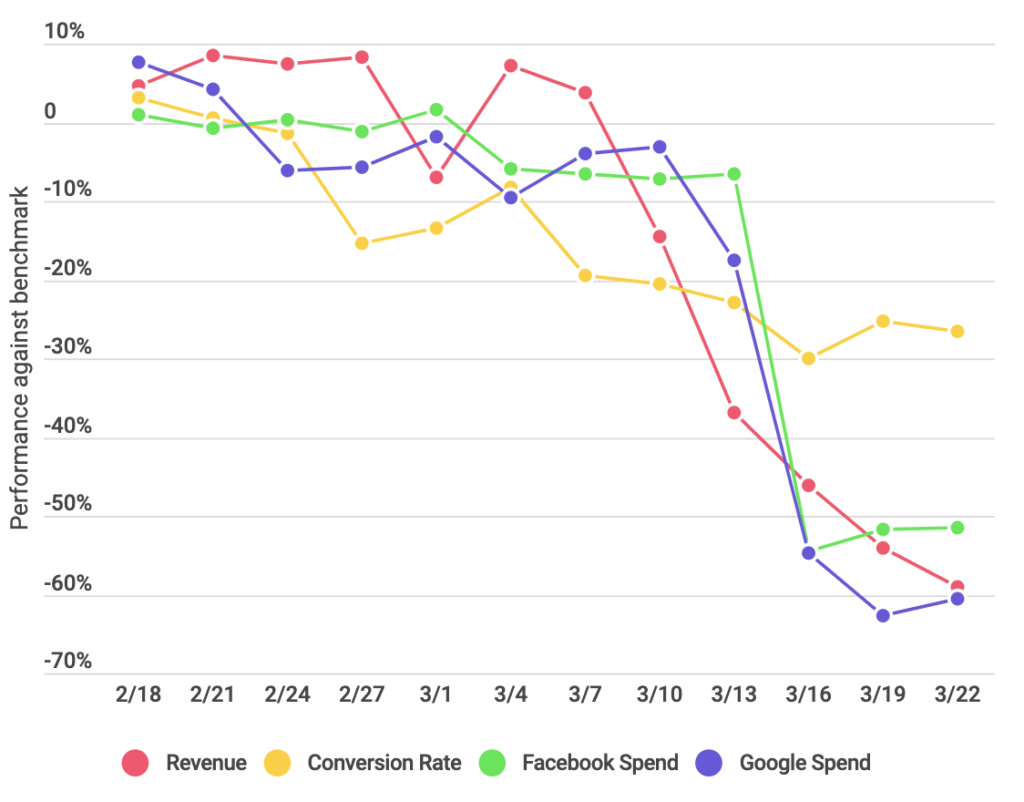

Fashion

Due to last week’s fall in CPMs and trying to replace lost traffic from Google search, fashion brands were able to reduce the bleeding in revenue with increased incremental spend on Facebook. Following a strong promotions strategy and resurgence of ad buying, conversion rates are rising toward their pre-COVID-19 benchmarks while revenue steadily trails behind.

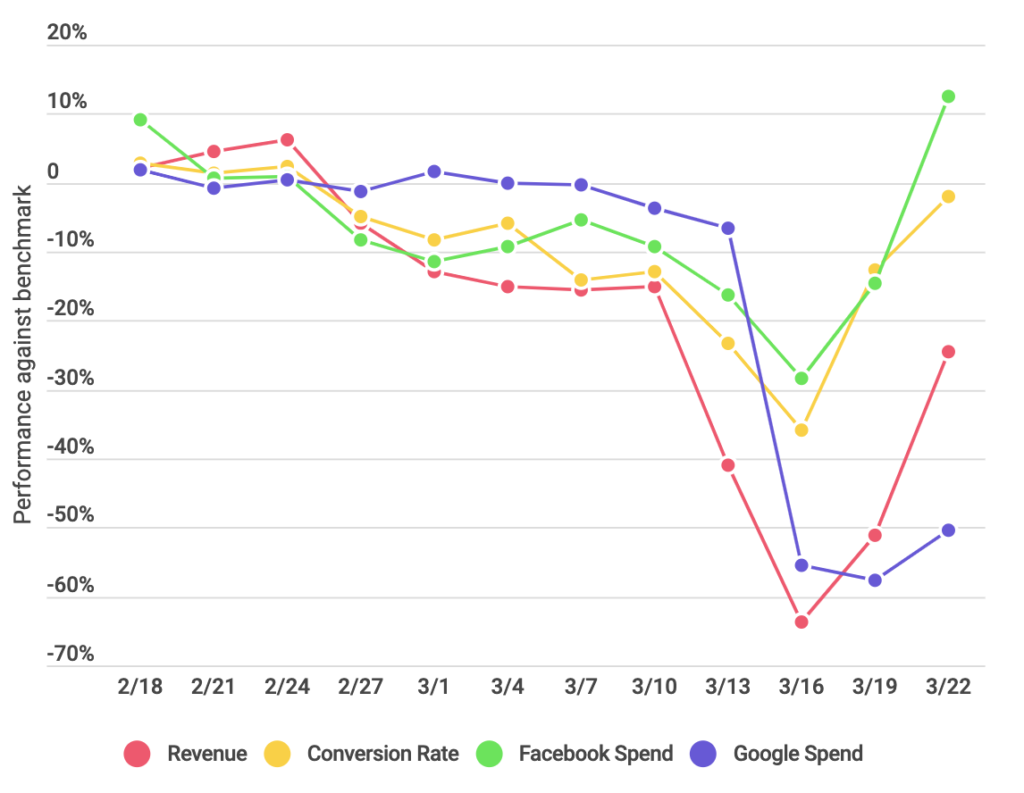

Subscription and At-Home Convenience

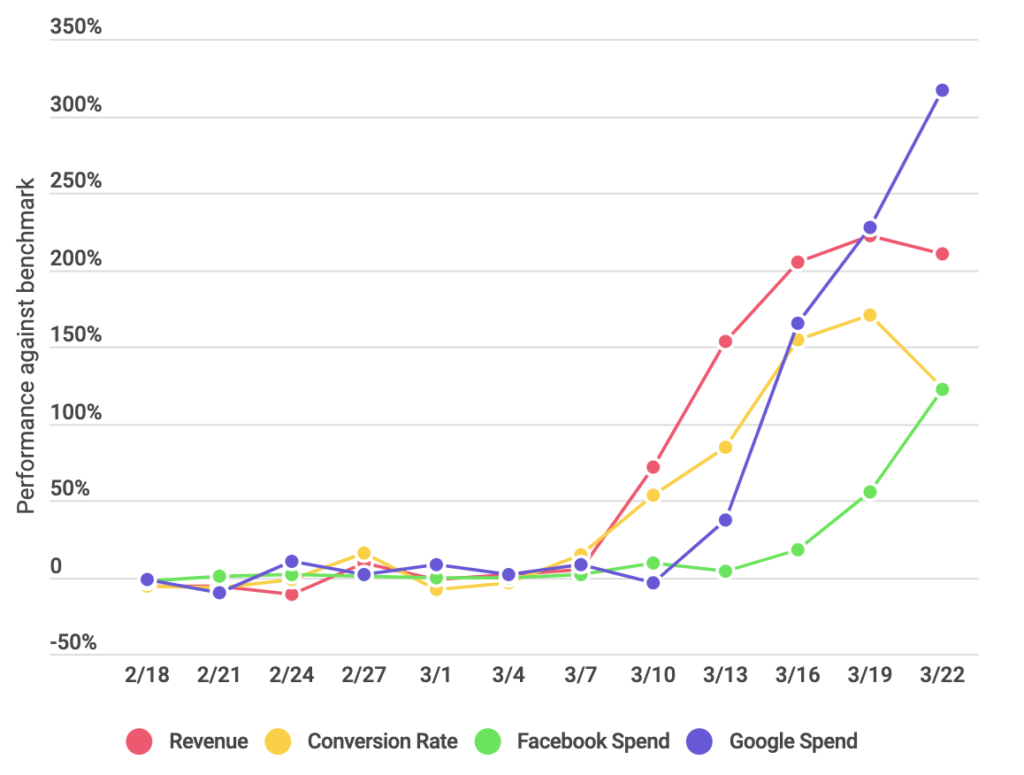

Seemingly, the one vertical not seeing challenges (other than supply chain) from COVID-19, Subscription and At-Home Convenience brand revenues grew past pre-COVID benchmarks topping out at a high of +222%. Due to lower CPMs on Facebook and higher demand for subscription-based delivery products, this category of brands continues to heavily invest in ad spend.

Luxury

Luxury brands continue to feel the hit on revenue. Up against volatile markets and bleak consumer outlooks, this group of brands is seeing the sharpest revenue and spending declines. Out of necessity, they’ve pulled back on spend and are relying on promotions to existing customers to maintain sales, accounting for the reported high conversion rates despite revenue and spending continuing to bottom out.

What about Amazon? Brands can adjust.

Consumers are adjusting to this new normal, focusing on their needs versus wants and changing shopping habits accordingly. They’re ordering essentials online to avoid leaving their homes and engaging in more online window shopping to pass their quarantined time.

Last week, WITHIN noted that Amazon (1) put a hold on receiving and stocking non-essential goods in their warehouses and (2) began meticulously monitoring and screening “the influx of sellers trying to capitalize on the COVID-19 pandemic.”

In the short-term, WITHIN recommends that brands selling on Amazon should adjust their campaigns on Amazon to accommodate these changing consumer habits. This includes reducing spend on ads that drive impressions but not purchases and avoiding the bad-faith practice of incorporating irrelevant COVID-19 related search terms into PDPs.

In the long-term, while this pandemic’s longevity remains undetermined, WITHIN recommends brands diversify their distribution channels and that Amazon sellers evaluate a shift to more fulfilled by the merchant if that can ensure their customers receive their products on a more timely basis during this time.

What winning looks like now.

Some brands were able to pivot strategies quickly to prevent declines or even see some areas grow. Here are WITHIN’s recommendations based on learnings from their ecommerce clients:

1. Reevaluate paid online media budgets, testing plans, and metrics. Set goals and plans into motion that reflect the current trends. Hit pause on incrementality testing to mitigate confusion as this crisis lasts for an indeterminate amount of time. Instead of topline revenue, use the more telling KPI of gross profit after paid ads (GPAPA).

2. Use shipping and promotions for acquisition. Omnichannel businesses needn’t just write off their brick and mortar sales as complete lost causes. Shift any resources from in-store promotions into shipping and sales promotions to deliver value to the typical in-store buyer. Consider offering free shipping — or lowering current free-shipping thresholds — and Cyber Monday–caliber deals like “Buy 3, Get 1 Free.”

3. Strategize around the “stock up” mentality. Subscription and At-Home Convenience brands, in particular, can employ marketing tactics that speak to households who want to stock up. Offer cashback on larger orders and ensure the brand is highly discoverable via search and Google Shopping ads.

4. Focus on CLTV. Rather than initiating sitewide sales, focus on delivering value and service to high–lifetime value customers with discount codes.

Despite the daily ups and downs, customers are still shopping, still need to safely obtain their essentials, and will never stop searching for a good deal. If brands continue to closely monitor consumer habits and online media trends, they can reduce their losses from a revenue standpoint and potentially find some upside.

Get more details on this research

We’re going to deep dive into this data live with the retailers providing their point of view at the next CommerceNext Community Webinar sponsored on Thursday, April 2nd at 4pm EST / 1pm PST.

Panelists include:

- John Hazen, Chief Digital Officer, Boot Barn

- Joe Yakuel, Founder & CEO, WITHIN

- Bill Bass, CMO at FULLBEAUTY Brands

For more daily insights and continued coverage of ecommerce during the COVID-19 crisis, bookmark WITHIN’s COVID-19 Retail Pulse.

Related Posts

-

Impact Of COVID-19 On Retail And Ecommerce: Survey Results

While our community and country cope with the uncertainty caused…

-

Tailoring Your Performance Marketing for Attribution

Attribution is one of the most sought-after yet daunting discussions…

-

Fueling Ecommerce Marketing Growth With A Customer Data Platform

It’s the technology that’s on every direct-to-consumer (DTC) and retail…