We have seen time and time again how Covid-19 has impacted retail in 2020. As marketers, we shifted our strategies and adapted to new circumstances. Preparing for Cyber Week was no different, as Covid-19 limited foot traffic in stores, drove up ecommerce demand which in turn caused shipping delays and generally impacted people’s spending habits. Additionally, companies had to tailor their customer experiences to meet both Covid-19 regulations and the changing needs of their customers.

In our latest webinar, “Cyber Week Recap: Lessons Learned and Advice for 2021” CommerceNext Co-Founder Veronika Sonsev was joined by Jason Goldberg (Chief Commerce Strategy Officer, Publicis Communications), Jenna Posner (VP Digital, SNIPES), Ujjwal Dhoot (CMO, DXL Group) and Tomas Diaz (CEO, flexEngage) to:

- Recap the trends from Cyber Week,

- Understand how, where and when people spent their money and

- Discuss how to use Cyber Week as a learning experience for 2021.

CYBER WEEK DATA

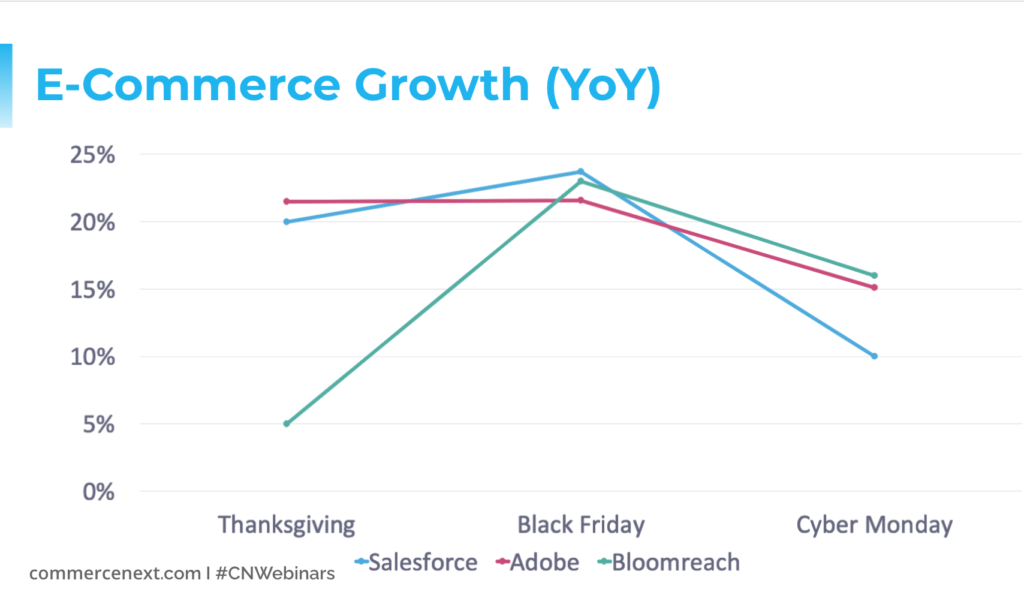

Goldberg presented ecommerce sales data from Salesforce, Adobe and Bloomreach to illustrate a few important Cyber-5 (Thanksgiving-Cyber Monday) trends this year:

- Cyber Week ecommerce sales were up between 20-25%, but still lower than the 33% that retailers predicted to see this year

- Black Friday was the biggest day of ecommerce growth at 20-23%

- Cyber Monday was the biggest ecommerce shopping day in the history of US ecommerce

- Adobe saw an overall ecommerce growth in November higher than the Cyber-5

- Salesforce saw more ecommerce sales on Black Friday than Cyber Monday (which would be new)

- Ecommerce sales did not compensate for the lack of foot traffic in Covid-times

- Ecommerce quarterly growth YOY was higher for Q2 than Q3

This image above shows the ecommerce growth YoY, highlighting that Black Friday sales increased between 20-25% from 2019.

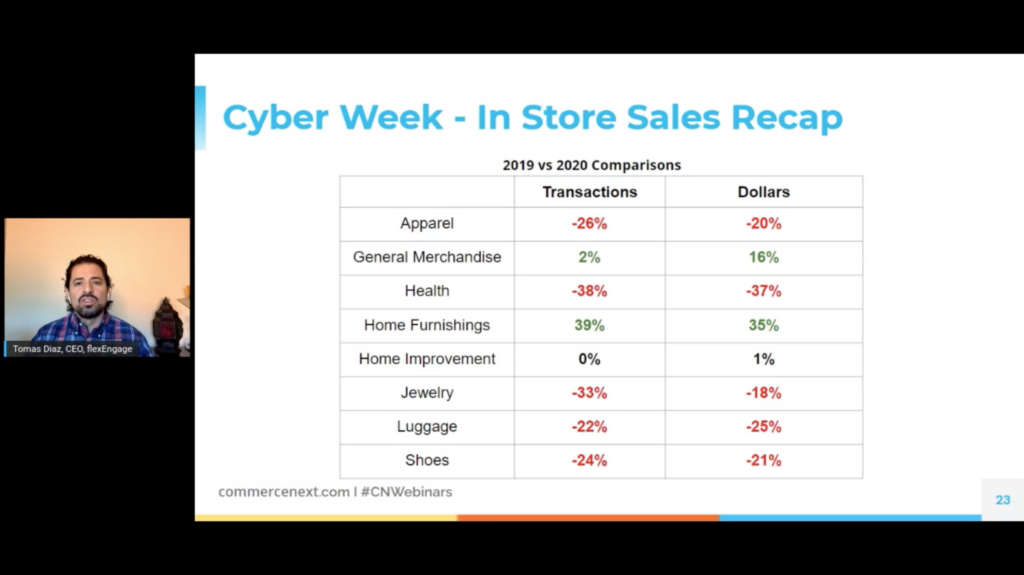

Diaz’s presentation used flexEngage’s data and focused on trends from in-person sales during Cyber Week. He also shared a few important, and perhaps, surprising insights:

- Overall store transactions during Cyber Week were down 8% and down 12% in dollars

- Sunday and Monday were big in-person shopping days, with store transactions up 22% and 42%, respectively, and dollars up 8% and 12%, respectively

- Categories like general merchandise and home furnishings were up, while others like apparel, jewelry, luggage, and shows, were down

- Curbside is increasingly becoming the preferred customer experience—in-store and curbside pickup increased 52% compared to Black Friday 2019

- Retailers who offered curbside, drive thru or in-store pickup increased digital revenue 29%, while those who didn’t only saw a 22% increase

This image above shows Cyber Week comparisons by category, highlighting that general merchandise and home furnishings transactions increased compared to 2019.

ANALYZING THE DATA AND TRENDS

The Future of Cyber Monday Sales

Retailers worked extra hard to generate sales this year. There were a large number of promotions when Covid-19 first hit the U.S. because stores were shut down. Then, many retailers held promotions for the entire month of November. Now Posner believes that customers are fatigued and promotions have become less meaningful. In order to improve customer experience and engagement, brands should rethink their promotional strategies.

Covid-19 has changed the spending landscape—there is a large amount of spending in retail this year that usually goes to categories like restaurants and travel, which explains why ecommerce spending during Cyber Week sales were still up 20-25% from last year. However, in our current economic environment, many people are still saving their money due to economic uncertainty, contributing to sales growth not being as high as predicted.

Holiday Spending

While sales did not meet the expected growth numbers, our panelists are certain that people will continue to spend and it will be an overall strong holiday season. As Dhoot put it, “Procrastination will not go away” and, therefore, retailers will continue to see last minute shoppers in the next few weeks. Diaz also predicts that people will go to the stores for last minute shopping, because they will be worried that shipping couriers will not deliver in time.

Retailers and customers alike worry about whether or not they will get everything in time for the holiday. Here’s what our panelists had to say about handling/avoiding Shippageddon:

- Buying online and picking up in-store will be an increasingly popular and safe option for customers who are worried about the time crunch but not willing to shop in person.

- Shipping carriers are overwhelmed, so more people will turn to curbside pickup – using store inventory allows people to get their items, have a positive customer experience and avoid the stress of waiting for FedEx or UPS to deliver their packages.

- For those who wish to stay away from stores altogether, they will rely on last mile delivery services such as Instacart or “the Door Dashes of the world” to deliver their products.

Economic Influence

The American economy is suffering greatly during Covid-19. Should retailers be worried about how the economy and absence of a new stimulus might impact spending?

In short, it is difficult to tell where the economy will go in 2021. The American consumer was very resilient this year. Unemployment was at an all-time high this year, but so were income and savings rates. As seen from the data, there are some categories in which people’s spendings dwindled, but other markets will likely continue growing as our country spends more time at home and continues to deal with Covid-19.

ADVICE FOR 2021

To end the discussion, our panelists shared their advice for moving forward into 2021:

- You don’t have to be promotional to be successful–focus on other ways to differentiate your company and meet consumer expectations.

- Double down on digital consumers.

- Retailers with the best customer experience and omnichannel infrastructure will come out stronger in 2021.

Watch the recording and other webinars here.

Thanks to all who joined in any of our Webinar Series for 2020. We look forward to seeing you again in 2021!

Related Posts

-

Creating A Seamless, Integrated Ecommerce Experience Across The Customer Journey

Today’s customers expect a seamless experience when interacting with a…

-

From AI to Impact: The Trends Shaping Marketing in the CPG Industry

How Unilever, Red Bull & PepsiCo Are Redefining CPG Marketing…

-

Engaging and Converting Customers With Killer Content

In our latest CommerceNext webinar, industry experts from American Eagle,…