The 2021 Holiday season is finally here—with supply chain issues impacting holiday shipping, retailers are being forced to adapt their usual tactics. To help you prepare, we partnered with Forrester’s lead retail analyst, Sucharita, Kodali, to survey 80+ retailers, learning about their expectations and strategies for the 2021 holiday retail season.

We also recorded a podcast earlier this week where Sucharita discusses the findings.

Below are the key themes that arose from the study:

Cyber Meh-day

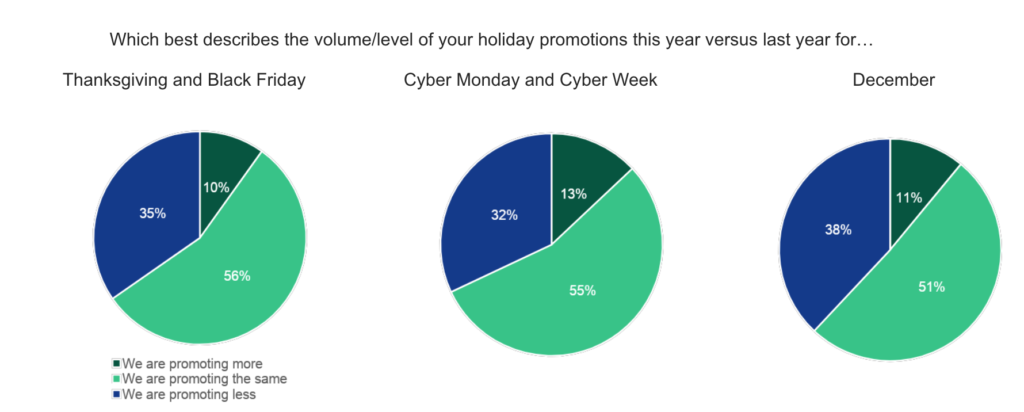

The majority of retailers reported they will promote either the same amount or less during promotional periods like Cyber 5 and the month of December.

Island of Misfit Sales

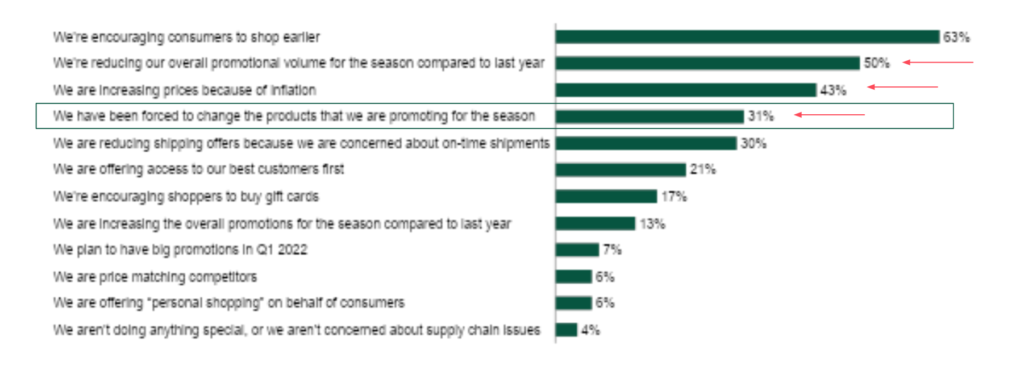

Over 76% of retailers reported inventory is a major issue for them this time of year. Supply chain issues related to holiday shipping have been on retailers’ minds for months, but how is that impacting what they’re doing for the holidays? Forty-three percent of retailers say they will raise prices due to inflation. Half of retailers said this is causing them to reduce their overall promotions compared to last year, and 30% have been forced to change the specific products that they’re promoting.

With major news coverage including mentions on SNL, it’s not surprising that almost all retailers (93%) believe their customers are ‘highly aware’ or ‘somewhat aware’ about these holiday shipping supply chain issues—regardless of their knowledge, retailers are planning to communicate shortages via email, landing pages or product detail pages. Given the lack of inventory, marketplaces are well-positioned to thrive and consumers will likely flock there to look for hard-to-find items.

12 Days of Slow Shipments

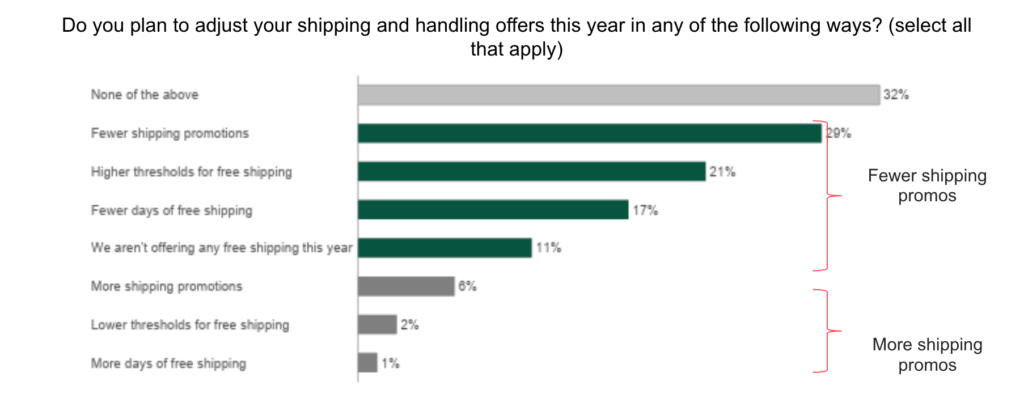

During the 2020 holiday season, shipping delivery times were an issue and they continue to be a difficult problem for retailers this year. Given carrier concerns, 30% of retailers reported reducing holiday shipping promotions due to delivery time concerns. Generally, holiday shipping promotions are trending downward—in addition to almost a third of retailers offering fewer promotions, 21% reported higher thresholds for free shipping, 17% fewer days of free holiday shipping and 11% that aren’t offering any free holiday shipping this season.

That’s not all—delivery concerns are also changing retailers’ promises to consumers. Just under half (43%) of retailers are shipping relatively slow, offering a 5+ day standard shipping commitment. When it comes to shipping cutoffs, 58% of retailers’ standard holiday shipping for Christmas will end by December 15.

Miracle in the 21st Month

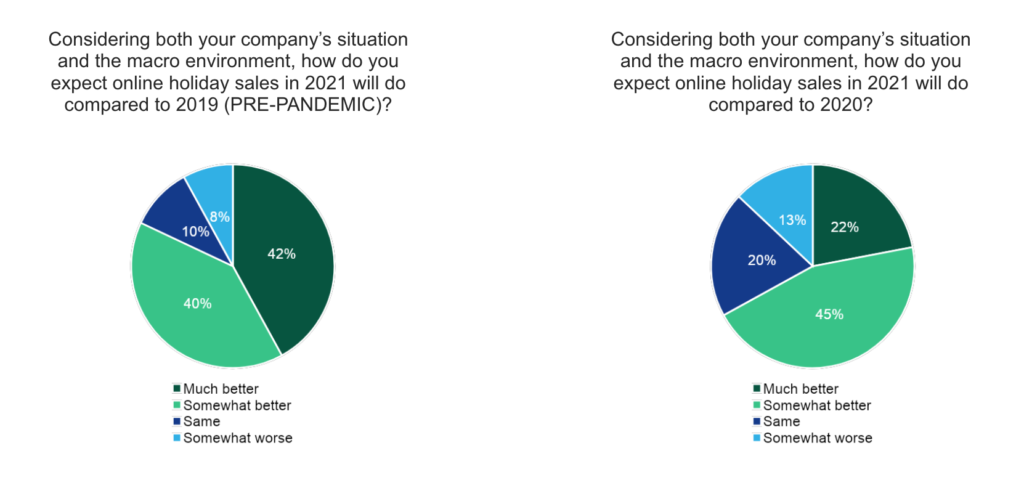

Despite these challenges facing the industry, retailers are optimistic about sales being better than both 2019 and 2020—82% of retailers think this year’s sales will be ‘somewhat better’ or ‘much better’ than 2019, and 67% think sales will be better than 2020.

Even with better sales, retailers surprisingly anticipate lower margins this year compared to 2020 (43% of retailers), which could be driven by expedited holiday shipping, customer service calls and refunds.

Applying The Research

In a recent webinar, we covered holiday shopping trends in 2021—a few significant findings included brands incorporating more transparency and experimentation into their holiday strategies. Brands like Bespoke Post and Food52 have made their collections available earlier to help with seasonal inventory, and big retailers like Walmart and Best Buy are pushing subscriptions to offer exclusive access to deals. One thing is for certain—making moves faster and standing up initiatives quickly will help your brand this holiday season.

Related Posts

-

Exclusive Holiday Research: Insights into Retailer Strategies for the Holiday Season

Delve into a recent CommerceNext retailer survey, where we asked…

-

Inspiring Digital Experiences Shaping 2025

In our latest CommerceNext webinar, industry leaders from Coach, Kendo…

-

Engaging and Converting Customers With Killer Content

In our latest CommerceNext webinar, industry experts from American Eagle,…