Retail media networks are advertising platforms hosted on retail websites and online marketplaces. Brands like Walmart, CVS and Amazon all offer retail media networks, allowing advertisers like Mars and TOMS to reach consumers more directly. At CommerceNext, we learn directly from these brands and others at our annual conference, and we’ll walk you through what a retail media network is, why it matters and how to integrate one into your digital advertising strategy.

Retail Media Network Definition

What is a retail media network? It’s a digital ad platform hosted on a retailer’s website.

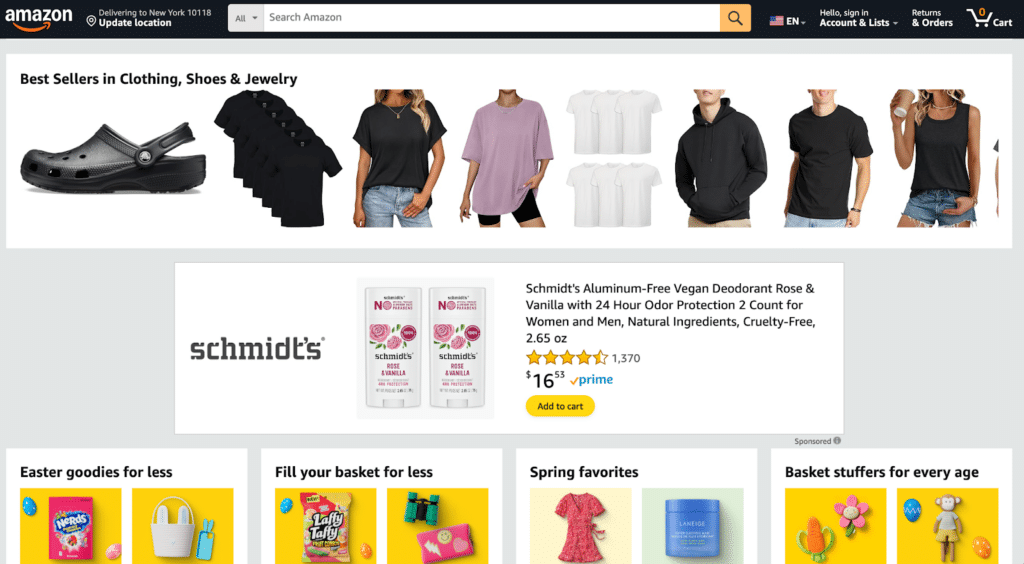

Schmidt’s Aluminum-Free Vegan Deodorant advertises on Amazon’s homepage.

There are hundreds of retail media networks worldwide. Brands bid for ad space on a retailer’s website, presenting targeted ads to shoppers based on their search history, purchase history and other behavioral data.

For example, if you search for beauty products often on Walgreens, they can target you with beauty brands ads’. Ads are displayed in various formats, including banners, product listings and sponsored search results. While most retail media networks are hosted online, more are expanding into in-store ad displays to address the need for omnichannel strategies.

The Benefits of Retail Media Networks: Data and Personalization

RMNs aren’t appropriate for every brand, but they can be much more cost-effective than traditional ad platforms like Meta or Google because of access to the retailer’s historical 1st-party customer data. Plus, you’ll reach a highly targeted audience of customers actively browsing or shopping, increasing the likelihood of conversion.

However, if you don’t have the time or resources to dedicate to the setup and management of the RMN, it might not be a good fit for you.

Overcoming Common Challenges in Retail Media Networks

Key challenges include competition, budget constraints, lack of expertise, misaligned brand goals and partner selection.

Competition/budgeting

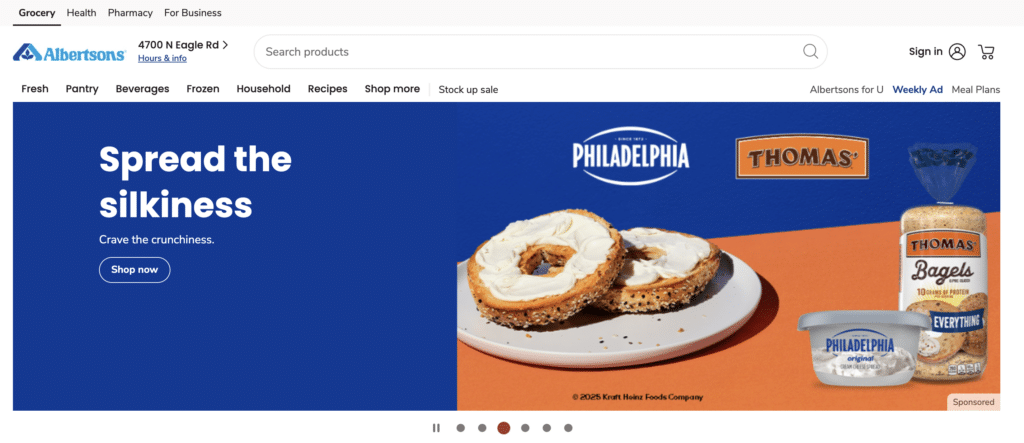

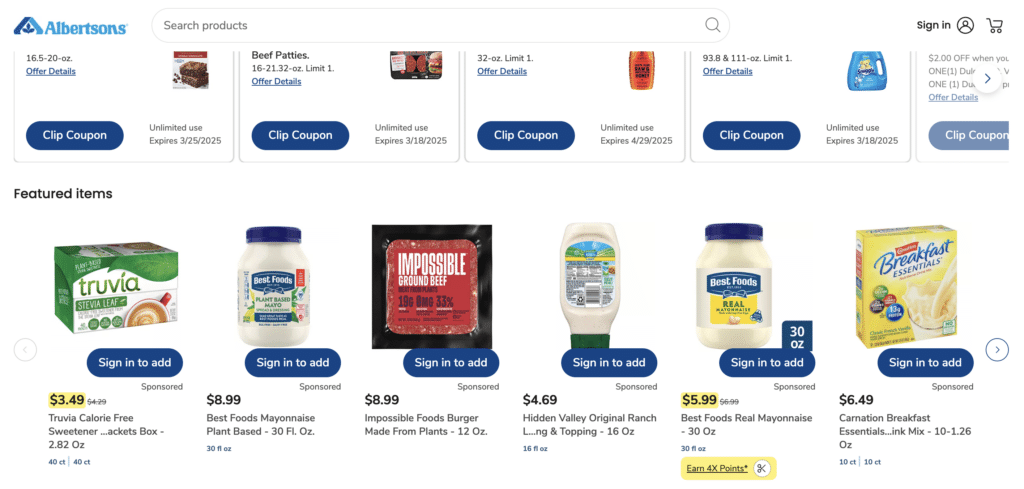

Just as many retail media networks compete for space in the industry, brands have the same challenge. Industries like grocery are more heavily saturated than others because of the vast number of grocers who have developed retail media networks; the more brands bidding for the same space, the more difficult it is to stand out among ads.

For example, Albertson’s home page has multiple sponsored products from different brands, including Kraft Heinz on the main banner and Truvia and Impossible Foods under the “Featured Items” section. The path to increasing brand recognition is filled with much more competition.

Look at the retail media networks in your brand’s vertical to suss out the competition. Continue to focus on your value-adds and ask your partners for best practices. Additionally, you should test multiple networks to find the best fit. Similar to spreading ad budget across various channels, like Meta and Google, many brands advertise across several RMNs to increase reach.

Lack of Expertise

Managing retail media ads is complex, especially with networks providing ad data in various formats. Without experience, you risk focusing on logistics over strategy. To help your team be well-equipped to implement retail media networks, wrangle data, adjust ad strategies and stay up-to-date on industry news. It’s as simple as finding LinkedIn articles from retail influencers or searching “retail media ads” on Reddit; these social platforms are a casual way to understand what people in the industry are experiencing first-hand.

Picking the Right Partner and Audiences

Don’t add retail media networks to your strategy solely for financial benefits—ensure alignment with brand goals. For example, if you want to introduce your brand to a new audience, you can bid for ad space in different verticals than your products. Or, if you’re very focused on a specific piece of data from the reporting to help you inform other ad channels, make sure you can gather that information from the network’s data displays.

Measuring Success with RMNs: Key Metrics, Audience Engagement and Strategic Integration

Track key KPIs like click rate, return on ad spend, cost per click and customer lifetime value. Beyond those metrics, assess the overall sales impact of advertised products and growth on your site. Check if keyword searches or website traffic increase while campaigns are live. Brands with subscription offerings can also track subscription growth as a sign of strong ad performance.

If you’re running ads across multiple platforms, consider using a third-party analytics tool to gain a clearer, more comprehensive view of your campaign performance.

Retail Media Network Strategy and Execution: Partner Selection

Audience Targeting/Engagement

Identify the most compelling ad formats for your audience. Repurpose top-performing content from other platforms and adopt a test-and-learn approach to optimize engagement.

Strategy Integration

Your retail media network strategy should complement existing efforts. Use it to expand your audience or target underperforming niches. Build a long-term plan that adapts to evolving retail media trends and your brand goals.

Integrating a retail media network into your ad strategy starts with key questions:

- Who is my target audience? How does it differ from other ad channels?

- What aspects of my current ad strategy work well, and how can I apply them?

- Which ad formats will be most effective?

- How can retail media networks complement my long-term goals?

You can use these questions to choose the right partner:

- What audience insights am I missing, and which partner can provide them?

- What level of data reporting will I receive?

- What insights will I gain on customer behavior and the path to purchase?

- Can I use my first-party data to enhance targeting?

Once you’ve chosen a partner and strategy, meet with your creative team to develop assets and messaging. Consult your partners for best practices and potential pitfalls.

Top Advertisements in Retail Media Networks in 2025: TOMS, Nabisco, Mars & More

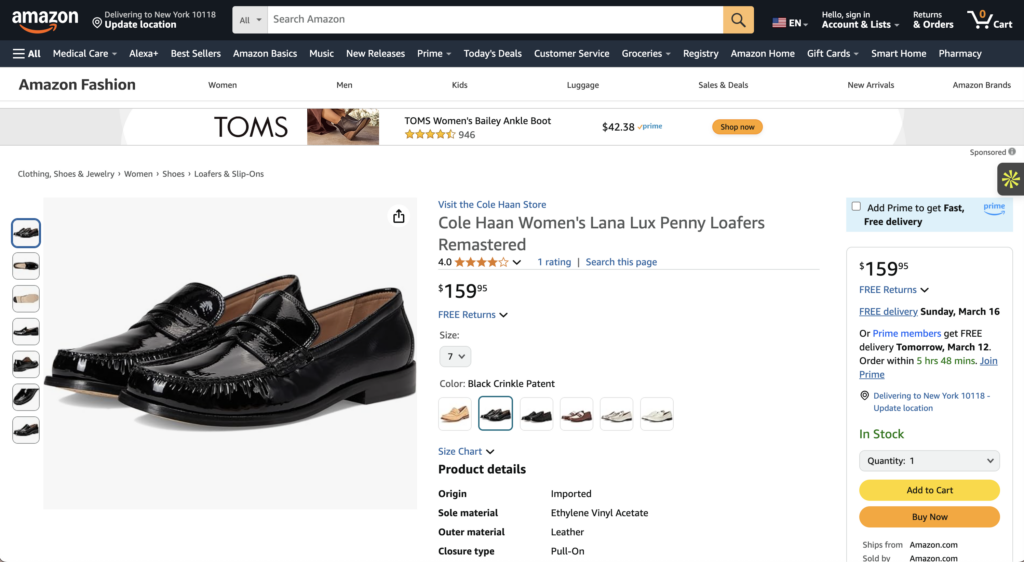

Retailer: Amazon || Advertiser: TOMS

TOMS advertisement on a competitor PDP

This campaign succeeds through smart audience targeting. Placing ads on competitor product pages captures attention during product discovery. Whether customers seek loafers or any shoes, they can explore TOMS. This boosts brand awareness and keeps TOMS top-of-mind.

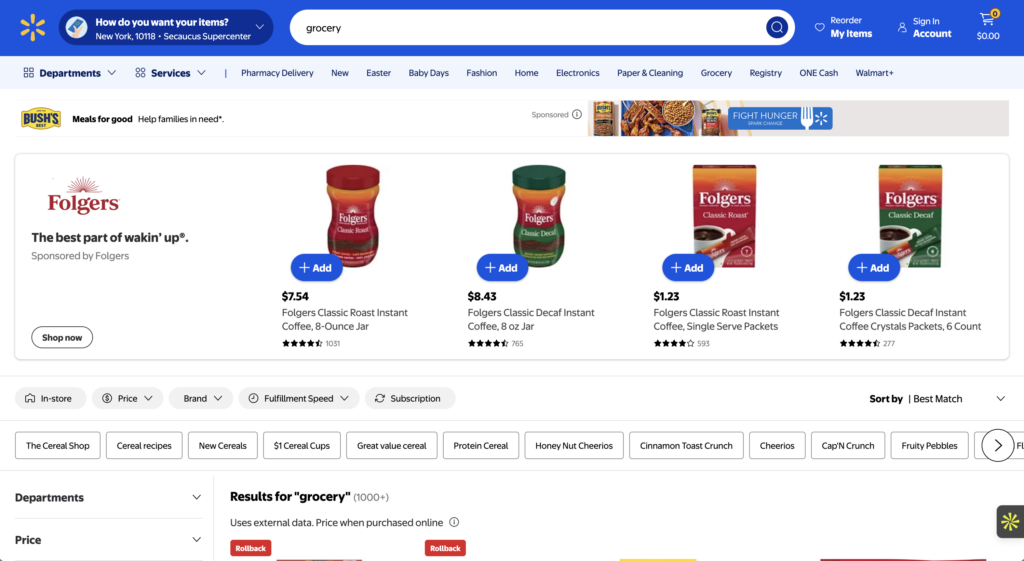

Retailer: Walmart || Advertisers: Bush’s, Folgers, Nabisco

When searching “grocery” on Walmart.com, we saw more than four ads. Here is a breakdown of some of them:

At the top, Bush’s small banner highlights its “Fight Hunger” partnership, appealing to socially conscious shoppers and boosting loyalty. Folgers’ larger ad, front and center, grabs attention and simplifies adding items to carts, increasing conversions. Both capture customer attention before they begin their “official” search.

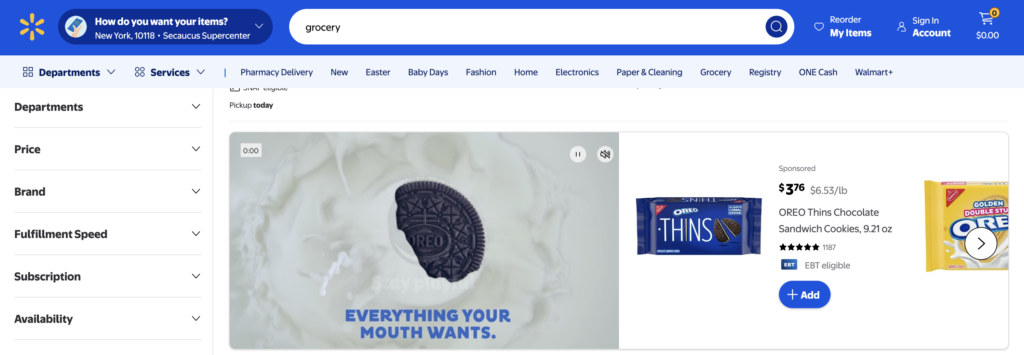

Further down, a video ad for Oreo (Nabisco) showcases products while letting users add them directly to their carts.

This variety in ad type enhances engagement and the “Add” button creates convenience.

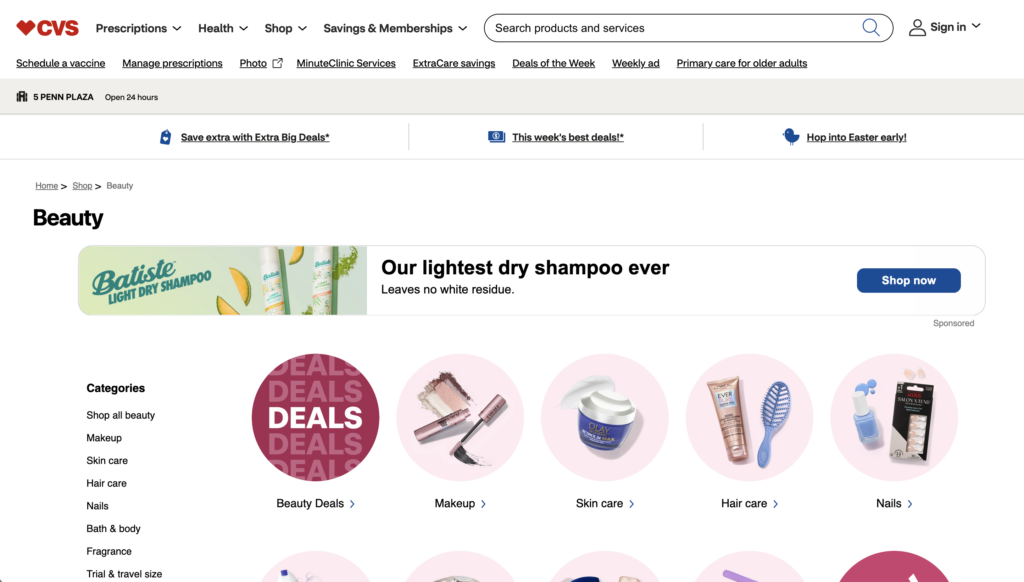

Retailer: CVS || Advertiser: Batiste Dry Shampoo

Batiste Dry Shampoo’s banner ad on CVS’s Beauty category landing page.

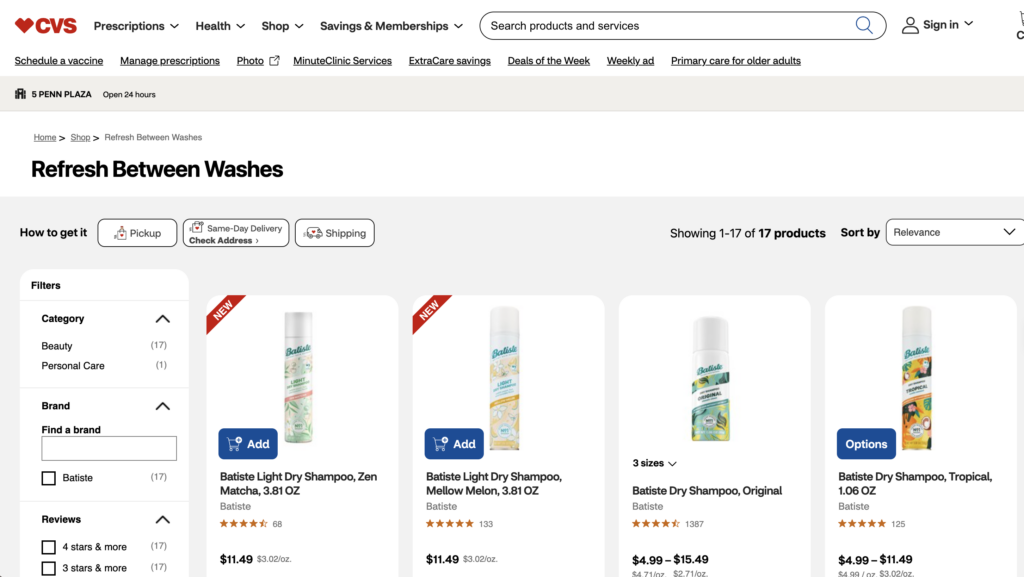

This ad succeeds in audience targeting, clear messaging and a seamless experience. Placed on the Beauty landing page, it reaches shoppers actively searching for beauty products. The copy addresses a common concern—dry shampoo residue—immediately resonating with consumers. Clicking “Shop now” leads to a “Refresh Between Washes” collection, letting shoppers easily explore and choose the best product for them.

Batiste Drop Shampoo Refresh Between Washes landing page

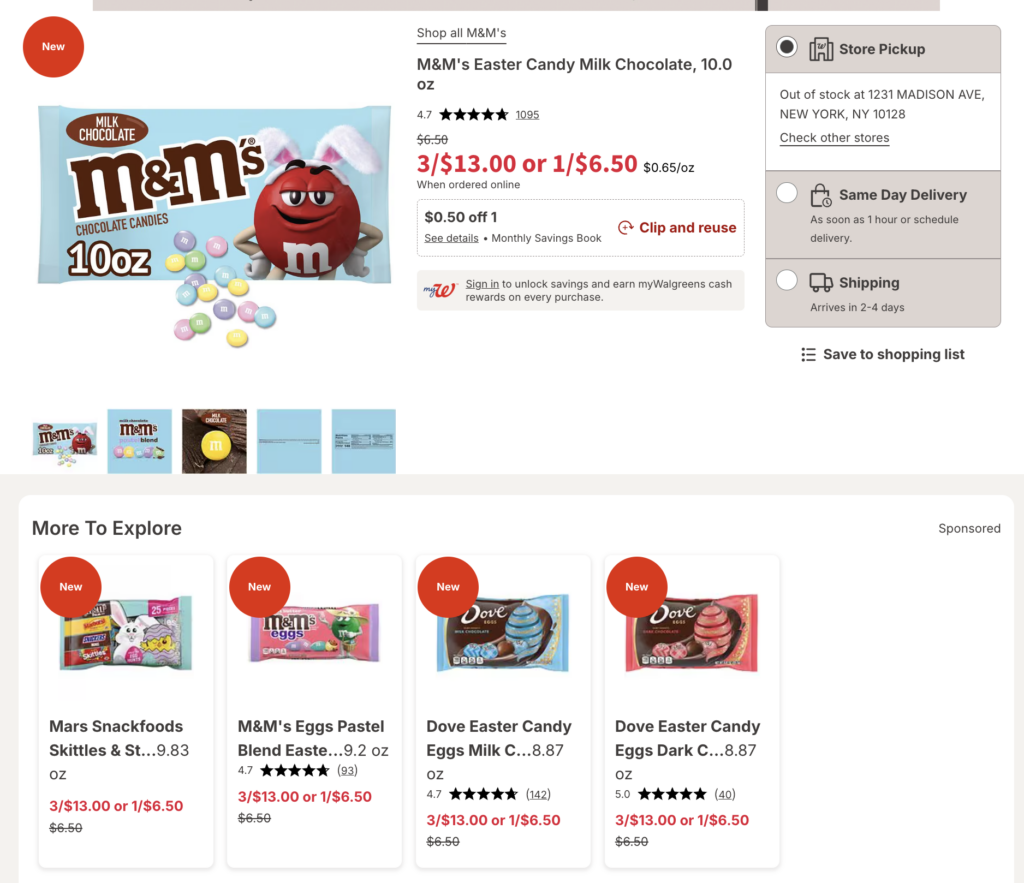

Retailer: Walgreens || Advertiser: Mars

Mars advertises the “More To Explore” section of this M&M’s product page.

This campaign is successful because of smart targeting and product relevance. It reaches shoppers already interested in candy/sale items and showcases other M&M’s and Easter-themed treats, aligning with customer intent.

The Future of Retail Media: AI, Expanding Audience and Evolving Ad Strategies

In the last year, Generative AI has become available to personalize retail media ads and create images. You can also use AI to help analyze your ad data across multiple retail media networks, creating a cohesive story that informs your future strategy. Stay informed about AI trends to see what tools are useful for your digital ads.

As retail media networks grow and ad formats evolve, so do opportunities to reach and engage more customers. Avoid overspending in saturated markets and continue to choose partners whose audiences align with your brand.

While the growth of retail media networks is positive, brands that rely too much on retailers’ first-party data risk missing out on long-term brand building. That’s why your retail media network strategy must integrate with your overall digital strategy.

Learn from Retail Media Experts at the CommerceNext Growth Show

Join industry leaders who have successfully implemented retail media network strategies at the CommerceNext Growth Show, June 24-26 in NYC. By attending, you can connect with top retailers, gain insights from their experiences and stay ahead of emerging trends in the retail media space.

Related Posts

-

Sustainability Marketing: 5 Lessons from Tapestry, Patagonia, Clorox and More

With Earth Day 2023 approaching fast, businesses have never had…

-

Abercrombie & Fitch’s Marketing Strategy, Rebrand and Digital Rebirth

How Abercrombie and Fitch Revived Its Brand Through Modern Marketing…

-

2025’s Best Retail Conferences for Decision-Makers

Must-Attend Retail Conferences in 2025 The 2025 CommerceNext Growth Show…