The holiday shopping season is upon us. Last year, we saw a staggering 19% increase in ecommerce sales compared to the previous year, for a total of $22.5 billion in sales according to the National Retail Federation. This year, the Digital Commerce 360 projected an estimated 3.8% increase in sales over last year. In anticipation of this busy holiday period, traditional retailers and direct to consumer brands turn to their marketing teams to focus on customer experience and customer acquisition to elevate their holiday sales.

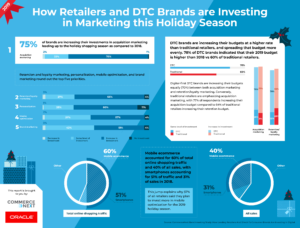

To understand how these holiday trends correlate with marketing investments for 2019, we partnered with Oracle to survey 100 top marketing decision-makers at leading brands to get their perspective on how they plan to invest in holiday marketing this year. We learned that 75% of retailers surveyed planned to increase their acquisition marketing investments in the 2019 holiday season, as compared to their 2018 holiday marketing investments. Rounding out their top five holiday priorities were loyalty and retention marketing (66%), personalization (60%), brand marketing (57%) and mobile optimization (51%). Mobile ecommerce accounted for 60% of total online shopping traffic and 40% of all sales in 2018 according to eMarketer, which is why 57%of brands said they planned to increase investment in mobile optimization to capitalize on these increases for the holiday shopping season.

We also looked at how holiday investments differed between traditional retailers and direct to consumer brands. Overall, direct to consumer brands are showing a greater increase in budget over traditional retailers heading into the 2019 holiday season. Seventy-eight percent of direct to consumer brands reported increased budgets this year, compared to just 60% of traditional retailers. On average, digital-first DTC brands are able to invest more in marketing technologies because of their ability to evolve quickly. Unlike traditional retailers that have incorporated digital commerce into their offering, younger DTC brands are unencumbered by aging technology. This allows them to more readily invest in and incorporate new tech into their marketing strategy. In 2018, we saw investment prioritized in acquisition channels, omnichannel marketing, personalization and brand marketing. Eighty-five percent of DTC brands said their investments in acquisition for 2018 met or exceeded their expectations.

However, this may change in 2020 as some of the IPO hiccups in 2019 lead to investors putting pressure on companies to operate more profitability. “Coming into 2019, we saw a trend where DTC [direct to consumer] brands were significantly outspending traditional retailers partially fueled by VC investments. After everything that happened with WeWork, the pressure is growing for profitability. I expect to see spending from DTC brands start to slow down in 2020 with more of a focus on profitability,” noted CommerceNext Co-Founder Veronika Sonsev.

As part of the study, we interviewed a few leading retailers and brands to better understand how they are channeling these marketing investments to expand their customer base and learned that they are using personalization as a mode of customer acquisition. Charlie Cole, Chief Digital Officer at Samsonite and Tumi, commented on his team’s endeavor towards personalizing the discovery process: “We’ve done a great job on personalization with people we know, using first-party data on existing customers. The thing we’re still exploring is how to execute on marketing to people we don’t know, with second or third-party data.” Their goal is to create a unified view of the customer to help them personalize from the moment of discovery through the repeat purchase process. To achieve this unified view, marketers are investing in customer data as well as personalization platforms. “Obtaining a unified view of the customer remains a tremendous but worthwhile challenge that provides numerous benefits from customer satisfaction to minimizing costs and simplifying business processes,” says Angela Hsu, SVP of Marketing and Ecommerce at Lamps Plus, “Linking all of this data together to get a better understanding of our customer is key.”

Faced with new technology and developments in marketing, we’re continuing to see brands increase their investment in customer acquisition and customer experience. Our research shows greater dedication to a more unified view of the customer, elevated customer experience and greater reach towards acquiring new customers with the hopes of another successful holiday shopping season.

To learn more, download the full report: “How Leading Retailers and Direct-to-Consumer Brands are Investing in Digital”.

Related Posts

-

How to Use Customer Service to Grow Sales this Holiday

Support requests increase from customers by 65% during Black Friday/Cyber…

-

Building a Marketing Team to Scale Customer Acquisition

“Marketing is hard, but not nearly as hard as building…

-

Customer Experience and Community as the Ultimate Marketing Tool

If you spend time online, you’ve undoubtedly heard of cult-favorite…