Delve into a recent CommerceNext retailer survey, where we asked how companies are navigating the unique challenges and opportunities this holiday season brings.

Understanding Merchant Sentiment

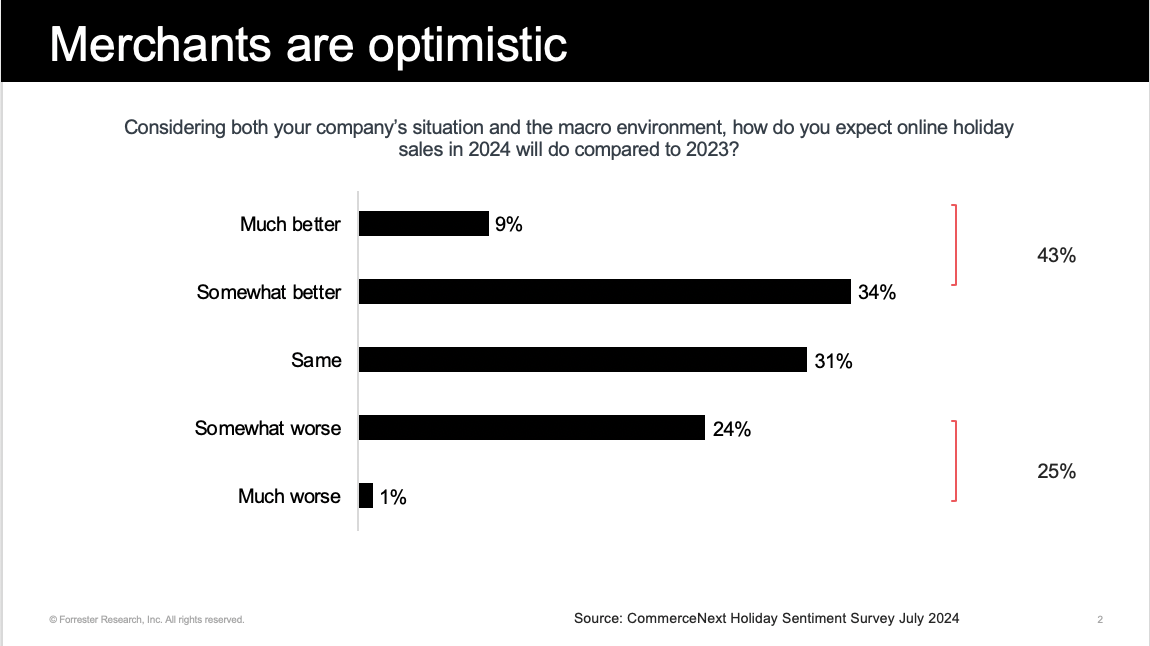

Merchants are generally optimistic about the upcoming holiday season. Survey data reveals that while 25% of merchants expect this holiday season to be worse than last year, a larger 43% believe it will be better. This positive outlook suggests a strong performance for the ecommerce industry. However, it’s important to recognize that there will always be winners and losers in any economic environment. Companies often attribute poor performance to broader economic issues, claiming that if they are struggling, the industry must be too. Despite this, the reality is that many ecommerce companies are reporting strong numbers, indicating that the overall industry is in a good position.

YoY Growth Number Statistics

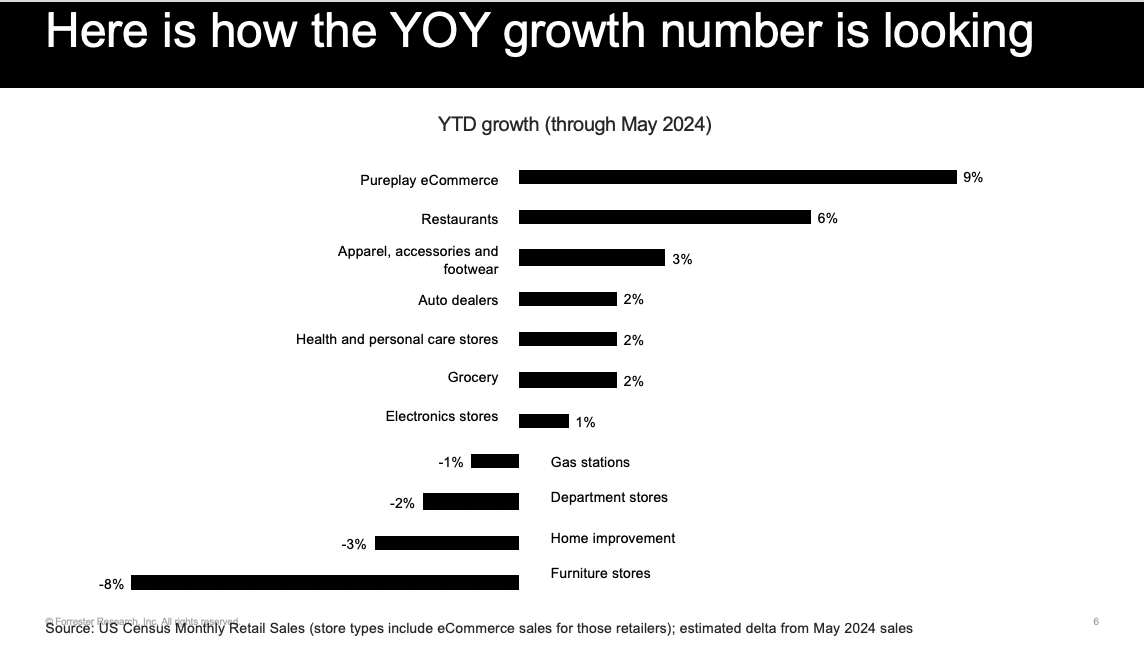

The global economy is currently performing well and this positive trend is visible across various retail subcategories. When analyzing retail performance, it’s evident that some companies are excelling more than others, particularly in Q4. Year-to-date data shows growth in sectors like ecommerce and the restaurant industry.

Additionally, clothing, apparel, accessories and footwear are making a comeback, gaining market share after previous challenges. Certain retailers, such as furniture and home improvement stores are facing difficulties. High interest rates are discouraging home purchases, affecting these big ticket item sectors. Department stores continue to struggle, a trend that has persisted for several years. Despite these challenges, many areas of the retail industry are showing strong performance, reflecting the overall health of the global economy.

Increased Promotional Volume

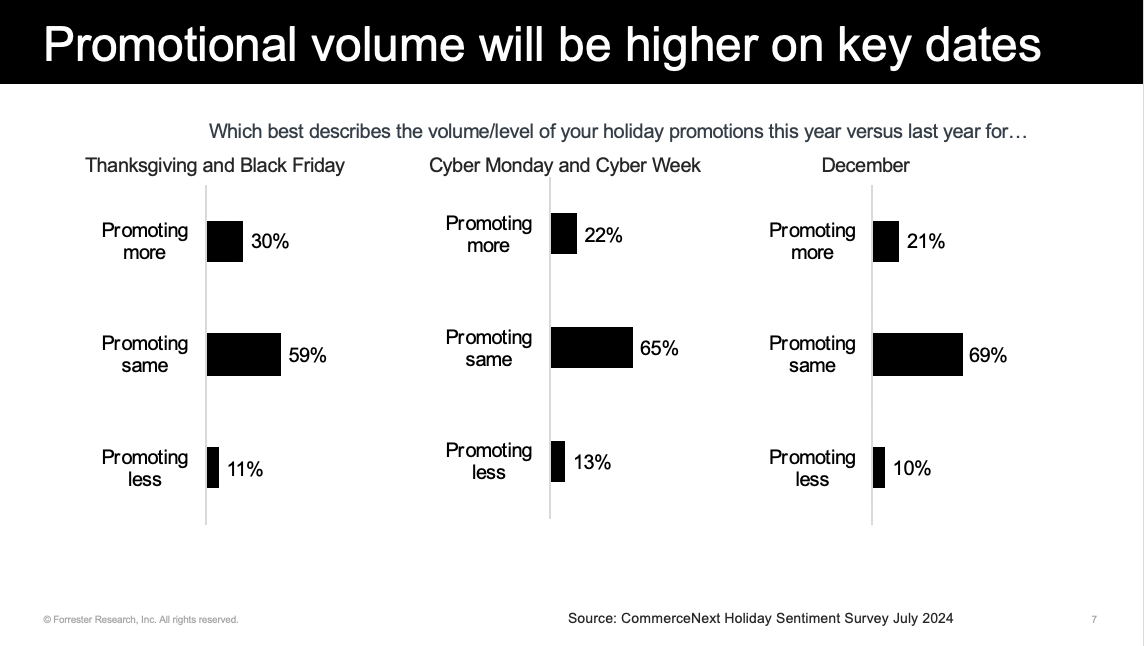

Retailers anticipate having a higher volume of promotions on Black Friday and Thanksgiving compared to last year. For Cyber Week, promotional activity is expected to moderate and align more closely with the previous year’s levels, despite this holiday season being relatively short. December is not expected to see a significant increase in promotional activity at this time.

However, holiday promotions are often highly flexible and can change quickly. Depending on how sales numbers turn out in November, retailers might introduce additional promotions, such as shipping discounts or BOGO offers, to boost sales in December. This allows retailers to respond to market conditions and optimize their promotional strategies as the season progresses.

The Biggest Concern Is Consumer Sentiment

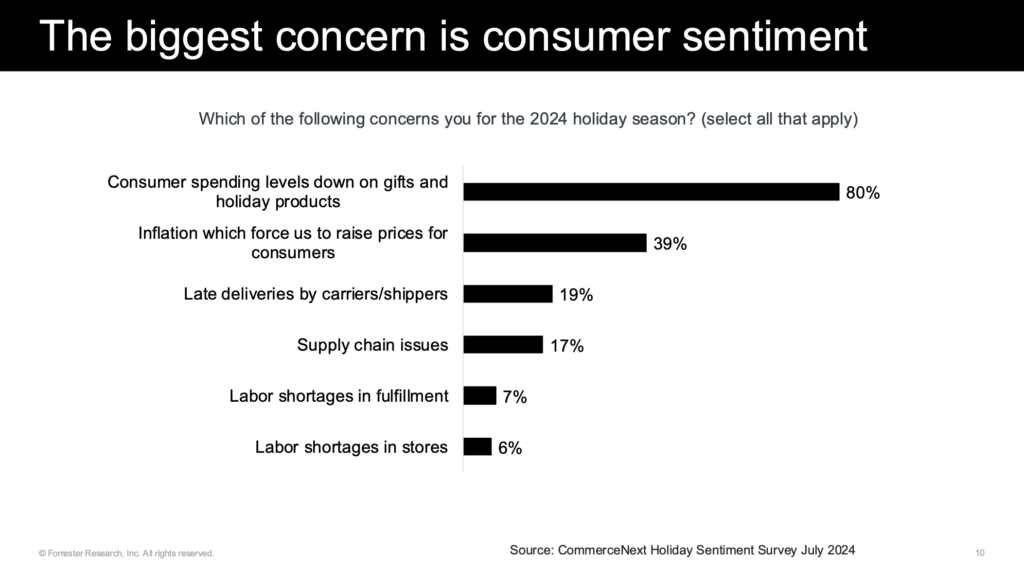

One of the biggest concerns merchants have for this holiday season is consumer spending levels. This worry stems from several factors, including lower consumer confidence and the lack of a significant sales lift for many merchants. There’s a general sense of uncertainty about the latter half of 2024, particularly regarding interest rates and potential economic shifts. Even with currently low unemployment rates, there is concern about the future. Additionally, 39% of merchants explicitly cite inflation as a significant issue. Factors that were major concerns in the past, such as labor shortages in stores and fulfillment centers, as well as supply chain issues and late deliveries are now barely registering. That indicates that merchants are more focused on broader economic uncertainties than logistical challenges this season.

View the full research below:

CommerceNext Holiday 2024 revised

Related Posts

-

The CommerceNext Steps Part 2: Actionable Takeaways from the 2024 Growth Show

At the 2024 CommerceNext Growth Show, we asked our industry-leading…

-

Mastering Post-Purchase Satisfaction During the Holiday Season

To ensure your success during peak holiday season, retailers must…

-

Conversational Commerce: Your Ticket to a Successful Holiday Season

When it comes to interacting with brands, consumers today have…