CommerceNext continues our coverage of COVID-19’s impact on ecommerce and retail. We recently completed our second survey to ascertain the effects of the pandemic on digital retail business. The majority of questions remained the same as our first survey, which collected data from the first half of March, in order to benchmark results.

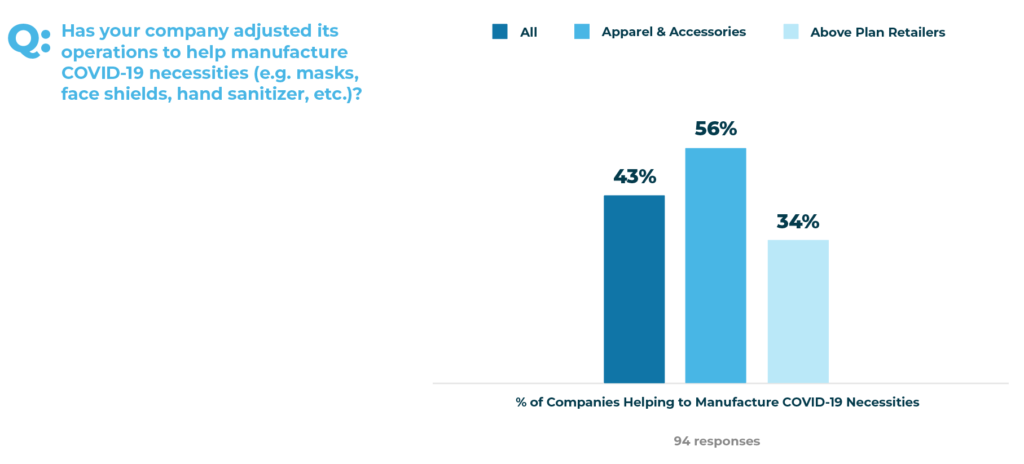

While the data from the survey paints a very challenging environment for digital retail, it is uplifting to see that the category hit the hardest (apparel and accessories) is also the category adjusting their operations the most to help manufacture COVID-19 necessities (e.g., masks, face shields, hand sanitizer, etc.). Kudos to these companies for their efforts!

Thank you to the nearly 100 respondents who took the survey and to Sucharita Kondali, VP and Principal Analyst at Forrester Research, for her analysis of CommerceNext’s survey results.

Announcement for Digital Retail Executives: The next survey will be April 13th & 14th. If you find this information valuable, we would greatly appreciate you taking less than 5 minutes to take the survey and helping us share information to inform ecommerce businesses making important adjustments to strategies and tactics.

Below is an overview of the analysis and you can also download a PDF of slides using this link.

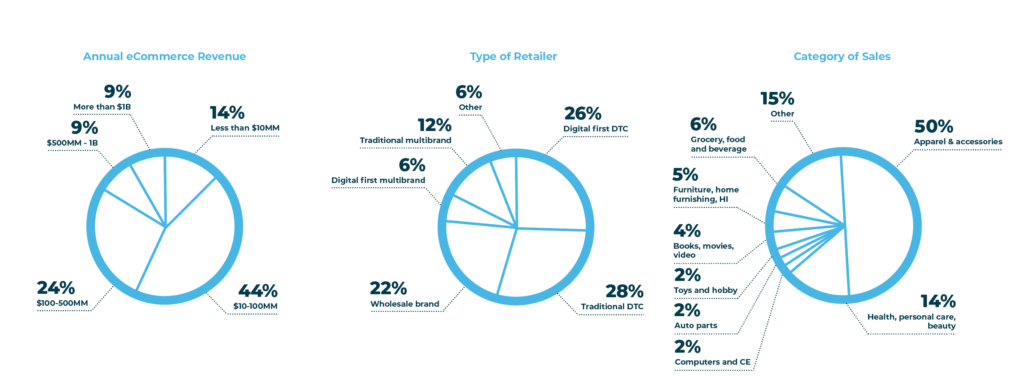

Methodology and demographics

Survey answers were collected on Monday, March 30th and Tuesday, March 31th, 2020 from 94 respondents who span the retail and ecommerce landscape. All data was collected confidentially and aggregated here in our analysis.

Summary of Findings

Based on Kodali’s analysis, here are the key takeaways:

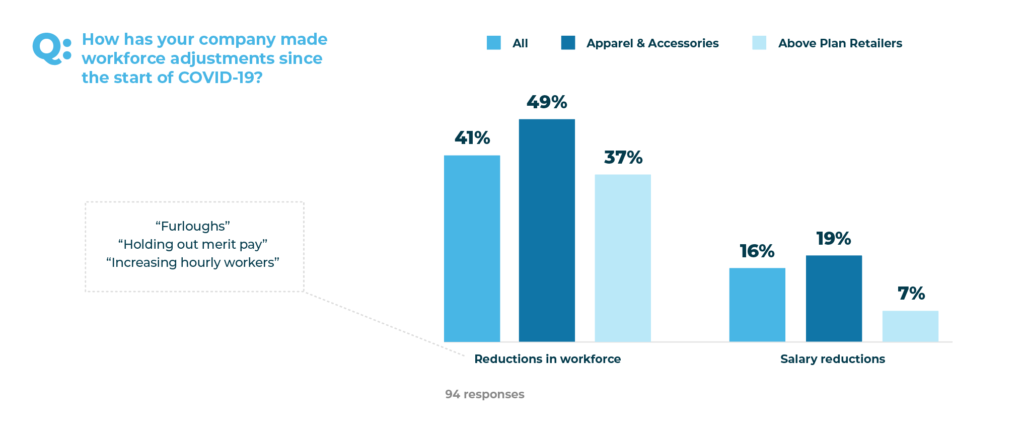

- 41% of retailers surveyed have reduced headcount to address the COVID-19 crisis.

- Sales continue to slump—49% of apparel industry respondents said their companies were significantly below plan from March 15th-28th.

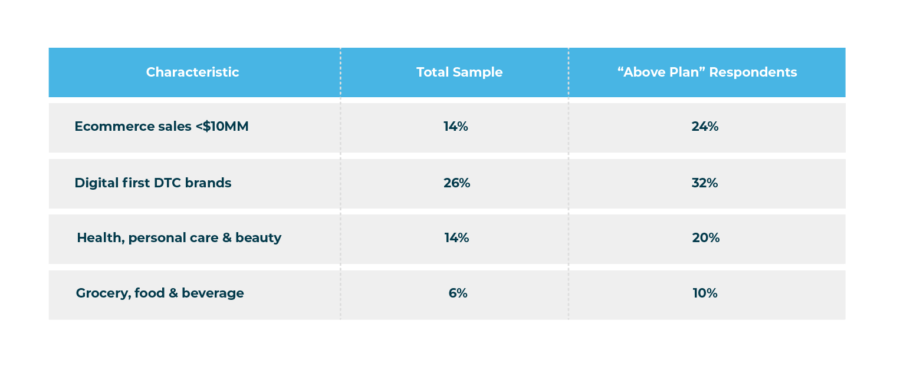

- Companies performing above plan tend to be smaller digitally-native retailers, or are focused on categories like food or health.

- Some companies have migrated store shoppers to online, but not all—57% of respondents said they have seen a shift to online in the latter part of March.

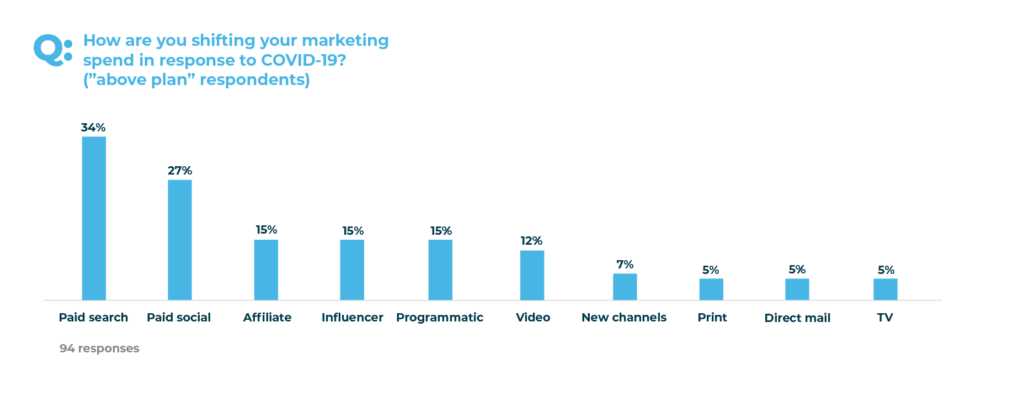

- Marketing spend has been declining, but a small group of companies doing well are spending more in digital marketing to extend their leads—27% of retailers performing above plan are increasing their marketing spend.

- To the degree that marketing spend is growing, the biggest beneficiaries are paid social and paid search. However, more retailers are reducing marketing spend.

- More than half of apparel respondents are manufacturing products (e.g. masks) for the COVID crisis.

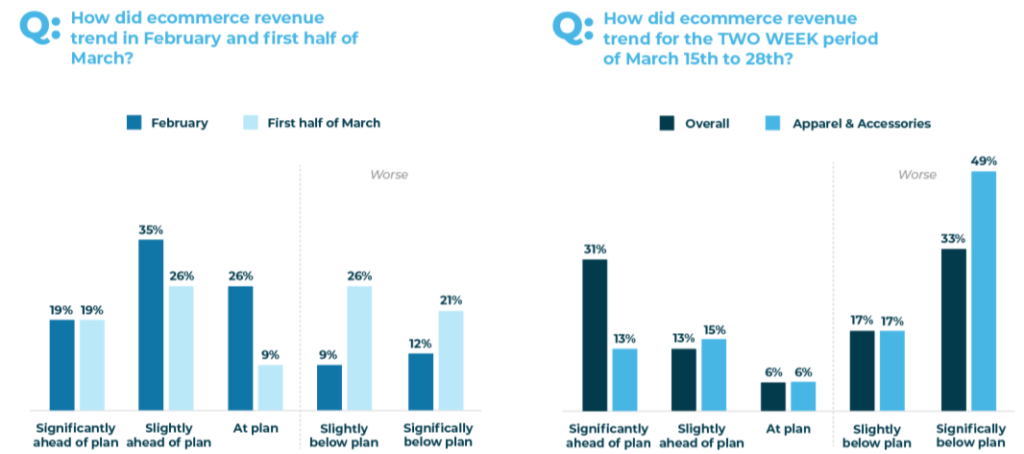

Question: How did ecommerce revenue trend for the two week period of March 15th to 28th?

Sales continue to decline overall. From February 1st through March 14th, only 20% of merchants were behind their ecommerce revenue goals. In the last two weeks of March, that percentage jumped to 50%. With most states having now ordered shelters-in-place or closed all but essential businesses, the apparel and accessories vertical is bearing the brunt of the downturn. But not all are taking hits—some smaller digital direct to consumer (DTC) brands and those in the food and health verticals are trending ahead of plan.

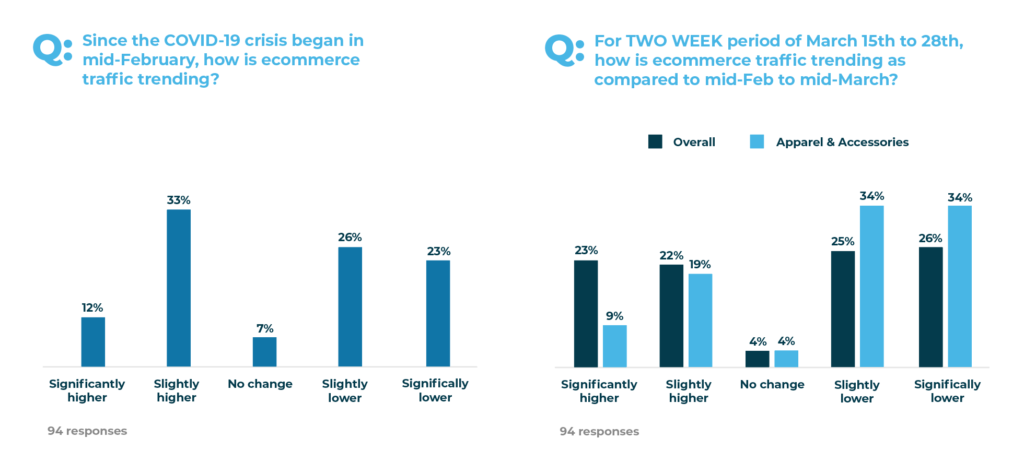

Question: How is ecommerce traffic trending compared to mid-Feb and mid-March?

Although most have maintained the same mid-March levels of traffic, apparel traffic is still falling.

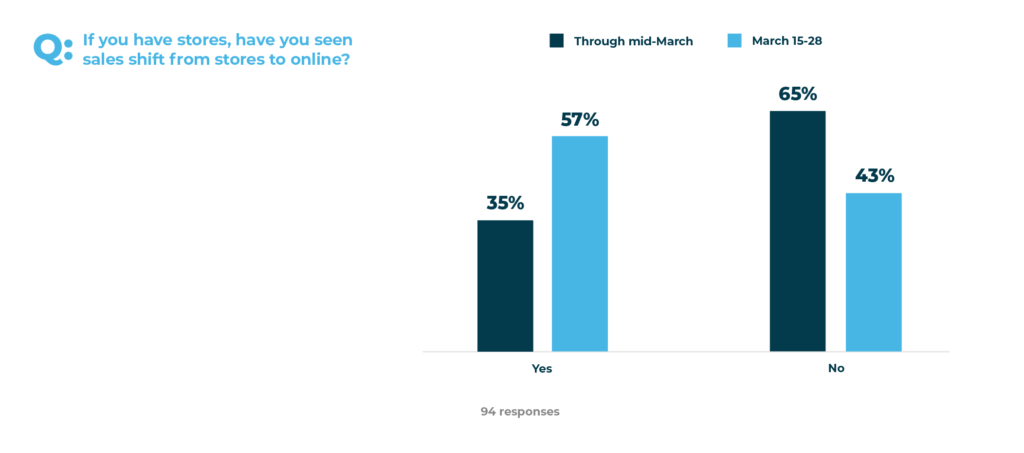

Question: [For those with brick and mortar stores] Have you seen sales shift from stores to online during the last two weeks?

One of the few positive developments is the shift in sales from stores to online. During the first half of March, only 35% of retailers saw this shift happening. During the second half of March, this increased to 57% as both retailers and consumer behavior adjusted to stores being closed.

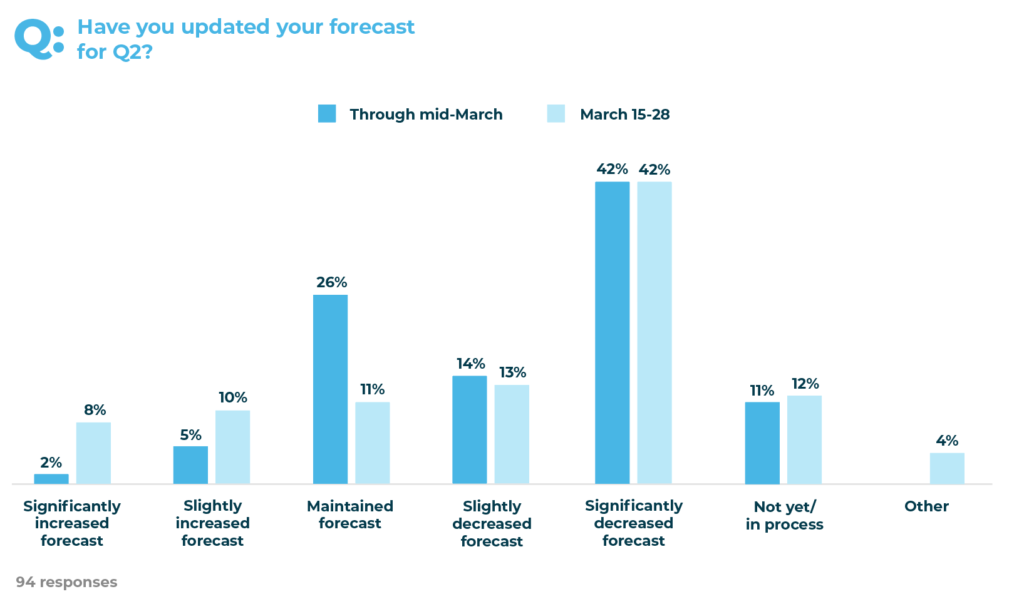

Question: Have you updated your forecast for Q2?

As customers continue to shift their shopping habits, merchants are, in turn, adjusting their forecasts. At this point, most merchants (89%) have adjusted Q2 forecasts and most have adjusted them downward.

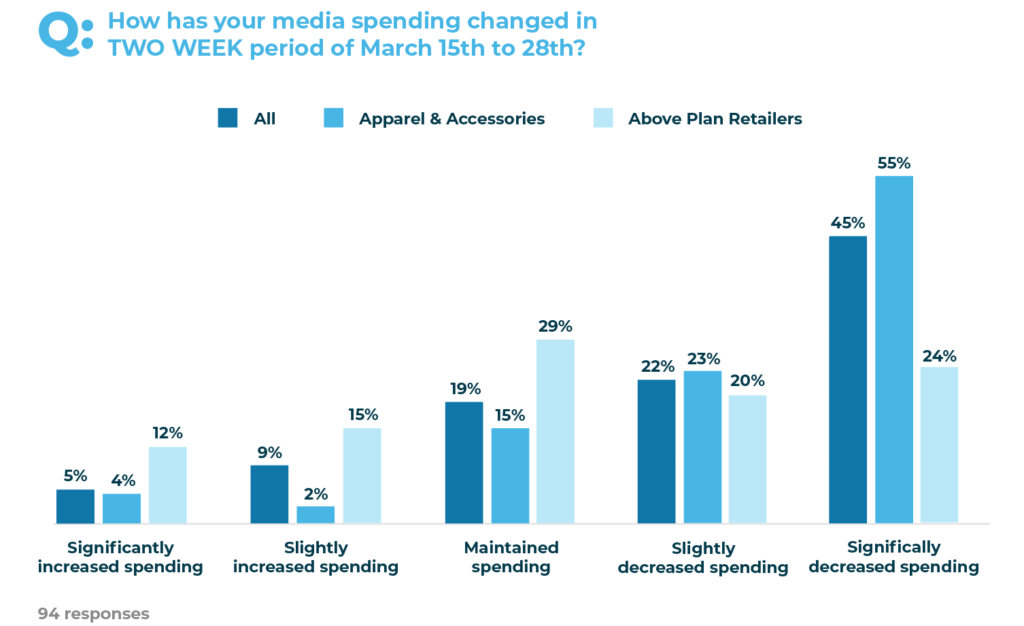

Question: How has your media spending changed in the last two weeks?

Most retailers (67%) are decreasing their media spend at this point. Those feeling the hardest hit in revenue are decreasing their digital spend significantly in response. Those seeing upticks in revenue are maintaining course or upping their spends to take advantage of a less crowded marketplace.

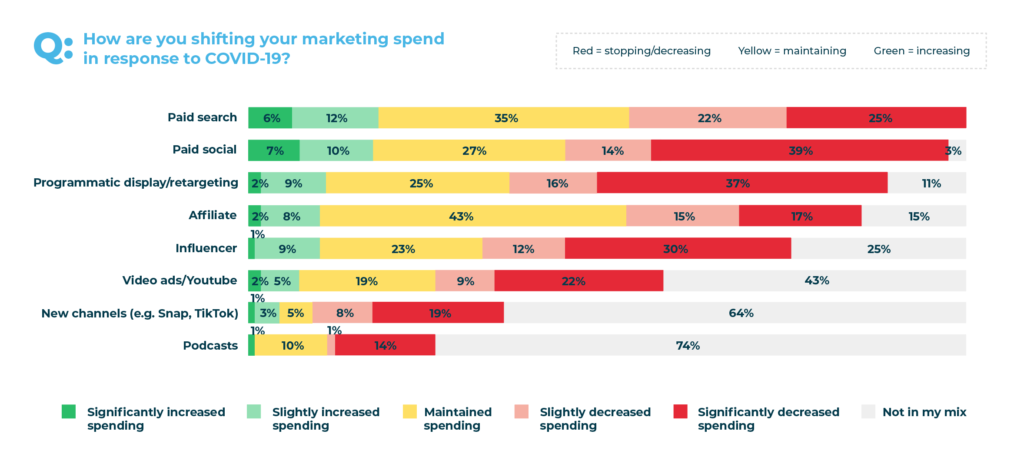

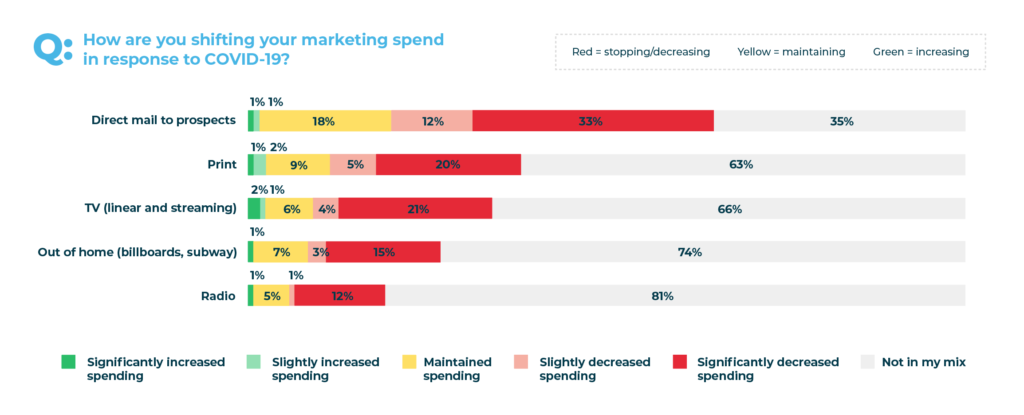

Question: How are you shifting marketing spend in response to COVID-19?

As consumer behavior and sales move more online, so are the paid search and paid social budgets of those merchants trending above revenue plans. The majority of retailers, however, are maintaining or cutting marketing spend across the board.

(first two charts below represent all respondents; third chart represents only those respondents reporting revenue “above plan”)

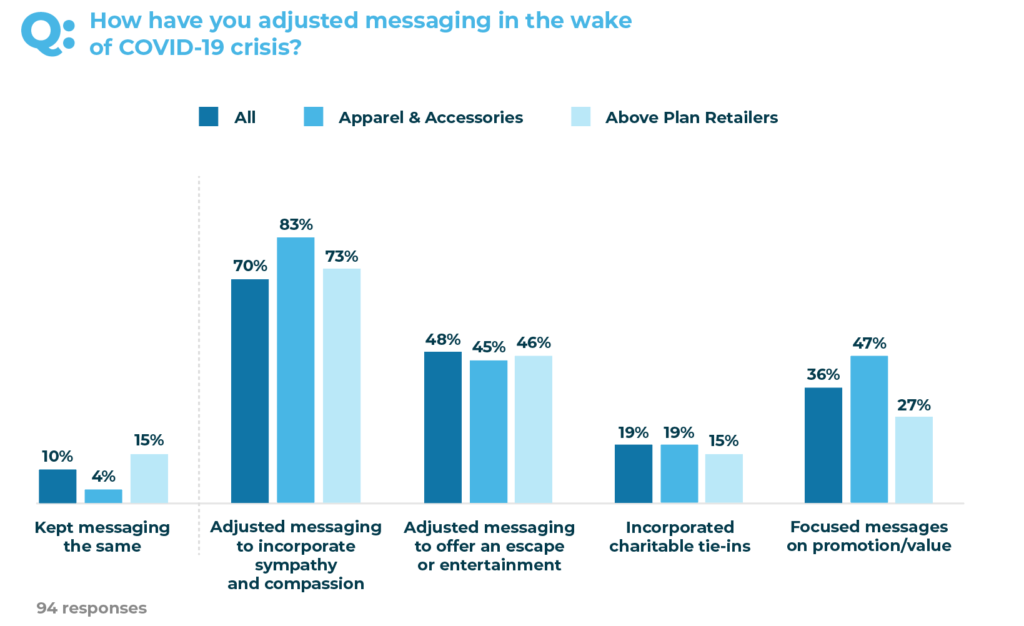

Question: Have you adjusted messaging in the wake of the COVID-19 crisis?

The majority of merchants incorporated a tone of sympathy into their March messaging while also testing out promotional and entertainment-focused communications. These patterns seem consistent, whether you’re an apparel retailer or in the fortunate situation of sales trending ahead of plan during the pandemic.

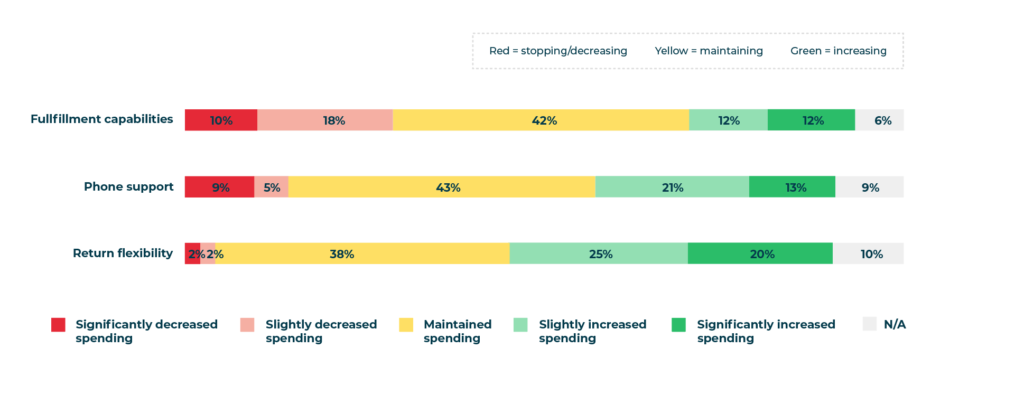

Question: How are you adjusting business practices in response to COVID-19?

Merchants are making the operational adjustments needed to accommodate the new patterns of consumer behavior. Many are focusing on enhancing their customer experiences, increasing phone customer service support and adding flexibility to their return policies.

Question: Has your company made workforce adjustments since the start of COVID-19?

Many companies have reduced employee headcount in the form of “furloughs,” “holding out merit pay,” and “increasing hourly workers.” Given store closures, CNN is reporting half a million workers furloughed last week.

Question: Has your company adjusted its operations to help manufacture COVID-19 necessities (e.g., masks, face shields, hand sanitizer, etc.)?

Despite its decreased revenue and online traffic, apparel has stepped up the most in contributing public health necessities.

Get more details on this research

We’re going to deep dive into these results live with the retailers surveyed in the upcoming CommerceNext Community Webinar sponsored by Contentsquare on Wednesday, April 8th at 2pm ET / 11am PT.

Panelists include:

Sucharita Kodali, VP and Principal Analyst, Forrester Research

Jon Mandell, SVP, Membership Marketing and Global Ecommerce, WW

Jean-Marc Bellaiche, Chief Strategy Officer, Contentsquare

Get help from fellow retailers and brands

Need even more community support, or tips on forming your crisis marketing playbook? We created a virtual (only for brands and retailers and without, solution providers) for collaboration and networking. Powered by Givitas, this tool connects easily to your inbox and facilitates asking for and offering help, advice, connections and introductions.

Join our CommerceNext Givitas Community and start getting crisis-proof ideas right away.

As our community faces both immediate and long term impacts from COVID-19, we’ll keep gathering data to help you better understand how the industry is doing. And, once this is behind us, we’re here to help you share knowledge on how to rebuild.

Related Posts

-

The Attribution Challenge: Why Your Conversion Counts From Ad Platforms Don’t Match Your Analytics

You pull together reports from all your advertising platforms (e.g.,…

-

Impact Of COVID-19 On Retail And Ecommerce: Survey Results

While our community and country cope with the uncertainty caused…

-

Analyzing the Ecommerce and Digital Marketing Impact of the COVID-19 Pandemic

WITHIN tracks daily revenue, media spend and conversion rates across…