“May you live in interesting times,” goes the ancient curse. Sadly, we are living in the most interesting times that generations of Americans have ever experienced. Mixed signals and confusion, it seems, are par for the course in interesting times. On June 5th we learned the U.S. unemployment rate for May was 13.3%—and this was considered good news despite the fact that, prior to COVID-19, unemployment hadn’t exceeded 10% since World War II. Retailers have felt acute pain driven by the stay-at-home and social distancing requirements caused by COVID-19. The U.S. Commerce Department reported that April 2020 retail sales were 16% below March, which was 8% below February. But the Dow Jones Retail Index is higher now than it has been since the beginning of 2020, before COVID-19 hit the U.S., even after a recent devastating few days.

If you’re feeling a bit of analytic vertigo, you’re not alone. CommerceNext has been running surveys of retailers since COVID first hit the U.S. in February to provide some contextual clarity for retailers.

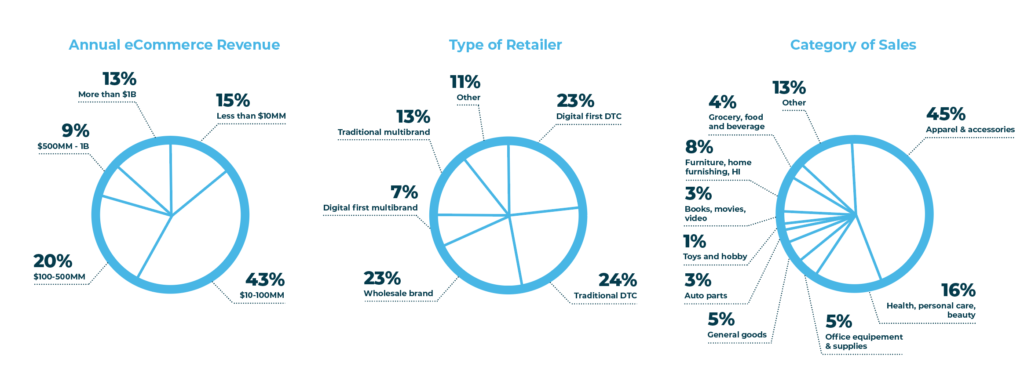

In this fifth survey, fielded between June 1st and 4th, CommerceNext gathered responses from 75 retailers, with the composition of respondents described in the chart and an analysis overview below. Thank you to those who participated in the survey.

Here is a slide overview of the findings. We’ve also summarized them in the blog below.

Tracking questions

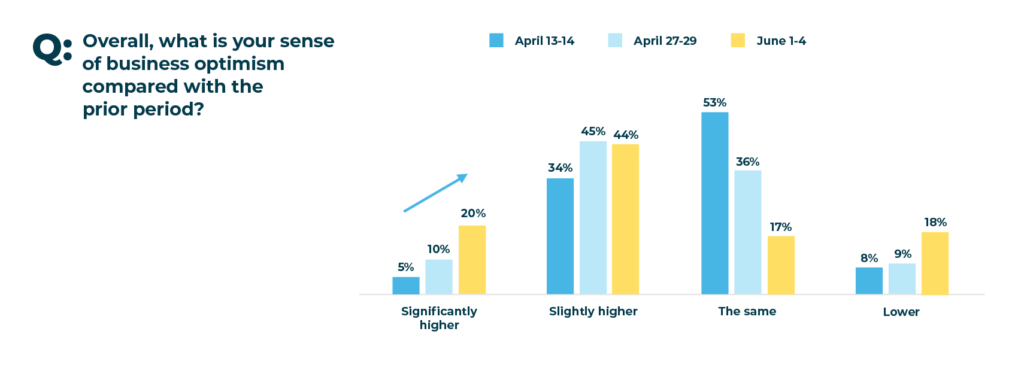

Starting at the highest level, we’ll look at overall business optimism, which has been growing significantly across three tracking waves in mid-April, late April and early June. Most recently, 64% of respondents indicated that their optimism had grown in May, up from just 39 % in mid-April. 20% of respondents were significantly more optimistic in June than in mid-April.

There is a cohort, though, of 18% that were less optimistic in early June than in May. Direct-to-consumer (DTC) retailers were were inordinately likely to be less optimistic. The struggles of digitally native DTCs and those that started selling in traditional catalog and store channels were both significantly less optimistic than the rest of the retail sector. Online native DTCs are challenged by relatively high price points that are necessary to absorb shipping and handling costs. Traditional DTCs are struggling because of their reliance on stores in malls that were largely closed in May.

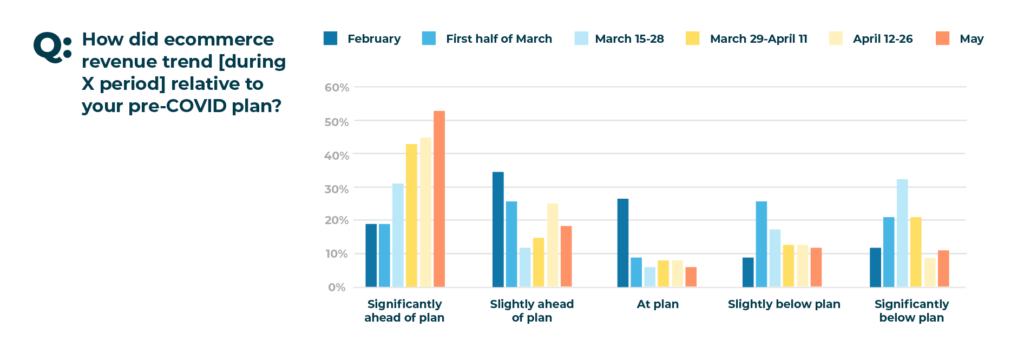

The principal driver of an increase in confidence is likely the strong, and improving, performance of retailers’ ecommerce channels. 53% of survey respondents say that they are running significantly ahead of the plans that they had built before COVID-19 hit the U.S. This compares with just 19% that were significantly ahead of plan in February. Clearly, a shift in sales from brick-and-mortar to ecommerce channels is driving this improvement. Adobe reports that online April sales were up 49% from March.

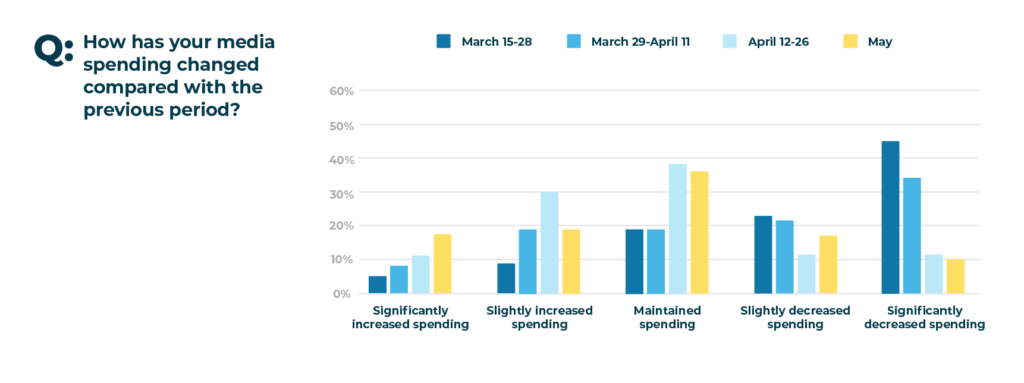

With a rise in optimism, we are seeing an increase in ad spending by retailers. In May, 17% of respondents indicated that they had significantly increased their media spend compared with April. More importantly, the percent of retailers that have cut ad spend since April has dropped to 27%, down from 67% in late March. This an important sign of investment that will be critical as stores re-open and Americans (hopefully) get back to work quickly.

Since CommerceNext’s fourth survey fielded in mid-April, the most important happening for retailers has been the gradual re-opening of “non-essential” retailers. In the U.S., where consumer spending accounts for 70% of economic activity, all retail is essential. Semantics notwithstanding, every retailer, essential or not, is having its own unique experience depending on what they sell, where their stores are most heavily concentrated and how their consumers are feeling about COVID-19 risks.

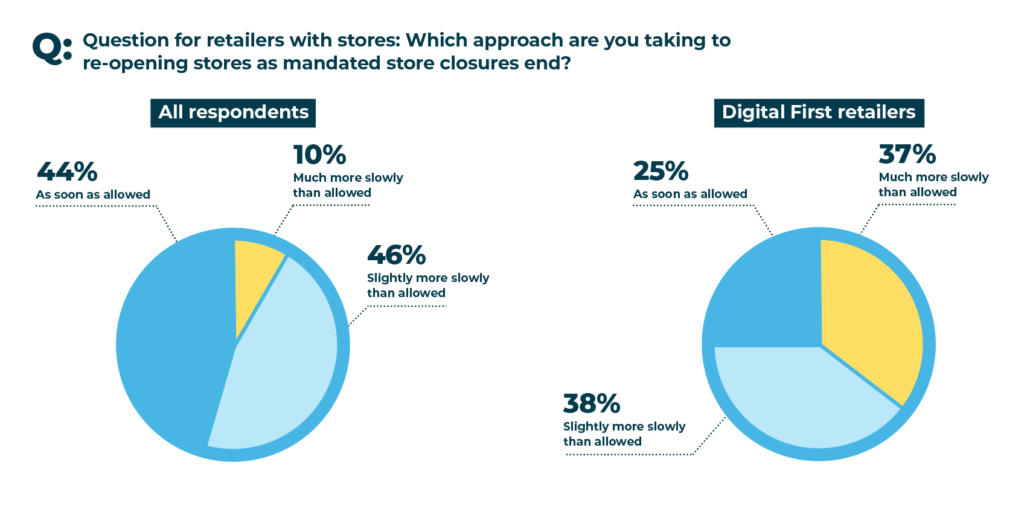

While retailers have limited control over when they’re allowed to open, they have complete control over how quickly they open once they are allowed. Interestingly, 56% of respondents to our survey told us that they are opening their stores more slowly than they are allowed. Ten percent are opening stores much more slowly than allowed. Clearly, retailers are trying to strike a balance between getting back to business with their customers’ willingness to shop, and with their employees’ safety.

Digital first retailers—those that started online and now operate stores—are much more likely to open significantly more slowly than they are allowed. This is likely a result of two factors: (1) stores represent a small part of the business for most digital first retailers; and (2) digital-first retailers’ stores are likely to be in major cities, where lockdowns are being lifted more slowly.

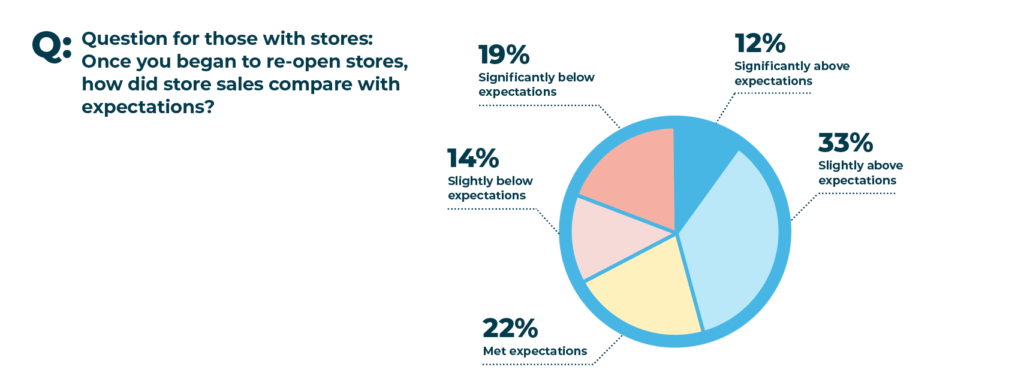

Thus far, those that have opened stores report mixed results. Thirty-three percent report sales below expectations; 47% report sales above expectations. The wild card in this data point, of course, is that entirely reasonable people can have very different expectations in the midst of this set of unprecedented events. It will likely be several months before anyone will be in a position to trust instincts shaped in a less interesting world.

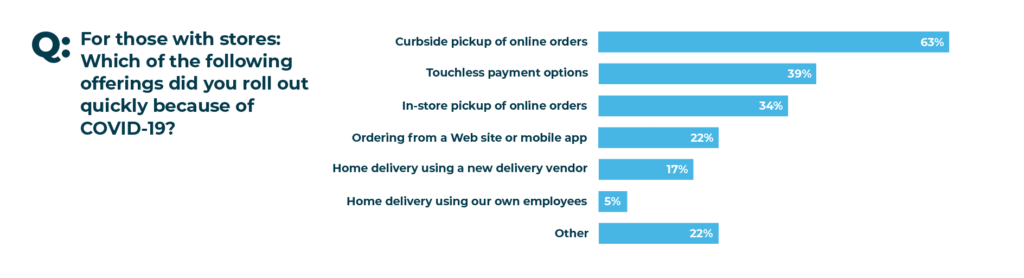

The silver lining to interesting times is that they can compel retailers to innovate in ways that might be difficult to prioritize ordinarily. In our fifth survey, we asked store-based retailers about technologies that they have adopted because of COVID-19. At the top of the list, not surprisingly, is curbside pickup, cited by 63% of respondents with stores. Consumer preferences have, over the years, favored curbside pickup over in-store pickup (or BOPIS), but retailers wanted to drive trips inside the store, where shoppers might purchase an additional item or two. Once consumers feel comfortable going into stores, retailers will need to decide whether to revert to in-store pickup only. We believe that consumers are going to continue to prefer the convenience of curbside, even when they’re not afraid to go into the store and that winning retailers will support this.

Number two on the list is touchless payment options. Thirty-nine percent of survey respondents told us that they had adopted this stubbornly slow-to-take off approach to checkout. Mastercard released consumer survey data recently, in which 79% of global respondents said that they now use contactless payments driven by safety and cleanliness concerns. Visa cites its own data, saying that the number of users of contactless payments in the US grew by 150% between March 2019 and March 2020.

When things are normal again, retailers would be well advised to continue certain habits forced upon them during COVID. Successful retailers, even in a normal world, are those that operate every day with an instinct toward innovation.

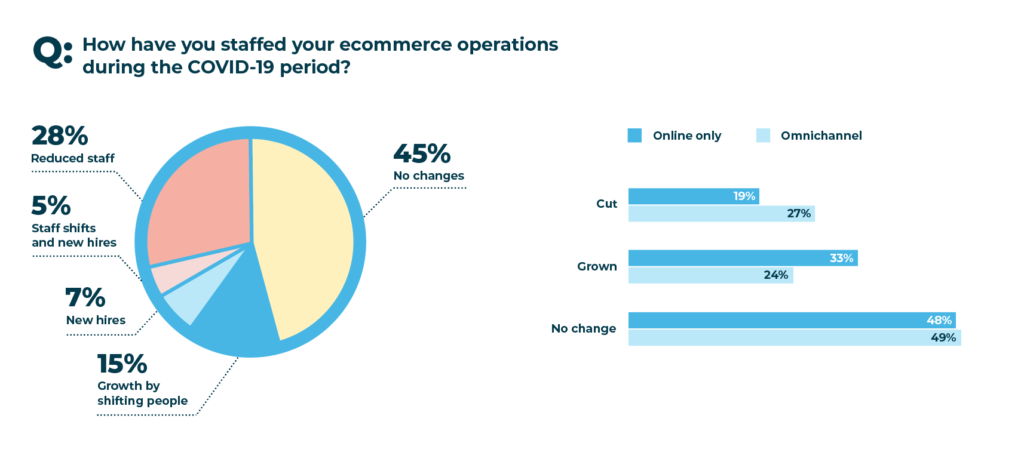

Finally, we’ll switch gears and look at how well retailers’ ecommerce infrastructure has held up during the unprecedented level of demand for goods purchased online during COVID-19. Sadly, many retailers were compelled to either maintain or cut staff despite sustained peak demand for many. Forty-five percent maintained their current staffing levels while 28% cut staff. Omnichannel retailers, reeling from an unprecedented drop in store-based sales (unless they sold groceries, toilet paper, hand sanitizer or masks) were more likely to have cut staff than online only retailers.

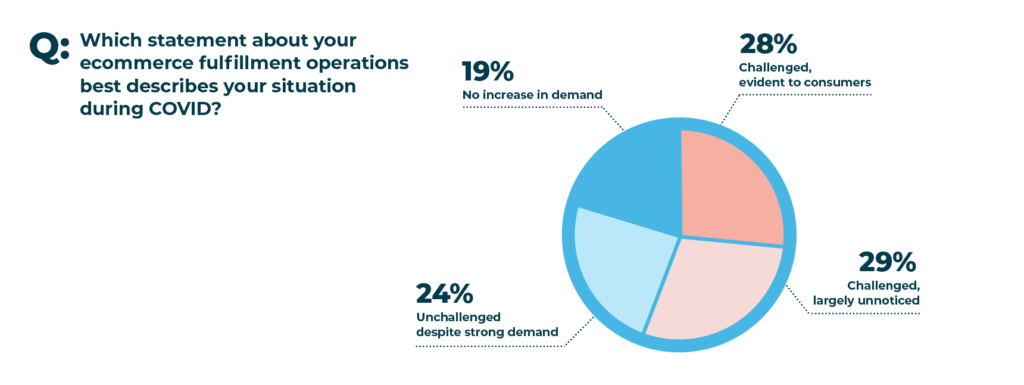

The big question, of course, is whether retailers got away with it. In our survey, 57% of respondents admit that they were challenged to keep up with demand. Roughly half of that group felt that while they were challenged, consumers largely didn’t notice. The other half weren’t so fortunate. Whether those potential consumer relationships can be rescued will remain to be seen.

In unpredictable times, every bit of context is critical to allow retailers to benchmark their own experiences, and to adopt great ideas from those that have been successful. We encourage you all to stay abreast of the information that we will continue to make available as we emerge, together, from these interesting times.

Watch the replay. Get the full take.

On June 10th, 2020, these survey results were featured in a webinar along with Forrester’s latest findings on the importance of identity marketing in personalization marketing. A panel discussion followed on how to provide enhanced value across all touch-points and channels to create connectivity with the customer along the entire path to purchase.

PANEL

• Guest Speaker: Ken Cassar, Principal at CassarCo Strategy & Analytic Consultants

• Guest Speaker: Brendan Witcher, Vice President / Principal Analyst, Digital Business Strategy, Forrester

• Panelist: Yoav banai, VP of Customer Engagement, Deezer

• Panelist: Bill Schneider, VP of Product Marketing, SheerID

• Moderator: Allan Dick, Co-Founder, CommerceNext (moderator)

Related Posts

-

4 Tips for Brand Communications During COVID-19

There is no doubt that right now, we’re all navigating…

-

The Era Of COVID-19 Ecommerce: Which Categories Are Thriving?

While the coronavirus doesn’t discriminate, we’ve definitely seen some categories…

-

As Stores Re-Open, Ecommerce Growth Continues Based On 4th COVID-19 Survey

As the economy and stores slowly start to re-open, CommerceNext…