For the past six weeks, CommerceNext has tracked the effects of the COVID-19 pandemic on retail and ecommerce. Last week, we completed our third community-wide survey tracking the impact of COVID-19 from March 29th-April 11th, benchmarking sales and ecommerce traffic results against our first and second survey results. In our third survey, we added a few new questions on business continuity and longer-term trends.

While the overall business sentiment among retailers surveyed is now cautiously optimistic, the retail and ecommerce leaders surveyed continue to express uncertainty about consumer confidence for the 2020 holiday later in the year. Most merchants have experienced logistical and workforce disruptions from the orders to close non-essential businesses, but even apparel (the category previously suffering the most) has experienced a bounceback in ecommerce sales and traffic.

Thank you to the 100+ respondents who took the survey and, again, to Sucharita Kondali, VP and Principal Analyst at Forrester Research, for her analysis of CommerceNext’s survey results.

Below is an overview of the analysis and we will post a PDF link shortly.

Methodology and demographics

Survey answers were collected on April 13th and April 14th, 2020 from 113 respondents who span the retail and ecommerce landscape. As all CommerceNext surveys previously reported on, this data was collected confidentially and aggregated here in our analysis.

Summary of findings

Kodali’s analysis revealed the following key takeaways:

- The ecommerce businesses of merchants surveyed appear to be improving. More respondents reported sales above plan, saw an uptick in traffic and are gradually increasing forecasts.

- Retailers who reported sales above plan are implementing more promotions, though some of the growth is due to promoting categories that are selling well and driving store shoppers online.

- Companies are experiencing business interruptions, such as changes to fulfillment capabilities and creative processes.

- More retailers laid off workers or reduced salaries since the last survey.

- While some ecommerce teams report picking up some sales from stores, the overall reports from retailers are that traditional sales have plummeted, not yet offset by ecommerce.

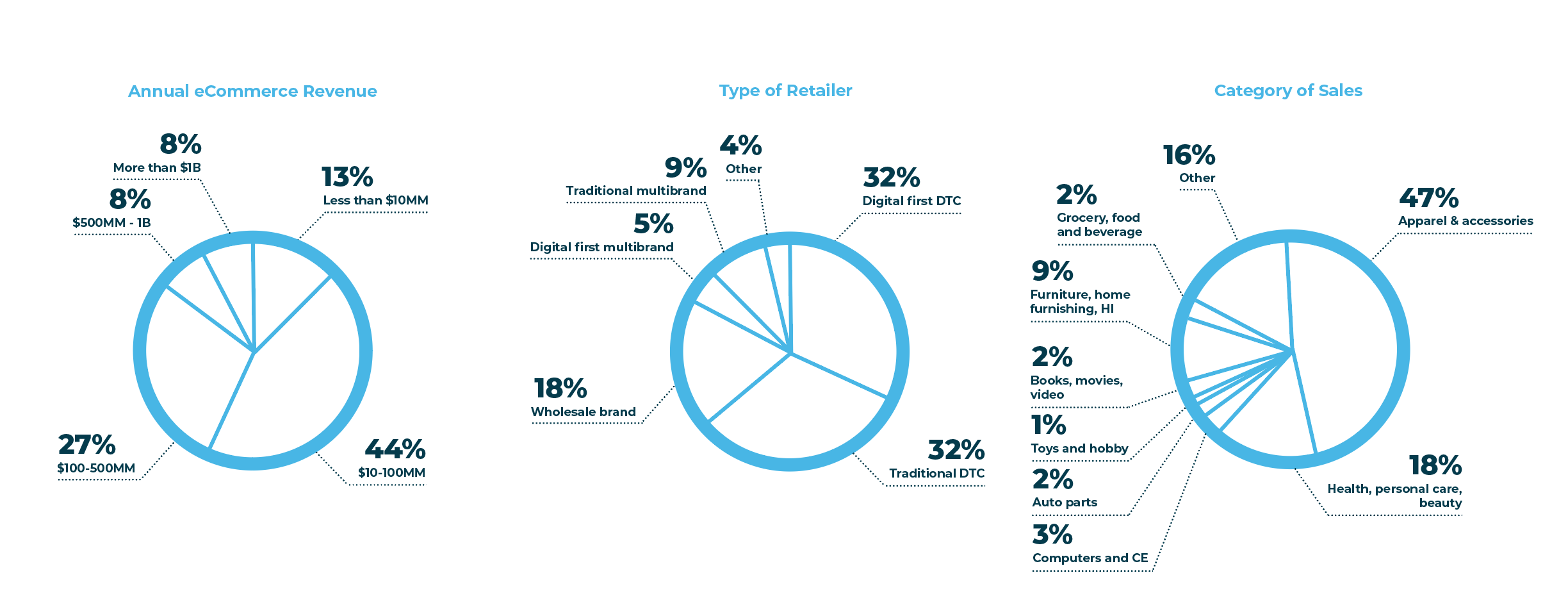

Question: How did ecommerce revenue trend?

Compared to our last survey cycle, more merchants across verticals are now reporting online sales ahead of plan. Even apparel is bouncing back, with 37% of apparel merchants now reporting ahead of plan, up more than 20% since the period of March 15th-28th.

Question: For TWO WEEK period, how is ecommerce traffic trending as compared [the weeks prior]?

Ecommerce traffic has steadily improved, with over two-thirds of respondents reporting higher ecommerce traffic than previously.

![For TWO WEEK period, how is ecommerce traffic trending as compared [the weeks prior]?](https://commercenext.com/wp-content/uploads/2020/04/slide-5-1.png)

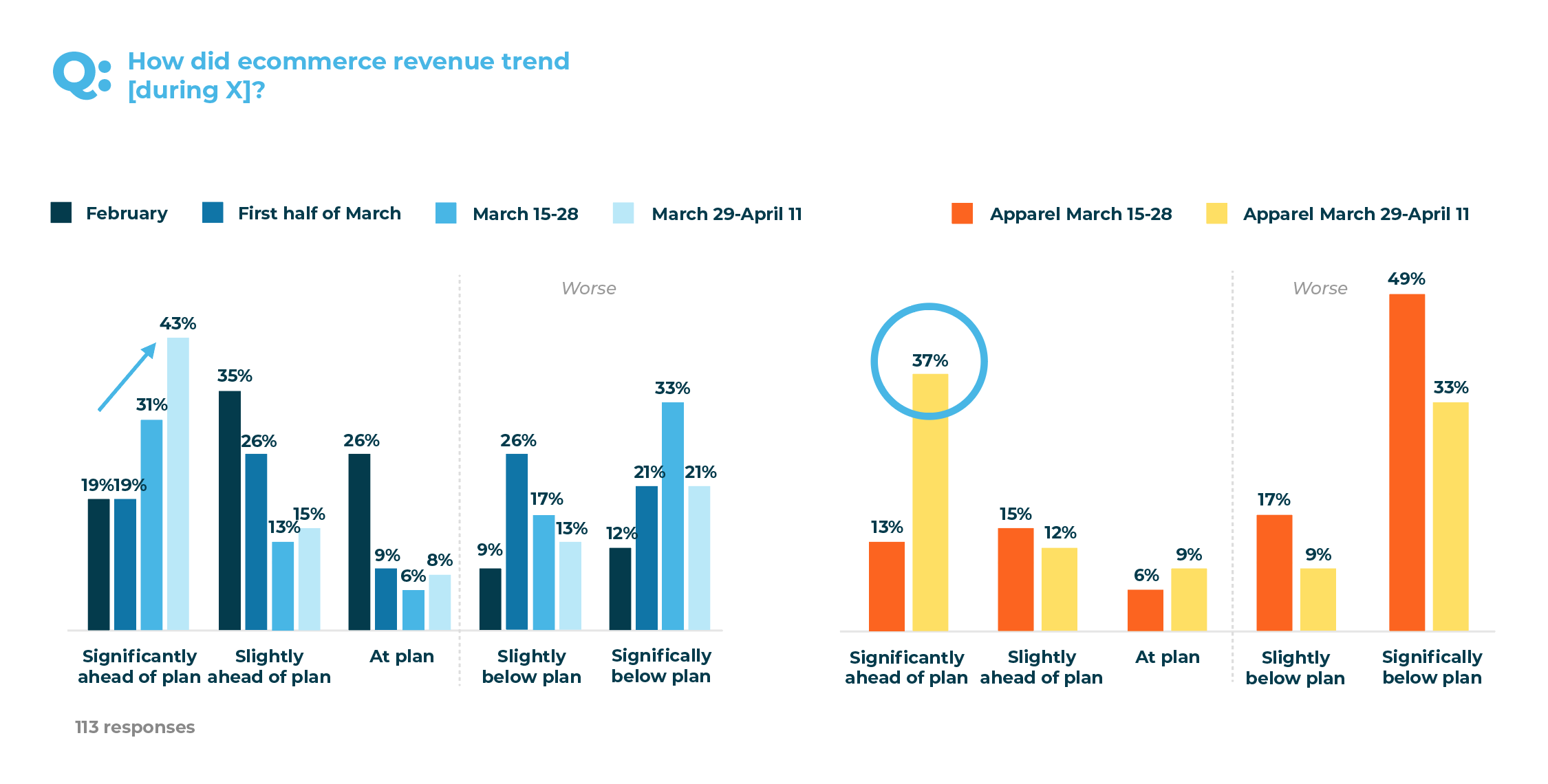

Question: [For those with brick and mortar stores] Have you seen sales shift from stores to online during the last two weeks?

The increased ecommerce traffic is partially coming from a shift in traffic from stores. Although stores continue to see sales shift to online, that transition is unlikely to completely offset the decline in overall sales for most merchants.

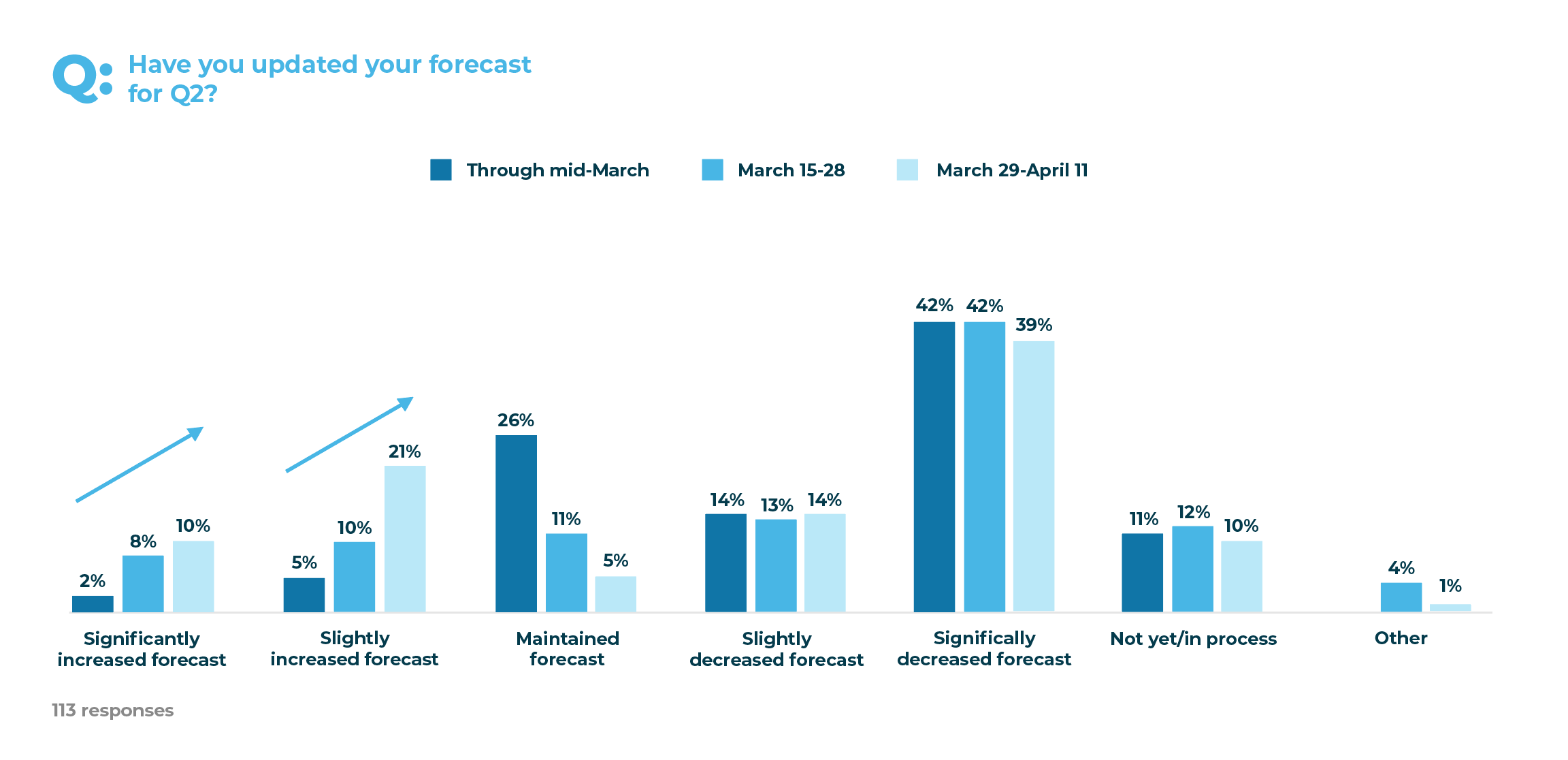

Question: Have you updated your forecast for Q2?

Illustrating respondents’ cautious optimism as ecommerce traffic ticks upward, more merchants are increasing their forecasts and less are decreasing.

Question: [For merchants reporting sales ahead of plan] What contributed to this result?

Merchants who are above plan give a variety of reasons explaining their sales numbers. Some are in pandemic-proof categories, while others’ quick pivots in marketing strategies have driven ecommerce demand for their products. Nearly a third are running more aggressive promotions than originally planned for this time of year and as compared to the same quarter in 2019.

![[For merchants reporting sales ahead of plan] What contributed to this result?](https://commercenext.com/wp-content/uploads/2020/04/slide-8.png)

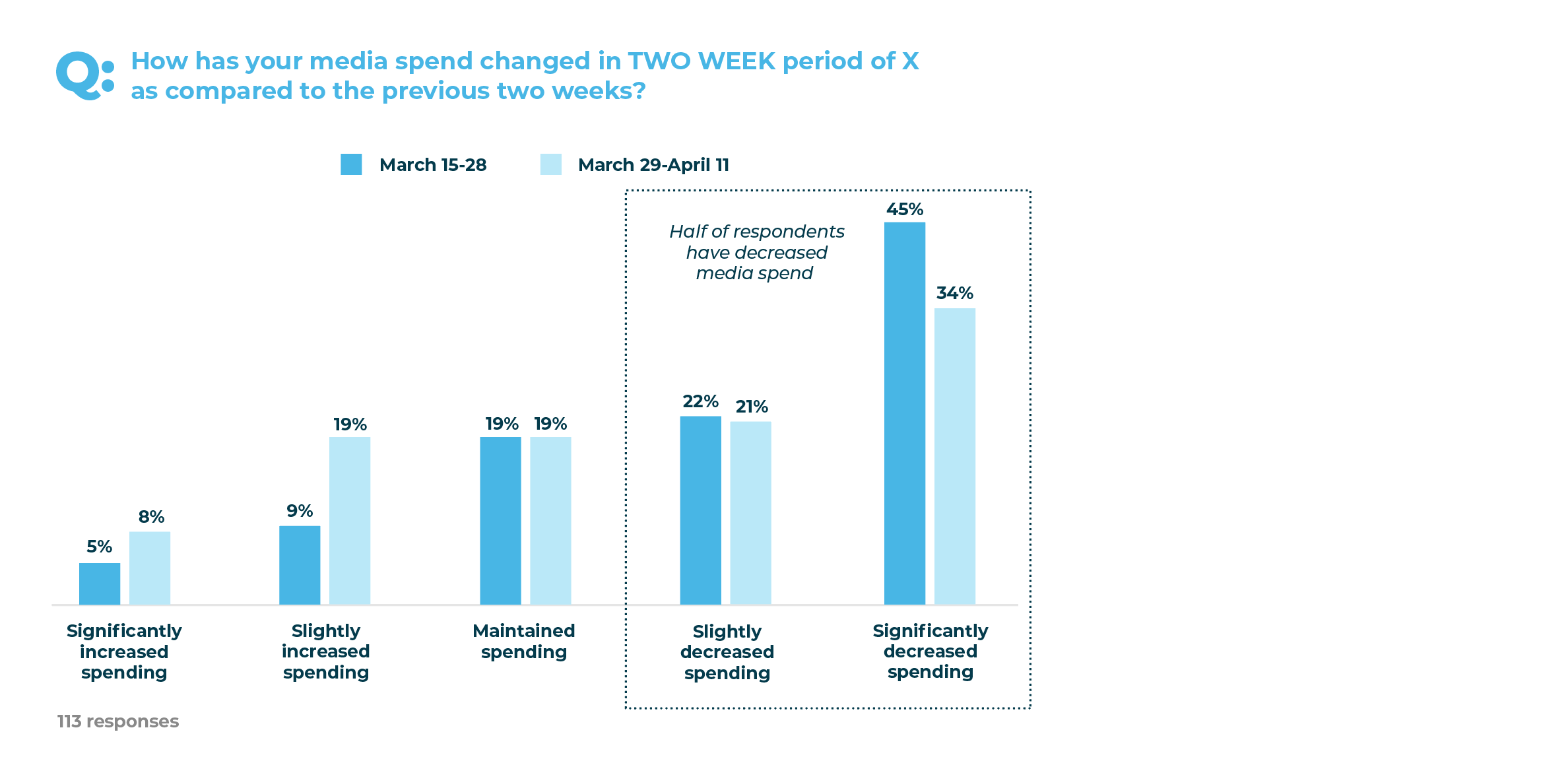

Question: How has your media spending changed in the last two weeks?

Despite increasing forecasts and traffic, over half (55%) of merchants surveyed are still reporting decreasing media spend.

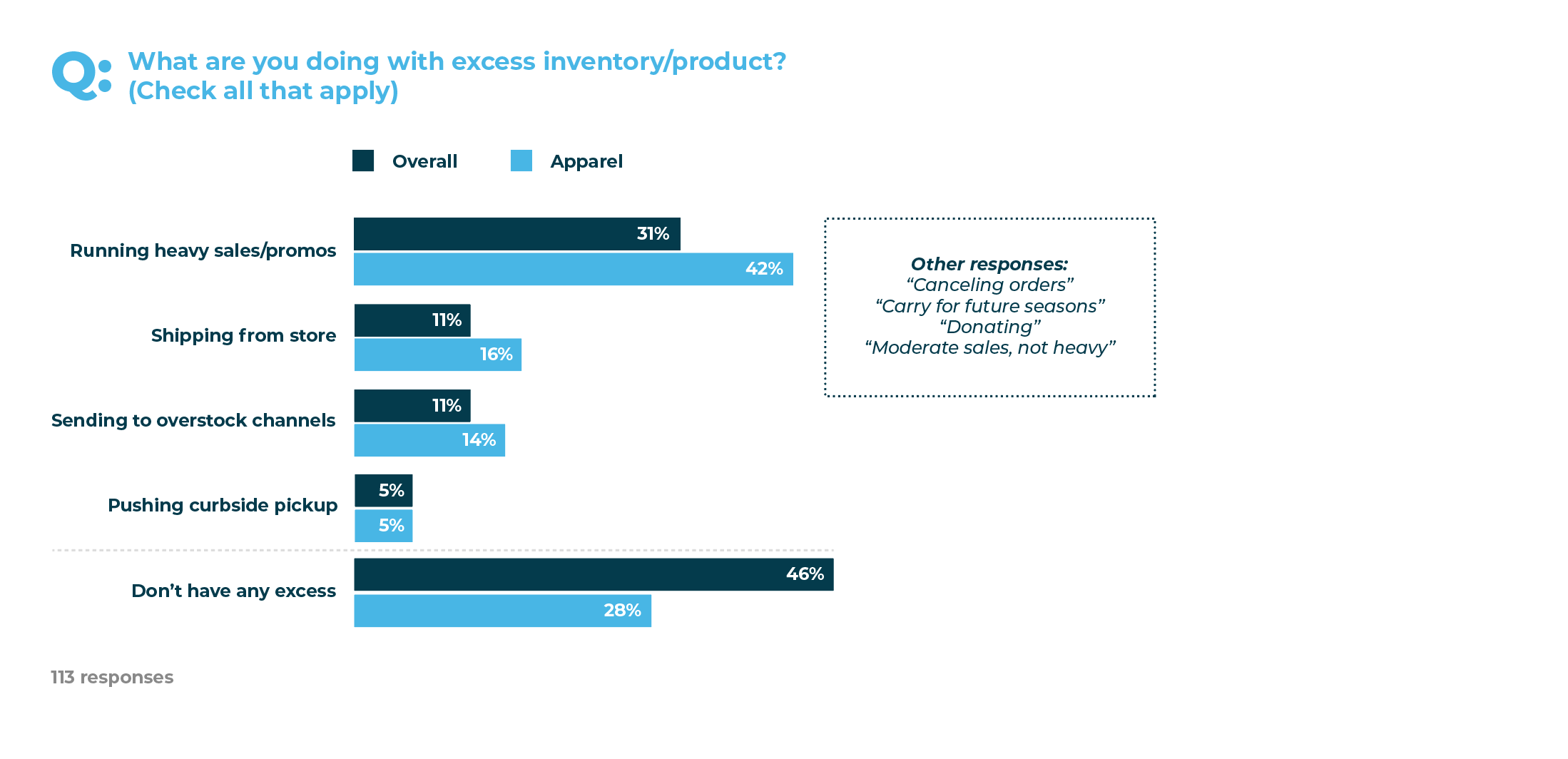

Question: What are you doing with excess inventory/product?

Apparel is the main category suffering from an excess in inventory (which may also be seasonal), thus, their increase in deep promotions. Some are also starting to use overstock channels and omnichannel strategies, like shipping from stores and offering curbside pickup, to help sell excess inventory.

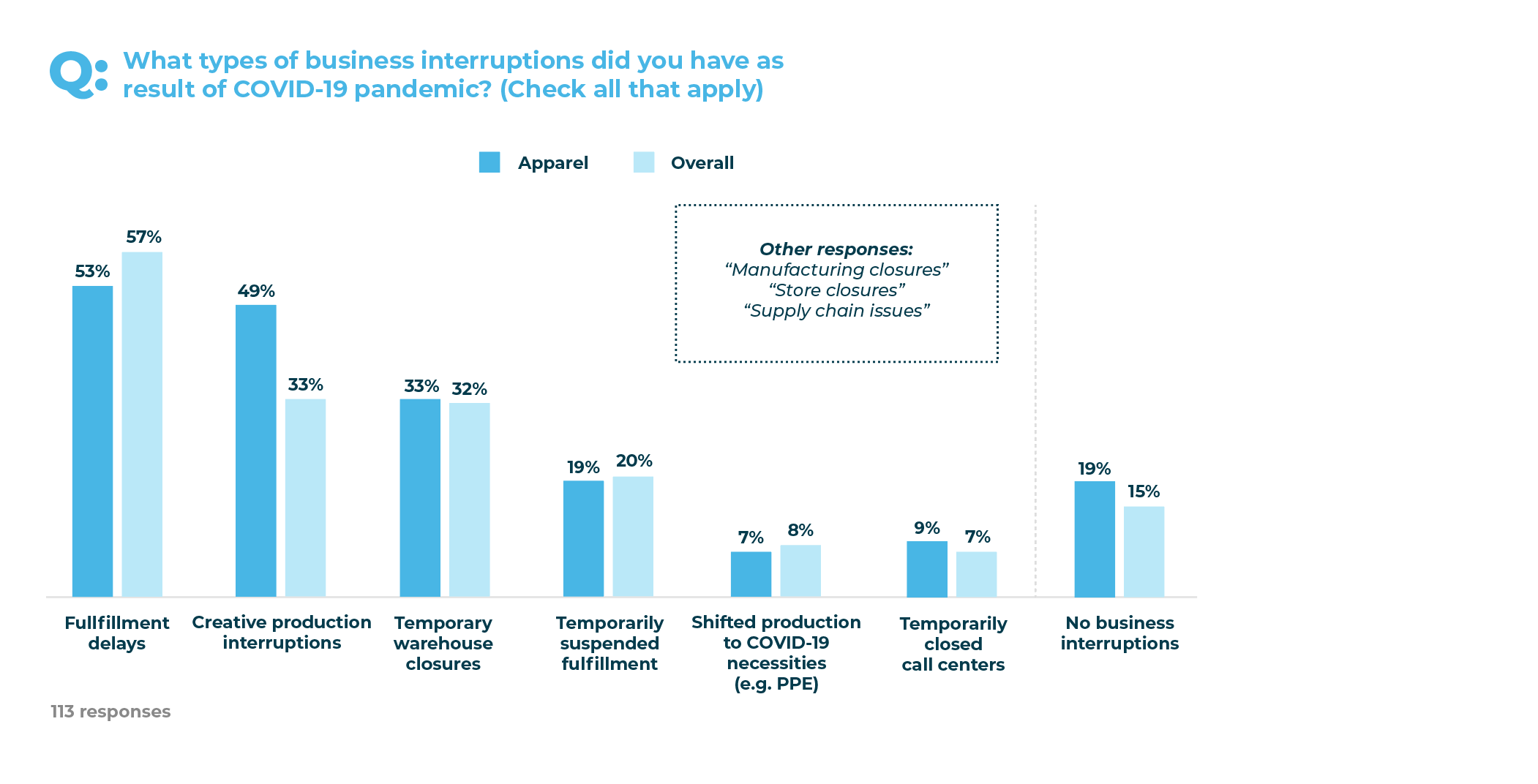

Question: What types of business interruptions did you have as a result of COVID-19 pandemic?

In addition to excess inventory, other types of unexpected obstacles and business disruptions are affecting many respondents. Closures of non-essential businesses means increased warehouse closures, and an influx of online deliveries has caused shipping and fulfillment delays.

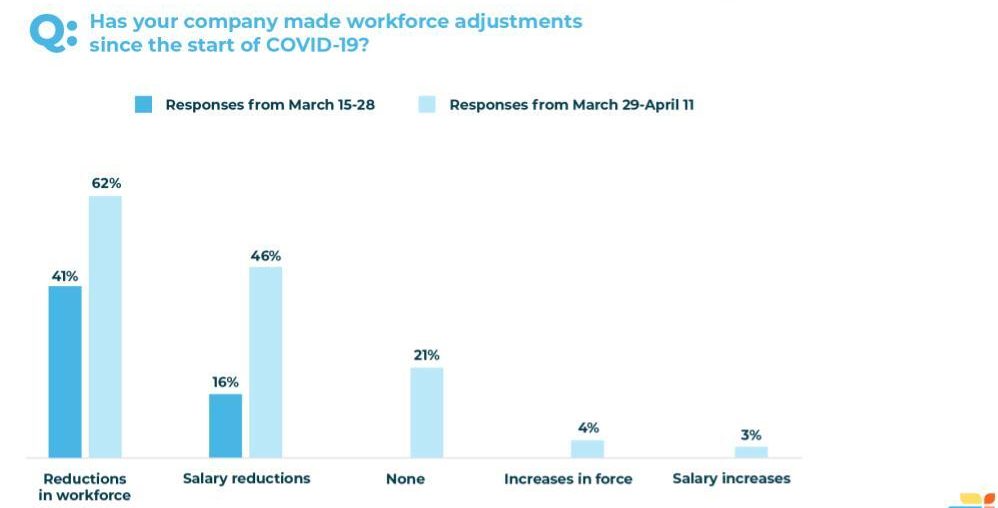

Question: Has your company made workforce adjustments since the start of COVID-19?

Although more respondents reported ecommerce revenues above plan, the positives haven’t offset the negative COVID impacts enough to avoid more drastic workforce adjustments. Nearly two-thirds of merchants have now made reductions in workforce and 46% have implemented salary reductions.

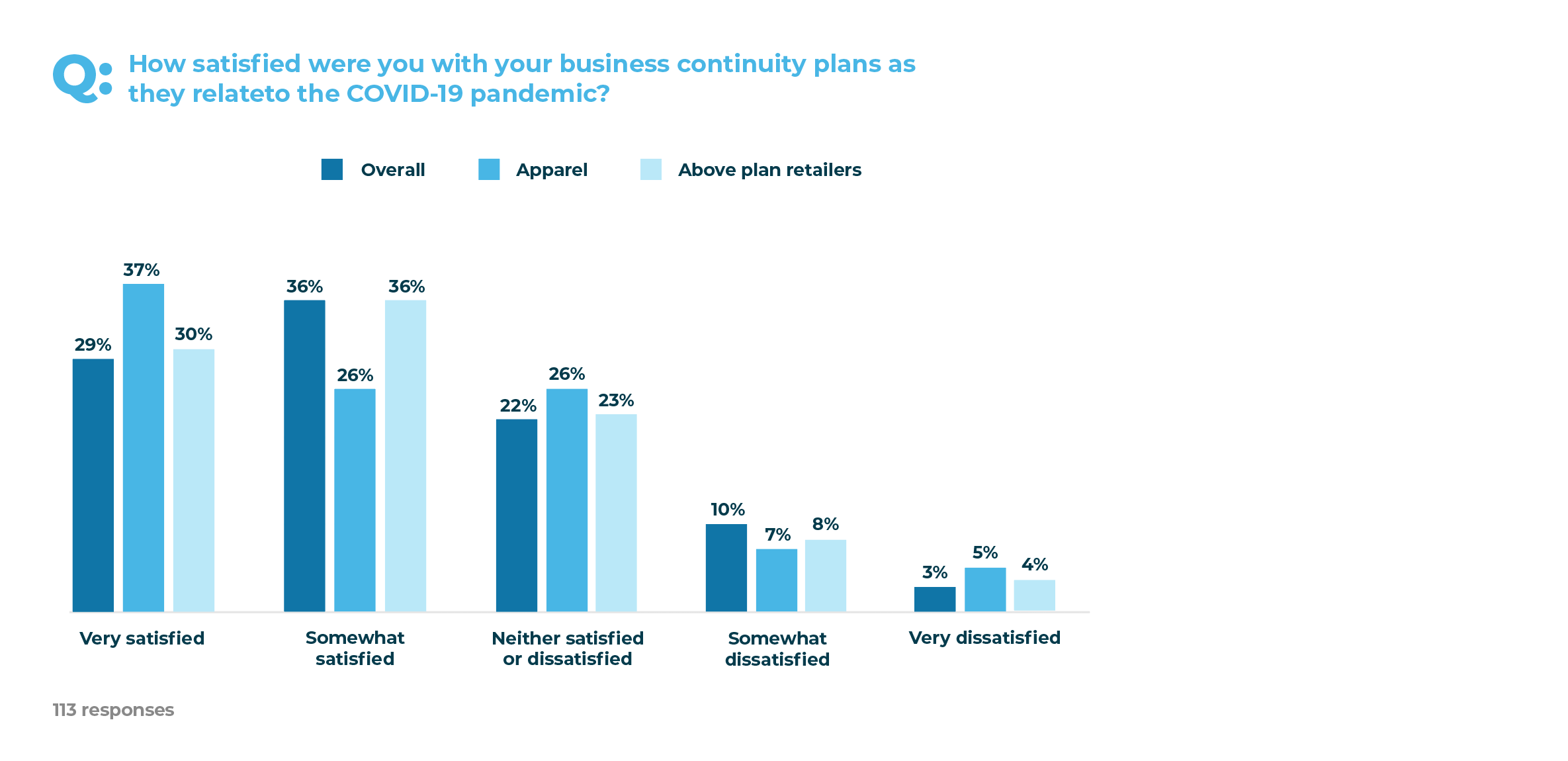

Question: How satisfied were you with your business continuity plans as they relate to the COVID-19 pandemic?

Even with the business disruptions, most merchants are satisfied with their business continuity plans.

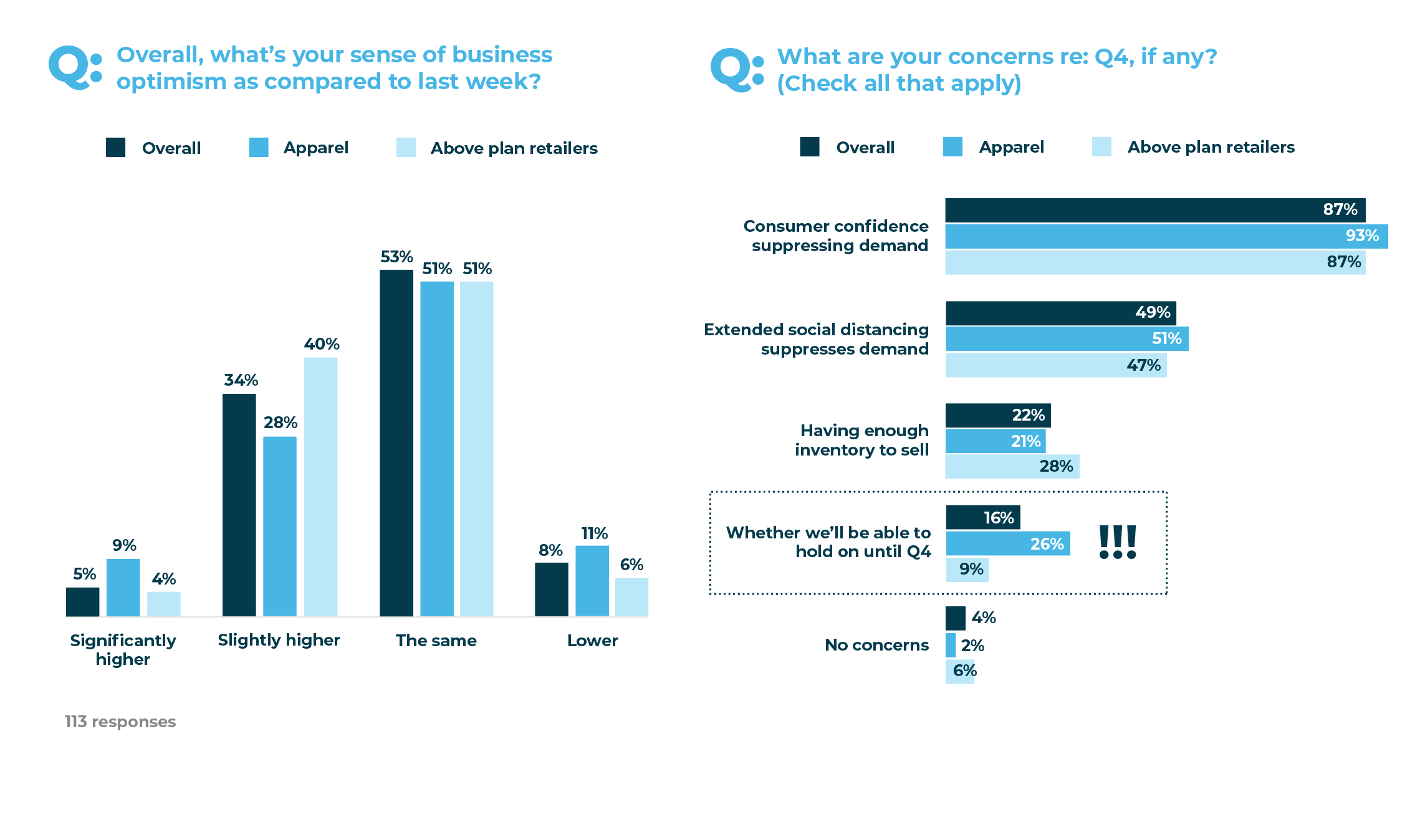

Question: Overall, what is your sense of business optimism as compared to last week, and what are your concerns about Q4?

Even among apparel respondents, we’re seeing increasing optimism as compared to two weeks ago when merchants were in the midst of a spike in industry furloughs. However, 87% of all respondents indicated uncertainty about consumer confidence in Q4 and 49% had concerns that continued social distancing measures in this period would cause weakness in demand. Strikingly, a quarter of apparel respondents are so concerned that they question their ability to stay in business.

Get more details on this COVID research

We’re going to deep dive into these results live with the retailers surveyed in the upcoming CommerceNext Webinar sponsored by Signifyd on Wednesday, April 22nd at 2pm ET / 11am PT.

Panelists include:

- Sucharita Kodali, VP and Principal Analyst, Forrester Research

- Rebecca Traverzo, VP of Marketing, ThirdLove

- Briana Walling Burwell, Vice President of Finance, Build.com

- J Bennett, VP, Operations and Corporate Development, Signifyd

View the webinar here.

Get help from fellow retailers and brands

Need even more community support, or tips on forming your crisis marketing playbook? We created a virtual community (only for brands and retailers and without, solution providers) for collaboration and networking. Powered by Givitas, this tool connects easily to your inbox and facilitates asking for and offering help, advice, connections and introductions.

Join our CommerceNext Givitas Community and start getting crisis-proof ideas right away.

As our community faces both immediate and long term impacts from COVID-19, we’ll keep gathering data to help you better understand how the industry is doing. And, once this is behind us, we’re here to help you share knowledge on how to rebuild.

Related Posts

-

Survey 2 Results: The Impact Of COVID-19 On Retail And Ecommerce For Last Half Of March

CommerceNext continues our coverage of COVID-19’s impact on ecommerce and…

-

Impact Of COVID-19 On Retail And Ecommerce: Survey Results

While our community and country cope with the uncertainty caused…

-

Analyzing the Ecommerce and Digital Marketing Impact of the COVID-19 Pandemic

WITHIN tracks daily revenue, media spend and conversion rates across…