Each holiday season is proving to be more unusual and unpredictable than the last, giving marketers constant challenges and unclear benchmarks. In this webinar, “Cyber Week Recap: Lessons Learned and Advice for 2022”, we walked through Jason “Retail Geek” Goldberg analysis on Cyber 5 Weekend aggregate sales data, the issues that are shaping Holiday 21 and what’s in store for 2022.

What We Learned

- Consumers wallets are increasingly going towards services instead of consumer goods

- The unprecedented growth in digital grocery shopping is setting trends for the entire ecommerce industry

- Changes in Cyber Week strategies reflected consumer personal motives to enjoy the holidays with their families instead of last-minute shopping

Speakers

- Jason “Retail Geek” Goldberg, Chief Commerce Strategy Officer, Publicis

- Barkha Saxena, Chief Data Officer, Poshmark

- Ian Yung, VP of Growth, Parachute Home

- Rosa Hu, VP Product Marketing, Yotpo

Watch the replay here — or — read the highlights below.

Cyber 5 Recap with Holiday 21 Forecast

Every trend we observed in retail in 2021 was a reaction to a trend from 2020. Publicis set the stage for this year’s Cyber Week by introducing the relative growth in total retail and ecommerce. After essentially 2 periods of growth, retail measured at $5.6T, 27% of US GDP and ecommerce was $883B, 15.7% of US retail. As expected, retail in 2021 was significantly ahead of previous years.

This holiday season, consumers’ financial decisions and retail preferences are affected by many societal and commerce trends. For example:

- Consumer Confidence index down 16.48%

- Consumer Price index up 5.80%

- Unemployment at 4.20%

- Wages up 13.65%

- Savings rate up 7.30%

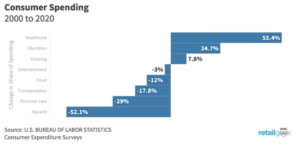

The massive growth in retail is partly because of the spike in savings rate during the pandemic last year. Consumers have a larger spending level from increased wages and savings rate, thus offsetting the increased inflation. This allotment for greater spending on goods and services is realized especially in services like housing, education, and healthcare which have increased. Meanwhile, retail pricing has decreased by 52% in the past 20 years, concerning retailers that the consumer wallet is being driven away from consumer goods.

As the apparel category has decreased by 52.1% from the rise of ecommerce, grocery shopping has seen an opposite trend. Grocery shopping is the fastest growing category in ecommerce at 15.4% of US retail because of the change in consumer habits from the pandemic. The pandemic necessitated (for most consumers) an increased dependence on eating at home, accelerated delivery and digital shopping. This expedited growth in grocery influenced trends throughout ecommerce categories in many areas, including fulfillment automation, retail media networks and ultrafast delivery.

Holiday 21 Results

This holiday season was very healthy, as shown in Publicis aggregation of data through Adobe, Salesforce and Mastercard for Cyber 3. According to Mastercard’s analysis, Holiday 2021 is up by 4.9% compared to 2020 and up by 28.7% compared to 2019. As for total retail and brick-and-mortar, 2021 sales have significantly increased from 2020 as consumers have been able to return in-stores. Plus, in comparison to 2019, holiday sales for Cyber 3 have returned to pre-pandemic levels.

In the end, this holiday ended up with 9-10% growth compared to the last 20 years. Also, this means Holiday 21 is in the top 4 largest growth holidays since 2000, and had the largest growth we have observed in eight years. Retailers and brands alike can celebrate the huge holiday success experienced this year despite continued privacy changes, supply chain disruptions, etc.

Holiday 22 Predictions

The changes observed in 2021 will continue into the new year with greater force and impact. The industry can at least expect new privacy regulations, rising acquisition costs and higher consumer expectations. Below are more trends to expect for 2022:

- Shopping Unbundled

Consumers shopping is not happening all at once in-stores or online anymore. Retailers and brands have discovered that they can succeed in fulfilling customers’ known demand. Yet, where they fault is their ability to help customers discover and then fulfill their unknown needs and wants. The digital discovery of products is typically spread across many micro moments, especially through social commerce touchpoints like livestreaming.

Thus, retailers will begin to digitally replicate the in-store discovery experience they used to own by integrating discovery touchpoints into their own sites.

- Retailers Becoming Brands

We have started to notice some retailer-invented brands in the past few years. This consumer focused approach to product design and development will continue to grow in the coming years. These non-private label brands allow retailers to listen to the consumer and measure big data for a data-driven approach to product offerings.

Target is the most successful product inventor since developing 11 brands in the last five years that sell over $1B a year. Their products are invented with differentiating features purposely, and then marketed very extensively throughout the store.

Yotpo walked through their predictions for 2022, as detailed in their annual research report:

- Brands will invest in a value exchange with customers

As brands continue to prepare for a cookieless world, in 2022 Yotpo expects a greater emphasis on value exchange versus transaction based relationship. In surveying high-level retail and brand marketing leaders, 44% of brands believe 1st and 2nd party data is more important than data collected from cookies. Therefore, it is predicted that in 2022 brands will invest in customer lifetime value, combat 3rd party data loss and drive growth in sustainable ways.

Brands are advised to employ loyalty programs, exclusive launches, etc. to exchange value and information with customers, giving them a reason to organically choose you.

- Brands will use SMS marketing to collect first-party data

With the introduction of IOS 15 and increase in privacy regulations, data collection has continued to be restricted. SMS marketing is a straightforward and adaptable solution to collect information on the customer and their purchasing data. Through this tactic, brands can keep learning and effectively engaging their mobile customers.

- Brands will have to be everywhere for their customers

In today’s age, shoppers expect you to be everywhere because there is a constant competition between brands to capture customers at each touchpoint. Brands are having to adjust to shopping becoming more and more passive and constant, versus a conscious, planned decision. Integrating in-store and online shopping experiences by leveraging social channels can lower barriers to purchase and capture customer purchase intent.

- Brands will redefine subscriptions to prioritize membership

In 2022, brands will reevaluate their subscription models to build more long-term relationships instead of transactions. Customers are aware that when signing up for a membership versus a subscription, they are choosing to belong to this organization. Brands will prioritize an emotional strategy by focusing more on a positive subscription experience to differentiate from competitors.

- Emotional Loyalty will be the foundation for retention

Brands are aware of the importance of loyalty programs and other initiatives to foster an emotional connection with the customer. In the next year, ecommerce brands will continue to invest in loyalty to win customers from competitors by building a stronger emotional connection. To successfully retain customers with emotional loyalty, a storyline based on the brand’s core values should be communicated at every touchpoint.

Changes in Brands’ Cyber Week Strategies and Performance

This holiday season started earlier than ever before, challenging marketers to arrange their strategies to capture customers faster than expected. Parachute Home leveraged this pace by employing a new strategy for this Cyber Week and offering members early access. The company observed a huge spike in sales from members. Like we explained before, fostering an emotional connection with customers by prioritizing membership and rewarding programs will create stronger, long-term results.

Poshmark also employed their usual promotion strategy of supporting their sellers with free shipping this holiday season. In line with Publicis’ perspective on 2022 trends, the resell platform saw an uptick in sales and more spread out holiday shopping. As we know, people began their holiday shopping early and Poshmark was the perfect place to do so given the supply chain disruptions as sellers manage their own shipping.

Also, Cyber Week has turned into more of a marathon than a sprint. Brands began offering deals usually contained to Black Friday or one weekend all the way in October. Plus, there is an increased transparency between brand and consumer about the feasibility of shipping times. Since the consumer is more educated on marketing strategies from industry/media news, they realize it’s a genuine problem and not a sales tactic. Poshmark also highlights an interesting aspect to data analysis this year by humanizing consumer behaviors.

It’s clear this year was unprecedented in company performance, challenges to marketers, and ecommerce trends. But, this year was also different in that families were able to come together to celebrate the holidays for the first time in a while. Holiday shopping was spread out also because people wanted to spend more time with their families instead of snagging the best deals of Black Friday.

CommerceNext enjoys providing our community with valuable trend forecasts and strategies to improve their 2022 plans. We hope you find value for your consumer and brand in this recap and forecast.

Related Posts

-

Unlocking Zero-Party Data with Loyalty

As demands for greater internet privacy and data protection ramp…

-

Successful Partner Marketing in Q4 and Beyond

Happy 50th Webinar-versary to us! In this week’s extra special…

-

Invincible Ecommerce: How to Build an Unshakeable Growth Marketing Foundation

Data privacy restrictions, economic shifts and Facebook and Google ad…

-

Cyber Week And The New Customer Experience

We have seen time and time again how Covid-19 has…

-

Cyber 5 Marketing Tips

Cyber 5, the days between Thanksgiving and Cyber Monday, is…

-

Session Recap: The Untapped ROI of Caring Post Sale

The stress and uncertainty of Covid-19 makes caring for customers…