Over the last three months, the consumer landscape has changed dramatically as people have taken up new ways to learn, work, entertain themselves, procure essentials and non-essentials, connect with others, and increase wellness while at home. Panic buying behavior that was reactionary has become more subdued as stores innovate to meet today’s climate. Sentiment in the U.S. is mixed, with many consumers unsure of the future and others picking up discretionary spending. The “new normal” is being referred to as the “next normal,” but it’s all becoming more “normal.”

Every brand is dealing with a consumer who is in a very new state of being. It’s critical to think about what’s important to customers now, which is different from before, and earn them back and/or continue to appeal to new ones. By now, assuming you’ve followed best practices—pivoted media and messaging strategy while stabilizing your own business—you are looking to what’s next as we experience the reentry phase, in which states and retail open up.

This blog post uses (1) brands’ evolving strategies, (2) first party performance data and industry research outlining key trends, and (3) platform responses and effective brand strategies that have evolved since the start of COVID-19 to address:

- The Current Landscape for Digital Advertisers

- Responding to Shifts in Consumer Behavior

- Recommendations for Advertisers

Openness To New Brands Creates Opportunity For Acquisition

An MIT report found more than 54% of people recently made purchases from brands that were new to them. The most frequently cited reasons included “favorite brand out of stock” and “willingness to try new brands.” The willingness to buy from new brands is driven by the digital media and purchase behaviors that have emerged as side effects of the COVID-19 pandemic, namely:

- More Time Spent Online: Since mid-March, there’s been an 87% increase in video-view rate on social & digital streaming. Consumers are spending more time browsing, messaging, watching, and buying across digital and social platforms, evidenced by a 52% increase in browsing on Facebook alone.

- Shopping For Items That Are New To The List: COVID changed how we eat, work, exercise and spend time with family/friends. As people have new needs for goods in these categories, openness to unfamiliar brands grows.

- Shifting Priorities Shifted Purchase Behavior: An Accenture study found that most people are fearful about health and job security. This mentality shifted purchase priorities towards brands that emphasize safe production, socially distanced fulfillment, free shipping and returns and commitment to local businesses. In addition, consumers’ preferred brands pre-COVID may not have effectively adapted to these new priorities quickly enough, making these consumers easier to convert to a competitor.

These trends have had a massive impact—from April 1st through June 1st, customer acquisition costs decreased by 50%. Particularly in times of crisis, a customer’s interaction with a company can trigger an immediate and lingering effect on their sense of loyalty.

Recommendations For Acquiring & Nurturing New Customers

Here are six strategies to turn your new COVID customers into repeat purchasers and brand loyalists.

- Segment & Analyze: Segment out new customers acquired during COVID and understand how they are similar and different from core customers. Tools like SocialCode’s Audience Intelligence Platform (AIP) can help advertisers better understand the makeup and value of these new audiences.

- Customize Messages: The people you’re converting now likely have different demographic and psychographic characteristics than your core pre-pandemic world audience. There may need to be additional education about your brand and why customers should continue to buy, considering they could have bought your products out of impulse and need versus desire.

-

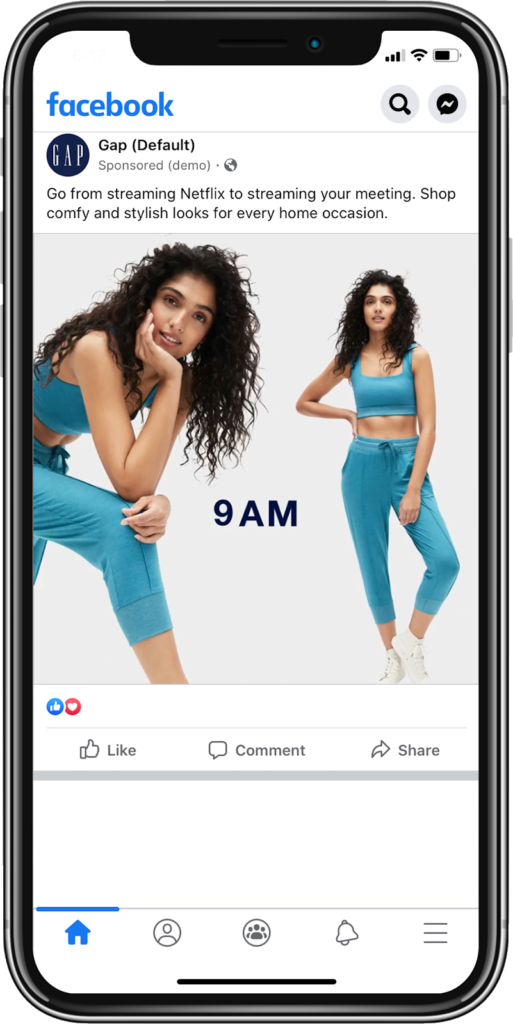

- GAP Case Study: SocialCode found that GAP’s Spring khaki initiative was low performing, corroborated by negative sentiment flagged by the brand’s organic social team. We recommended new assets focusing on basics and sweats, themes working in-market assets with other similar brands. The new assets achieved 72% higher RoAS compared to previously planned khaki assets.

- Dynamic Cross-Sell And Upsell: Ensure periods of rapid acquisition translate into longer term relationships by automatically triggering cross-sell campaigns for adjacent products or categories after initial purchase. Leverage historical purchase data to move new customers to loyalty.

- Reevaluate Campaigns Made Pre-COVID: Financial uncertainty has created a shift away from conspicuous consumption. This means some campaigns designed pre-COVID may not perform as well in the current climate, and that brands should be thoughtful when deciding which parts of their catalog to activate in paid media. Ensure media and social-listening teams are in lock-step to turn off product assets that become attached to negative sentiment.

- Invest in Platforms Where You Can Scale Up And Down Quickly: With premium content production and professional sports in limbo, pinpointing the best place to reach your audience will be an even faster-moving target than usual. In this landscape, we recommend shifting budgets from channels like television, which require heavy upfront planning and investment, to digital platforms that can be throttled up and down fluidly.

-

- Chipotle Case Study: Chipotle CEO Brian Niccol said “Investing in digital over the last several years allowed us to quickly pivot our business with Q1 digital sales reaching our highest ever quarterly level.” SocialCode helped the brand transition budget scheduled for live sports breaks on TV towards home delivery and carryout campaigns on digital, maintaining performance benchmarks established at lower scale.

- Test, Learn, and Act:Test messages, placements and buying strategies to understand how to best engage. Conduct monthly new customer analyses to identify what new cohorts are showing up in sales-tracking systems at scale to gain inputs for future creative personalization.

Today’s consumers are seeking ease, comfort, and availability through a lens of price consciousness. The experiences they have with your brand today can trigger an immediate and lingering effect on their sense of trust and loyalty. There’s now a big opportunity to turn your new COVID consumers into brand loyalists, especially as discretionary shopping picks up and people continue to seek products that provide comfort and spark joy.

Source: Accenture “Covid-19 Will Permanently Change Consumer Behavior

Source: MIT “Growth Opportunities for Brands During COVID-19 Crisis”

Source: SocialCode COVID Trend Analysis, Consumers Browsing & Buying

Source: SocialCode COVID Trend Analysis, Efficiencies & Inventory

Related Posts

-

How Retailers And Direct to Consumer Brands Are Investing In Marketing This Holiday Season

The holiday shopping season is upon us. Last year, we…

-

The Comeback Of TV: How Direct To Consumer Brands Can Win Big

With the cost of Facebook and Google advertising continuing to…

-

The Role Of Amazon In A World Of Direct-To-Consumer Brands

How three companies navigate the pros – and cons –…